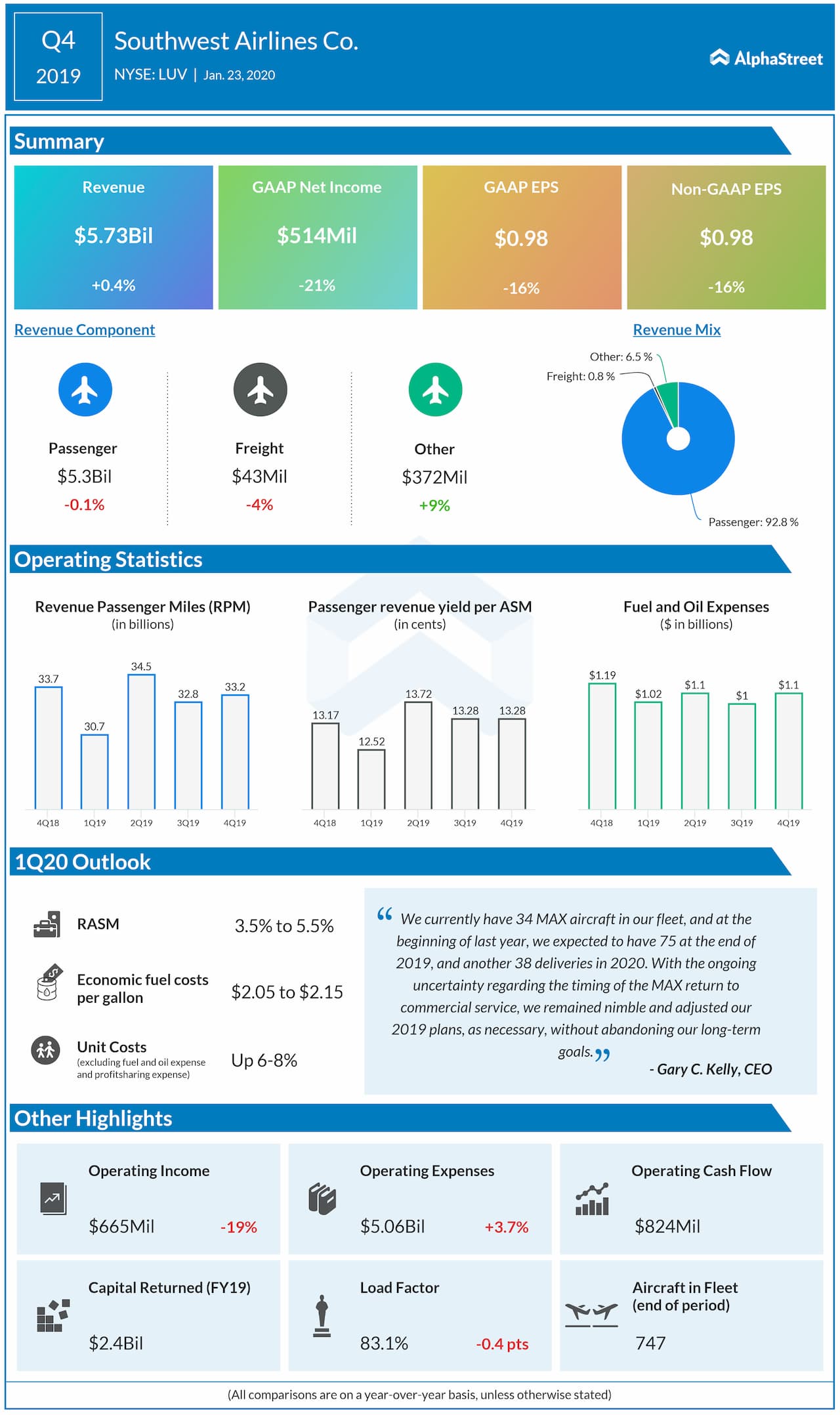

Southwest is expected to take a hit to its top and bottom line numbers due to the disruptions caused by the outbreak. Along with capacity declines, the company is expected to see a drop in its load factor. In the fourth quarter, the load factor was 83.1% which was slightly down from the year-ago period.

Southwest was meaningfully impacted by the Boeing 737-Max

groundings in 2019, which led to several flight cancellations and shaved off

$828 million from its operating income. The company saw healthy passenger

booking and revenue trends in the first two months of 2020 before the COVID-19

crisis hit. In March, the company saw a significant drop in demand and an

increase in cancellations.

Last month, Southwest stated that it expects a negative

impact of $200-300 million to its Q1 2020 operating revenues. The company also

expects unit revenues to be down 2% to up 1% year-over-year versus the previous

outlook of 3.5-5.5% increase.

The airline is expected to benefit from the reduction in oil

prices as fuel costs comprise a meaningful portion of expenses. In March,

Southwest said it expects its first quarter fuel costs to come in the range of

$1.90 to $2.00 per gallon versus its prior guidance of $2.05 to $2.15 per

gallon.

For the first quarter of 2020, the company expects unit

costs to increase 5-7% year-over-year versus its previous outlook of 6-8%. Capacity

is estimated to decrease approx. 1% year-over-year.

During its call, Southwest is expected to provide more

clarity on the impact of the pandemic on its results and its outlook as well as

provide updates on its strategy going forward.

In the fourth quarter of 2019, Southwest beat revenue expectations but missed earnings estimates. Revenue inched up slightly to $5.73 billion while adjusted EPS fell 16% to $0.98.

Shares of Southwest have dropped 44% since the beginning of the year.