Lackluster results

Business performance and challenges

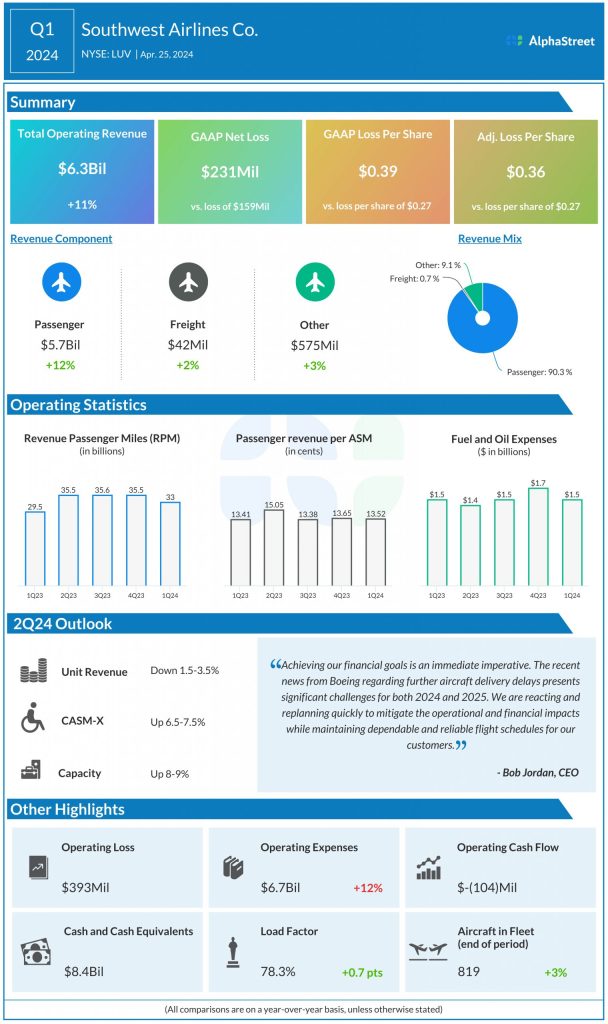

Southwest’s top line momentum was driven by strong demand trends and growth in passenger and ancillary revenue. Unit revenues were flat year-over-year, mainly due to lower-than-expected close-in leisure passenger volume. Managed revenues rose approx. 25% from last year.

Passenger unit revenue rose 0.8% in Q1. Traffic rose 12% while capacity was up 11% YoY. Load factor was 78.3% while CASM-X, or unit costs, was up 5% YoY.

Costs remain a challenge for the company and it continues to take steps to reduce its expenses and control discretionary spending. As part of these efforts, Southwest is limiting hiring and offering voluntary time off programs. It expects to end 2024 with around 2,000 fewer employees compared to 2023.

The aircraft delivery delays from Boeing pose significant challenges for Southwest in 2024 and 2025. As part of its network optimization efforts, Southwest has decided to close its operations at the Bellingham International Airport, Cozumel International Airport, Houston’s George Bush Intercontinental Airport, and Syracuse Hancock International Airport.

Outlook

Southwest said that, based on current booking trends, it continues to expect an all-time quarterly record for operating revenue in the second quarter of 2024. Unit revenue is expected to be down 1.5-3.5% YoY in Q2 while capacity is expected to be up 8-9%. CASM-X is expected to be up 6.5-7.5% YoY.

Due to the Boeing aircraft delivery delays and the reduction in capacity for the second half of 2024 owing to this issue, Southwest now expects operating revenue growth for FY2024 to approach high single digits, when adjusted for current trends and planned reductions for post-summer schedules.

The company now expects capacity for 2024 to be up around 4% YoY versus its previous expectation of up around 6%. CASM-X is now expected to be up 7-8% versus the previous estimate of up 5.5-7.0%.