Passenger traffic, which accounts for more than 90% of the airline’s revenue, is estimated to have picked up pace during the holiday season. The bottom-line stands to benefit from the moderation in oil prices, which could be partially offset by higher unit costs due to flight disruptions.

Cost in Focus

Southwest executives have been focused on reducing costs to ease the impact of the flight cancellations, which continues to be a drag on fuel efficiency. Non-fuel operating costs have remained high, especially after the 737 MAX grounding, which will have a negative impact on profitability this time.

Looking Back

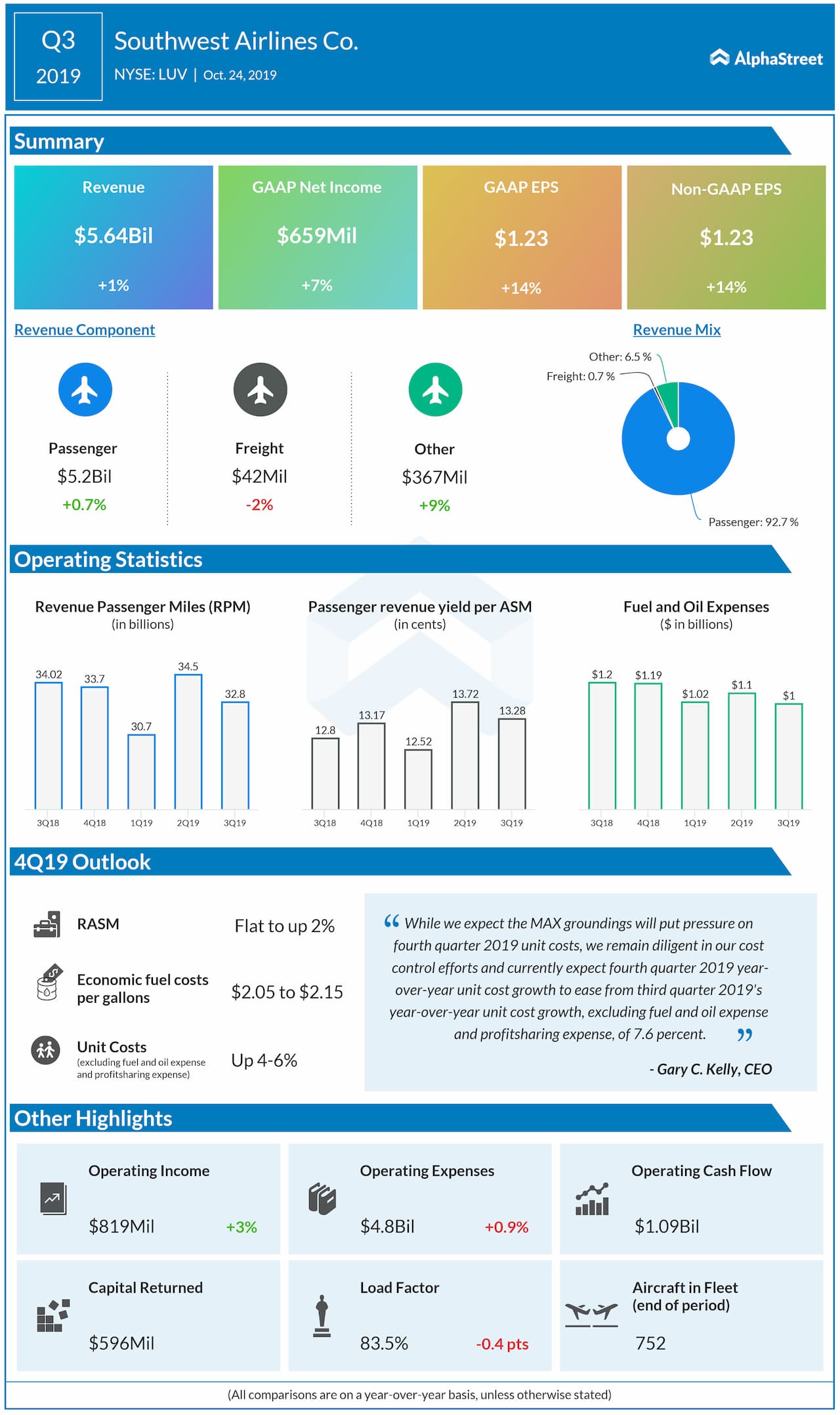

In the third quarter, revenues edged up to $5.64 billion, in line with the estimates, while earnings grew in double digits to $1.23 per share. Cautioning about the low fleet strength, the management predicted a decline in capacity in fiscal 2019. Going forward, the performance will depend a lot on the timing of the 737 MAX flight resumption and the delivery of new aircraft.

Competition

United Airlines (UAL) this week reported double-digit growth in fourth-quarter earnings, reflecting the uptick in passenger traffic. Earlier, Delta Air Lines (DAL) reported higher profit and revenues for its most recent quarter, which particularly benefitted from the favorable oil prices.

Also see: JetBlue Q3 earnings exceed estimates on strong traffic

The relatively low price of Southwest’s stock makes it attractive to investors, with the strong cash flow adding to the positive sentiment. On Wednesday, the shares traded close to the levels seen a year earlier, after losing strength in recent weeks. The stock has lost 2% since the beginning of the year and 4% in the past month.