Delta Air Lines (NYSE: DAL) reported an 8% increase in earnings for the fourth quarter of 2019 helped by stronger revenue, lower fuel and gain related to the unwinding of the GOL relationship. The results exceeded analysts’ expectations.

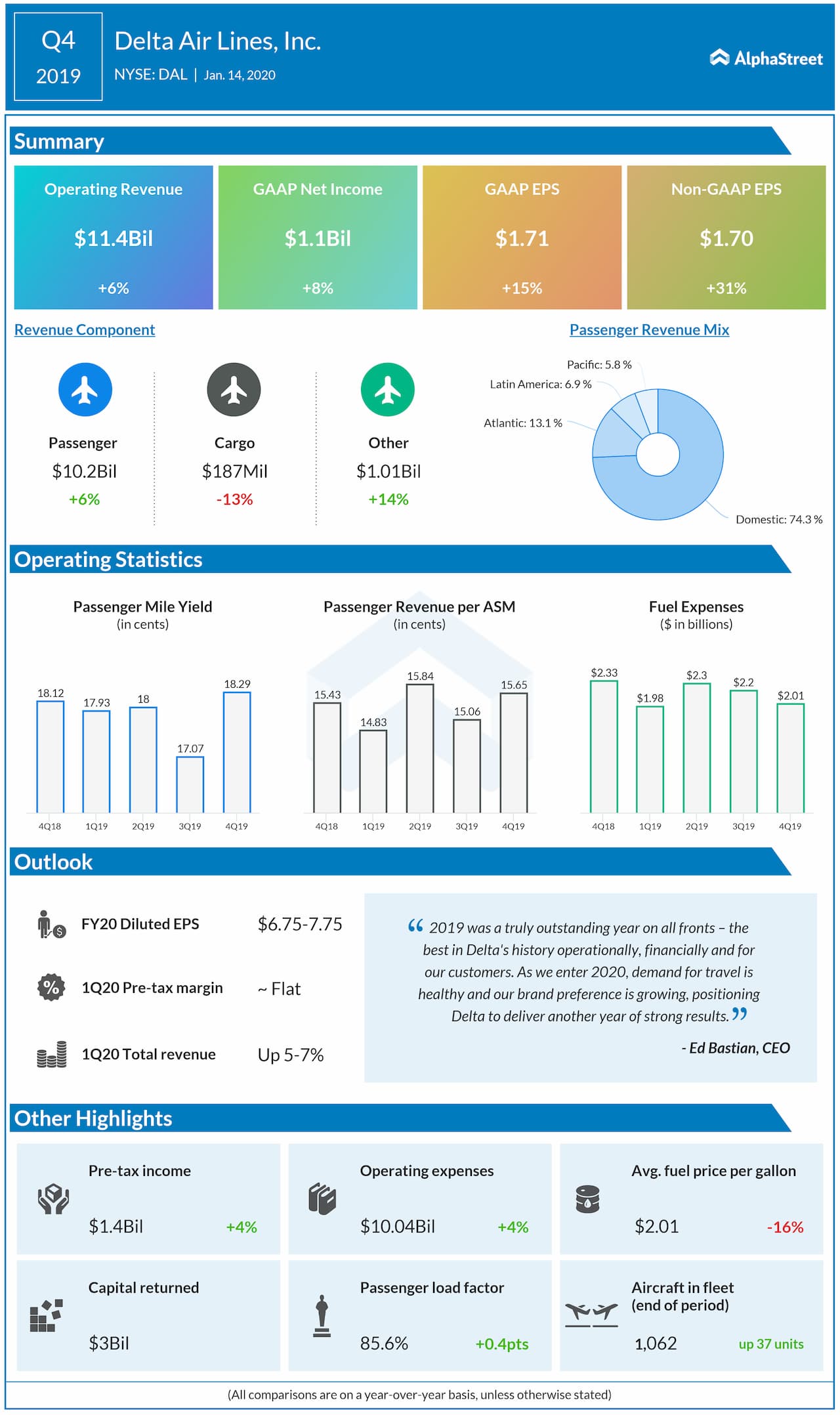

Net income increased by 8% to $1.1 billion or $1.71 per share. Adjusted earnings climbed by 31% year-over-year to $1.70 per share. Total operating revenue grew by 6% to $11.44 billion. Analysts had a consensus EPS estimates of $1.40 on revenue of $11.35 billion.

The top line was driven by a 9% increase in premium product ticket revenue, an 18% increase in loyalty revenue and a 31% increase in third-party maintenance revenue, which was partially offset by 13% lower cargo revenue.

Looking ahead into the first quarter of 2020, the company expects total revenue growth in the range of 5-7% and pre-tax margin to be about flat. Non-fuel unit costs are anticipated to rise by 2-3%.

For fiscal 2020, the company expects to deliver another year of strong results, including EPS of $6.75-7.75 as the demand for travel is healthy and its brand preference is growing. The company expects to generate free cash flow of $4 billion again this year, putting it on track to deliver 3-year cumulative free cash flow of over $10 billion by the end of 2020.

For the fourth quarter, domestic revenue rose by 7.7% on 1.6% higher passenger unit revenue (PRASM) and 6% higher capacity. Domestic premium product revenue grew by 11% and corporate revenue grew by 6%, driven by strength in business and leisure demand through the holiday period. Revenue and margin improved in all domestic hubs with revenue up 10% in coastal hubs and 6% in core hubs.

Atlantic revenue rose by 0.8% helped by a 2.4% higher capacity and a 1.6% decline in PRASM, driven almost entirely by foreign exchange rates. Latin revenue increased by 6.7% on continued double-digit unit revenue growth in Brazil and Mexico. However, Pacific revenue declined by 0.5% as the continued softness in China hurt unit revenue that fell by 4.4%.

In the fourth quarter, revenue passenger miles increased by 5.2% while available seat miles improved by 4.7%. Passenger revenue per available seat mile (PRASM) was up 1.4% while total revenue per available seat mile (TRASM) rose 1.7%. Adjusted TRASM increased by 2.4%, exceeding expectations on strong holiday travel demand.

Operating cost per available seat mile (CASM) was down 0.6% while CASM-Ex was up 4.4%. The passenger load factor improved by 0.4 points to 85.6%. The average price per fuel gallon decreased by 15.9% to $2.01. On an adjusted basis, the average price per fuel gallon was down 17.7% to $1.99.