Southwest Airlines (NYSE: LUV) reported better-than-expected revenues for the fourth quarter of 2019 while earnings fell below estimates. Shares dropped 1.2% in premarket hours on Thursday.

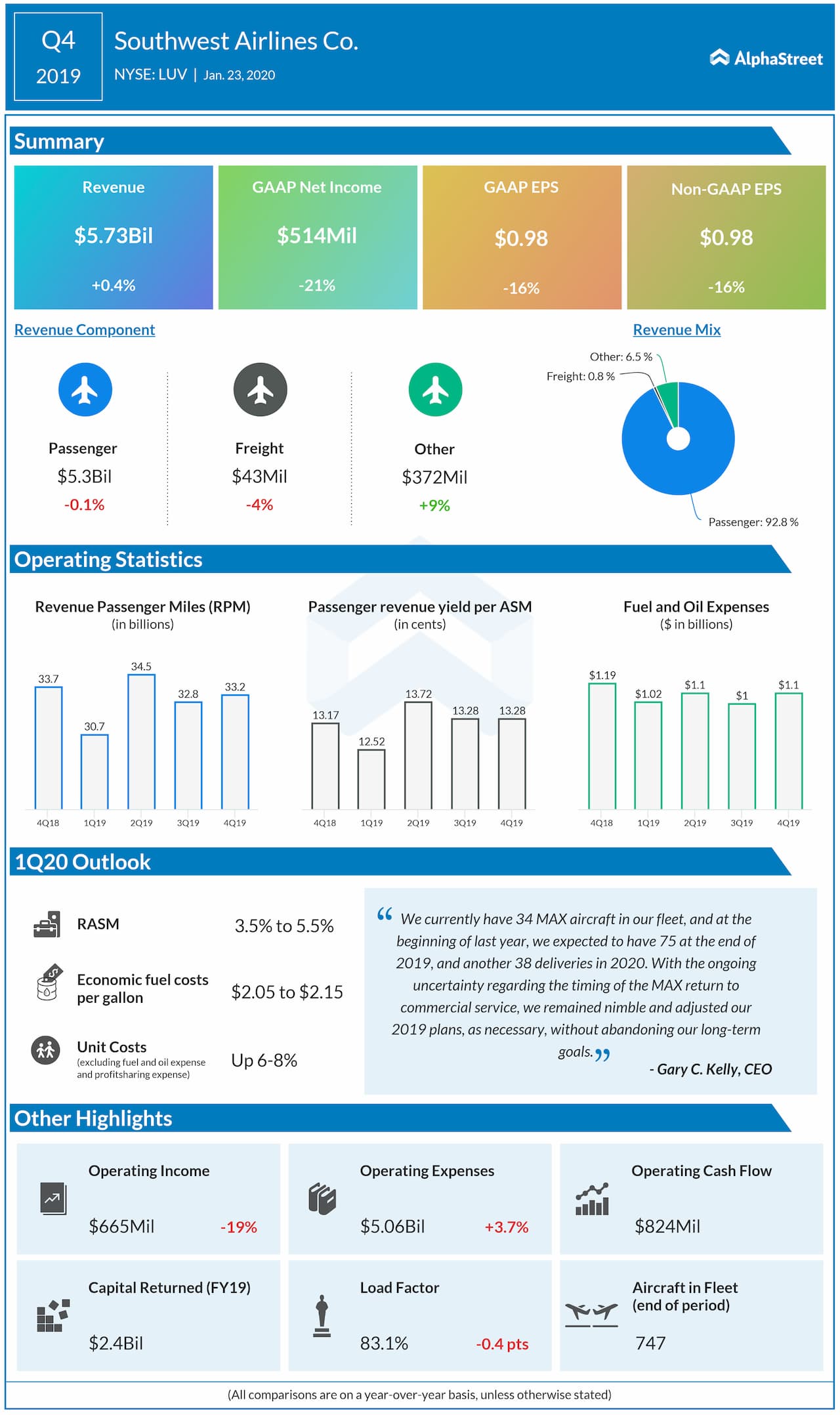

Total operating revenues of $5.73 billion were up 0.4% from the same period last year and above forecasts of $5.72 billion.

Reported net income was $514

million, or $0.98 per share, compared to $654 million, or $1.17 per share last year. Adjusted EPS amounted to $0.98,

which was below the estimates of $1.09.

RASM increased 1.3% year-over-year driven mainly by a strong performance from the Rapid Rewards loyalty program and a passenger revenue yield increase of 1.5%. Capacity fell 0.9% year-over-year due to the Max groundings.

Total operating expenses

increased 3.7% to $5.1 billion. Unit costs, or CASM, increased 4.6%. CASM,

excluding fuel and oil expense and profitsharing expense, rose 5% year-over-year.

Economic fuel costs in the quarter were $2.09 per gallon, in line with the company’s expectations compared with $2.25 per gallon in the year-ago period. Fuel efficiency dropped 0.8% year-over-year, mainly due to the removal of the company’s most fuel-efficient aircraft from its schedule due to the MAX groundings.

During the fourth quarter, Southwest reached an agreement with The Boeing Company (NYSE: BA) on compensation related to the estimated financial damages in 2019 due to the Boeing 737 Max groundings. Substantially all of the compensation will be accounted for as a reduction in the cost basis of both owned MAX aircraft and future purchased MAX aircraft, and this is expected to reduce depreciation expense in future years.

For the first quarter of 2020, RASM is expected to increase 3.5-5.5% year-over-year. Southwest expects CASM, excluding fuel and oil expense and profitsharing expense, to increase 6-8% year-over-year. Capacity is expected to decrease 1.5-2.5% year-over-year.

Southwest estimates first quarter 2020 fuel efficiency will decrease 2-3% year-over-year, due to the MAX groundings. Based on the company’s existing fuel derivative contracts and market prices as of January 17, 2020, Q1 2020 economic fuel costs are expected to come in the range of $2.05 to $2.15 per gallon. Annual 2020 economic fuel costs are expected to be $2.00 to $2.10 per gallon.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions