COVID-19 effect

The company saw high levels of engagement and monetization during the quarter, with new performance records in its forever franchises, Social Slots and Casual Cards portfolios. User pay revenue grew 61% and user pay bookings increased 47% year-over-year.

Advertising revenue and bookings both witnessed single-digit declines during the quarter due to lower demand in the current environment.

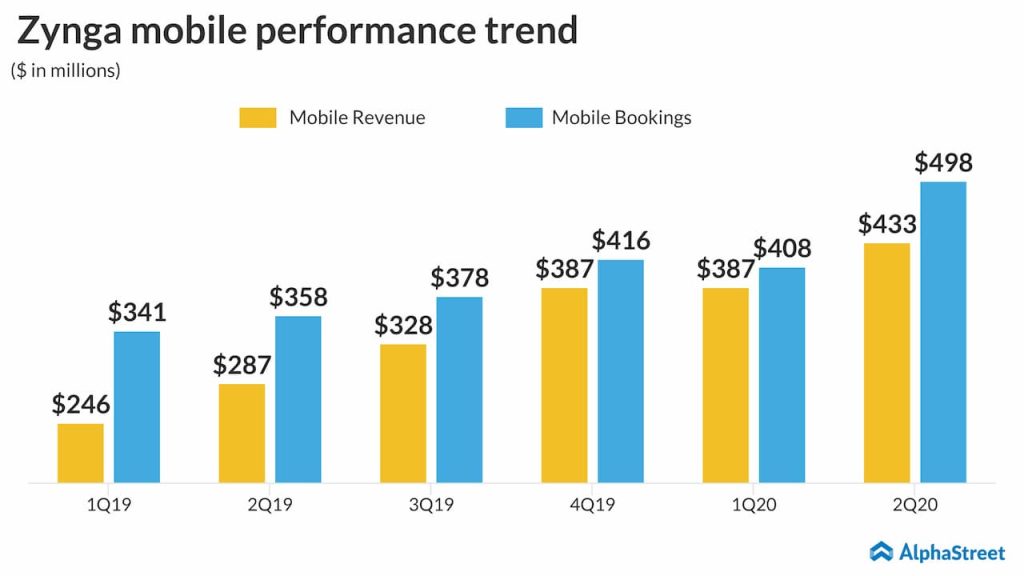

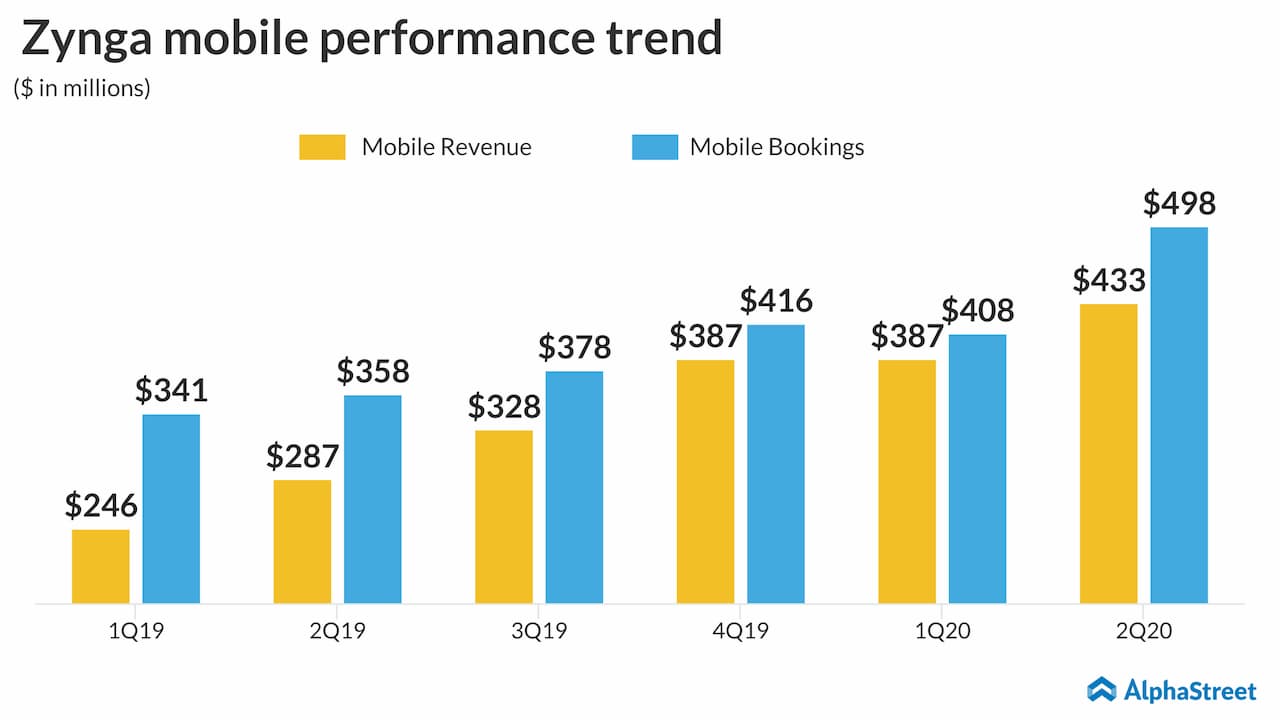

Zynga saw mobile daily active users (DAUs) reach a peak in April and early May due to the shelter-at-home mandates. In the back half of the quarter, DAUs started to return to levels seen in Q1. Average mobile DAUs in Q2 increased 4% while mobile monthly active users (MAUs) remained flat. Mobile average bookings per mobile DAU increased 32%, reflecting strong audience engagement.

Acquisitions

Zynga’s strategic acquisitions have helped expand its portfolio and drive growth. The Small Giant Games and Gram Games acquisitions are performing ahead of expectations. In July, the company acquired mobile puzzle game maker Peak, adding the Toon Blast and Toy Blast titles to its live services portfolio, giving it eight forever franchises.

Toon Blast and Toy Blast are expected to help the company drive its already strong international growth even further, especially in Japan. Zynga has also agreed to acquire Istanbul-based mobile games developer Rollic, giving it an entry into the rapidly growing hyper-casual games market.

“With Rollic, we are meaningfully growing our audience, expanding and diversifying our global advertising business, and adding to our game pipeline and developer network. Zynga and Rollic are well-positioned to grow faster together.”- Frank Gibeau, CEO, Zynga

Zynga will acquire 80% of Rollic for $168 million in cash and the remaining 20% in equal instalments over the next three years. The deal is expected to close this October. Rollic has over 5 million mobile DAUs and 65 million mobile MAUs. The hyper-casual gaming category is seeing fast growth driven by advertising-driven games that have a broad global appeal.

Growth strategy

Zynga’s multi-year growth strategy focuses around the growth of live services, the addition of new forever franchises to its portfolio, and investments in new platforms, technology, and markets. The company is expanding its popular brands and adding new features to its leading titles within its live services portfolio to drive engagement and monetization.

Zynga is adding new forever franchises and also rolling out new games to broaden its live services portfolio. The company is also making significant investments in technology in order to drive growth across interactive entertainment in the fast-changing mobile space.

Outlook

Zynga expects Q3 revenues to increase 29% year-over-year to $445 million and bookings to increase 57% to $620 million. Live services is expected to drive the vast majority of revenue growth, led by forever franchises. However, declines in older mobile and web titles are likely to partly offset this strength. User pay growth is expected to offset lower advertising yields.

The company raised its full-year 2020 guidance and now expects revenue to grow 36% to $1.8 billion and bookings to increase 41% to $2.2 billion. The full-year guidance does not reflect contributions from Rollic.

Click here to read the full transcript of Zynga Q2 2020 earnings conference call