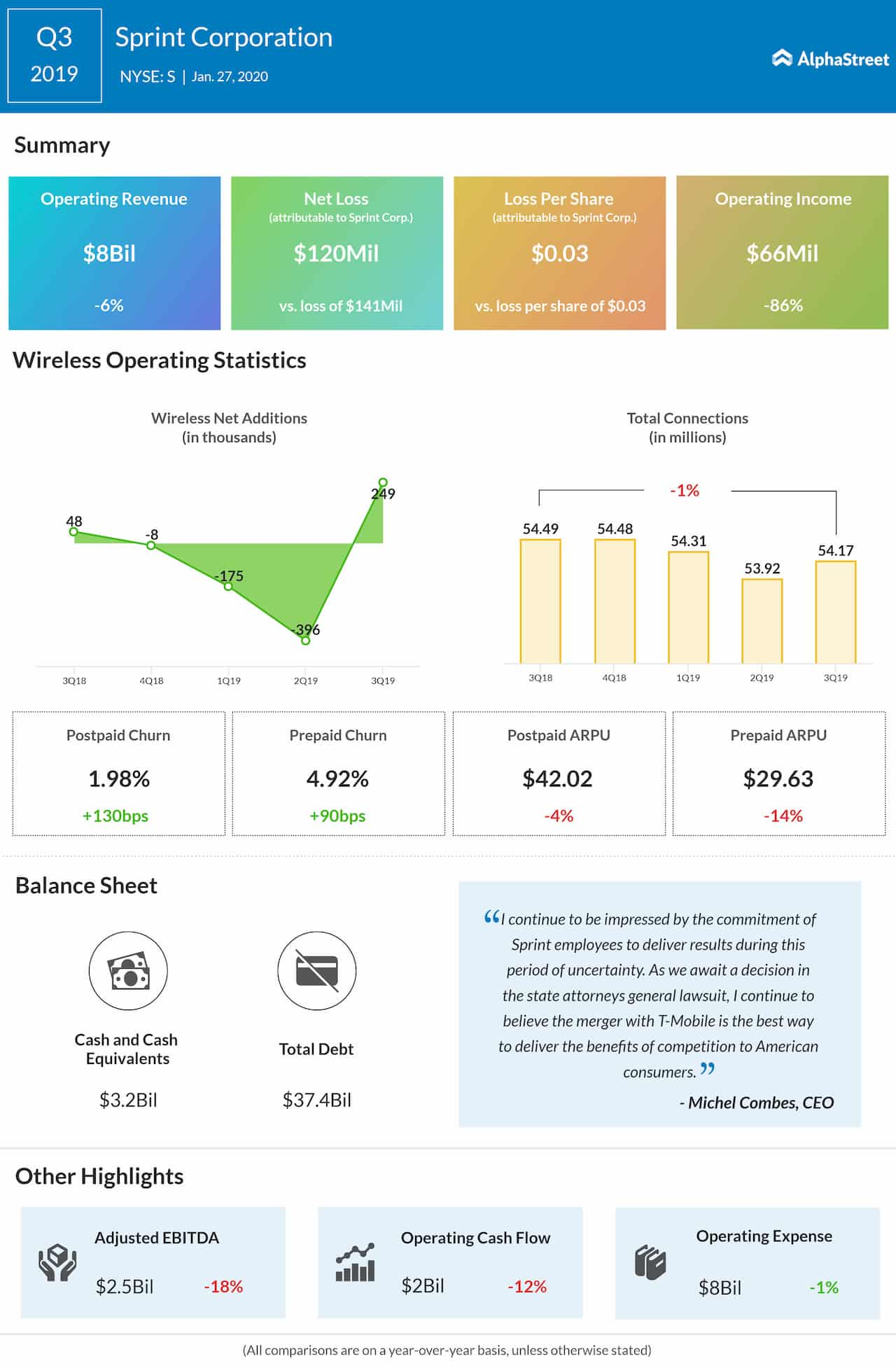

Telecommunication company Sprint Corporation (NYSE: S) reported a narrower net loss for the third quarter of 2019 even as the fate of its proposed merger with T-Mobile (TMUS) remained uncertain. The continuing weakness in the wireless service business took a toll on revenues. The bottom-line also came in above the market’s prediction.

Total net operating revenues dropped 6% to $8.08 billion from $8.60 billion last year. The top line missed the estimates. Total wireless service revenue dropped 5% annually to $5.2 billion, reflecting lower unit revenues. The postpaid average revenue per account dropped 3.7% to $42.02. Meanwhile, postpaid phone average revenue edged up to $50.37

During the quarter, total wireless net additions were 249,000, which represented a marked improvement from the 48,000 additions recorded in the third quarter of 2018. The recovery reflects a 60% annual growth in wireless postpaid net additions to 494,000, which was partially offset by losses in the postpaid cellphone and prepaid business.

Loss Narrows

Third-quarter net loss narrowed to $120 million from $141 million in the corresponding period of last year. On a per-share basis, loss remained unchanged at $0.03 per share. The bottom line beat the Street view.

“I continue to be impressed by the commitment of Sprint employees to deliver results during this period of uncertainty. As we await a decision in the state attorneys general lawsuit, I continue to believe the merger with T-Mobile is the best way to deliver the benefits of competition to American consumers,” said CEO Michel Combes.

Growth Initiatives

Of late, the management has been striving to reduce costs and improve Sprint’s digital capabilities to enhance the customer experience. However, the effect of the cost-cutting program was offset by incremental costs associated with network coverage and capacity improvements. As part of deploying the next-generation network, the company expanded its 5G mobile coverage to about 20 million users.

Shares of Sprint closed

the last trading session at $4.83, broadly at the levels seen five

years ago. The stock dropped 22% in the past twelve months and 8%

since the beginning of 2020.