It was not a brew-tiful quarter for coffee chain giant Starbucks (NASDAQ: SBUX), which got hammered by the COVID-19 pandemic in the second quarter of fiscal 2020. Starbucks expects the negative financial impacts of COVID-19 to be significantly greater in Q3 compared to Q2, and to extend into Q4. EPS, both on a GAAP and non-GAAP basis, slumped 47% from the year-ago quarter, while revenue decreased 5% primarily due to a 10% steep drop in global comp-store sales in the second quarter ended March 29, 2020. Let’s look at what the management discussed on the impacts of pandemic and its financial outlook.

In Starbucks first quarter earnings call at the time only when China was troubled by the pandemic, there were nine occurrences of “coronavirus” and during the second quarter earnings call, when all the countries in the world got shattered by the deadly virus, the word “COVID” was mentioned 57 times.

China

China, which holds a lion’s share of revenue in Starbucks International segment and where the pandemic impacted the company’s business for most of Q2, registered a 46% decline in revenue, hurt by the 50% decline in comp-store sales. More than half of Starbucks stores in China were temporarily closed as of January 28, 2020. Starbucks started restarting stores in February and now almost 100% of the stores are open in China, many with limited seating, reduced hours and other safety protocols in place.

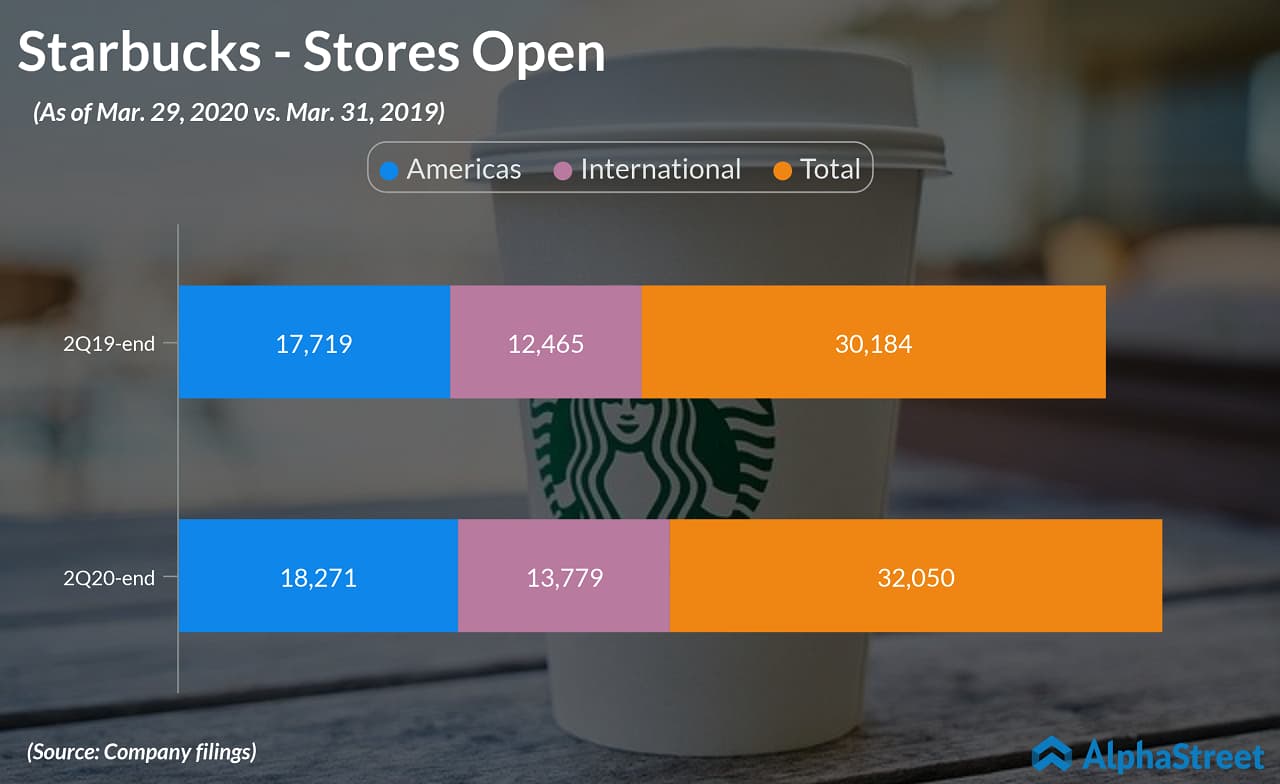

Even though new store development activities were discontinued for most of the quarter, Starbucks opened 59 net new locations during Q2, and added another seven locations in April. The company eyes to open at least 500 net new stores in fiscal 2020 with as many as 100 new stores, originally planned for the current fiscal year postponed to fiscal 2021.

On recovery, the management said:

“And so we are seeing people come back into the cafes and sit there, albeit not to the levels that we saw pre-COVID. What we’re seeing is that there is a higher percentage of to-go orders taking place in China, and we expect that trend to continue. And if there is a silver lining, I think it is forming a new habit in China, where you are seeing more people take to-go orders and get used to doing that. And so we’re optimistic that the shift will continue to occur. We anticipate the 80% of where we were pre-COVID will come back. Maybe not as high, but the overall sales levels that we’ll see in China, we will get back to full recovery and on a path to full recovery by the end of this fiscal year.”

Starbucks had planned to open Coffee Innovation Park outside Shanghai in 2022, which will serve as a key component of Starbucks’ worldwide coffee roasting network for Chinese customers.

US

Performance in Starbucks’ largest market was interrupted in mid-March when a nationwide lockdown was declared to lessen the effects of COVID-19. More than 50% of company-operated stores were closed and about 60% of the orders were drive-through and over 80% of the orders before the crisis were on the go, with the majority of these orders being placed at the drive-through or by using the Starbucks app to mobile order for pickup or delivery. The company estimates Americas Q2 revenue decline attributable to COVID-19 to be about $450 million.

There was also some positive news during the quarter. 90-day active Starbucks Rewards members, the loyal customer base with whom the company can directly communicate digitally, increased to 19.4 million in the US, up 15% from a year ago. Also, the average ticket growth increased by 5% in the quarter.

Outlook

Except China, most of the countries in the world are in earlier phases of COVID-19 impacted response. As a result, Starbucks suspended its formal guidance for fiscal 2020. With 98% of the stores are open and increased consumer traffic, Starbucks expects sales in China to advance in the second half of fiscal 2020 relative to the 50% decline reported for Q2, declining 25% to 35% in Q3, and trending towards roughly flat by the end of Q4 relative to the prior year. For the full fiscal year, China’s comp sales are expected to decline between 15% and 25%.

Combining the effects of comparable store sales declines and new store development deferrals, Starbucks estimates revenue in China to be negatively impacted by COVID-19 in the range of $750 million to $850 million with an estimated EPS impact of between $0.30 and $0.37 in fiscal 2020.

[irp posts=”55526″]

For the US, Starbucks expects the negative financial impacts of COVID-19 to be significantly greater in Q3 compared to Q2, and to extend into Q4. The company plans to open the US stores in the next week with modified operations and shorter operating hours. The management added that in a month’s time there will be clear visibility on the recovery and expects approximately 90% of company-operated stores to be open by early June. In the third quarter, the company expects 13 weeks of impact, most significantly in the month of April, but reduced in the months of May and June as the company will reopen the stores and normalize pay practices.

“While the initial impacts in the US are less severe than they were in China, from a comparable store perspective, owing to the prevalence of our drive-through model in the US, we do expect the impacts to persist for a longer period of time as we move through the monitor-and-adapt phase with the recovery phase extending into fiscal 2021. We expect the COVID-19 impacts in Canada and Japan as well as in our international licensed businesses will follow a similar pattern of the US, very pronounced in the third quarter with some easing of these impacts expected in the fourth quarter as these businesses move into the recovery phase.”

ADVERTISEMENT

On a reported basis, Channel Development segment revenue is expected to decline between 6% and 8% in fiscal 2020 relative to the prior year, with the impact being more prominent in Q3 and less in Q4. Additionally, the disruption resulting from COVID-19 is expected to adversely impact foodservice business under the Global Coffee Alliance and ready-to-drink business during the balance of fiscal 2020.

Cash needs

Starbucks has been accessing additional capital to bridge its near-term cash needs, which is expected to peak in Q3. The company has been creating additional room for investment by suspending share repurchases, reducing discretionary expenses and delaying certain capital expenditures. As a result of postponing some new store openings and store refurbishments, Starbucks expects capital expenditures for fiscal 2020 to be about $1.5 billion, down $300 million than the previous estimate.

[irp posts=”58863″]

While Starbucks results for the second half of this fiscal year are not going to be good, it is expected that given the scale of the company, combined with the strength of its balance sheet, it will be able to maintain adequate liquidity and manage through the current crisis and bounce back in fiscal 2021.