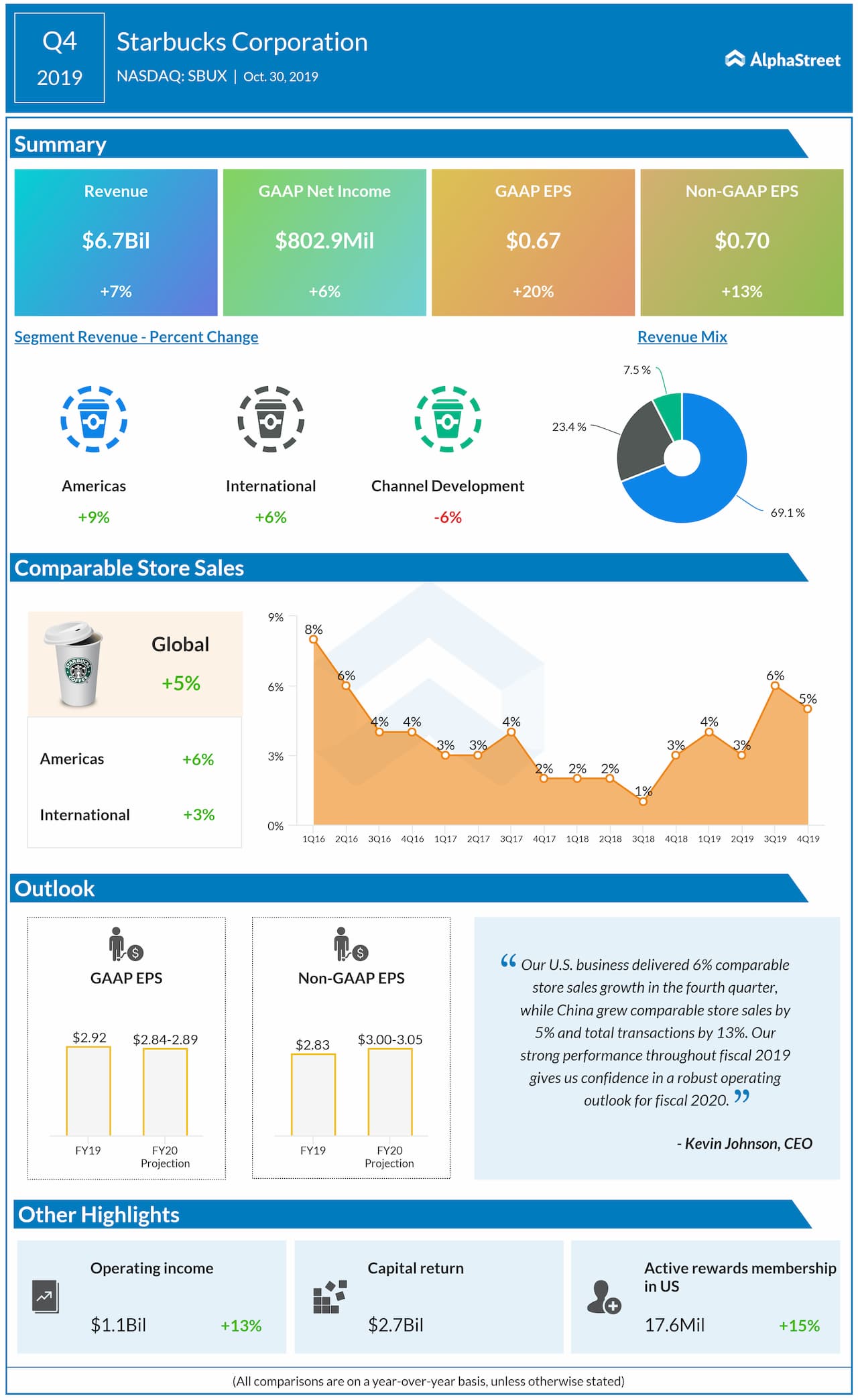

Revenue grew by 7% to $6.75 billion. The global comparable store sales increased by 5% driven by a 3% rise in average ticket and a 2% increase in comparable transactions. US comp sales grew 6% while China comps rose 5%.

Looking ahead into fiscal 2020, the company expects revenue growth in the range of 6% to 8% with global comparable-store sales growth of 3% to 4%. Earnings are anticipated to be in the range of $2.84 to $2.89 per share and adjusted earnings are predicted to be in the range of $3.00 to $3.05 per share.

The company opened 630 net new stores in Q4, yielding 31,256 stores at the end of the quarter, a 7% increase over the prior year. Starbucks Rewards loyalty program grew to 17.6 million active members in the US, up 15% year-over-year.

For the fourth quarter, the top line grew by 10% over the prior-year adjusted for unfavorable impacts of about 3% from Streamline-driven activities. This includes the licensing of CPG and Foodservice businesses to Nestle and the conversion of certain international retail operations to licensed models.

In the fourth quarter, Starbucks realigned its operating segment reporting structure to better reflect the cumulative effect of its streamlining efforts. Specifically, the previous China/Asia Pacific segment and Europe, Middle East, and Africa segment have been combined into one International segment.