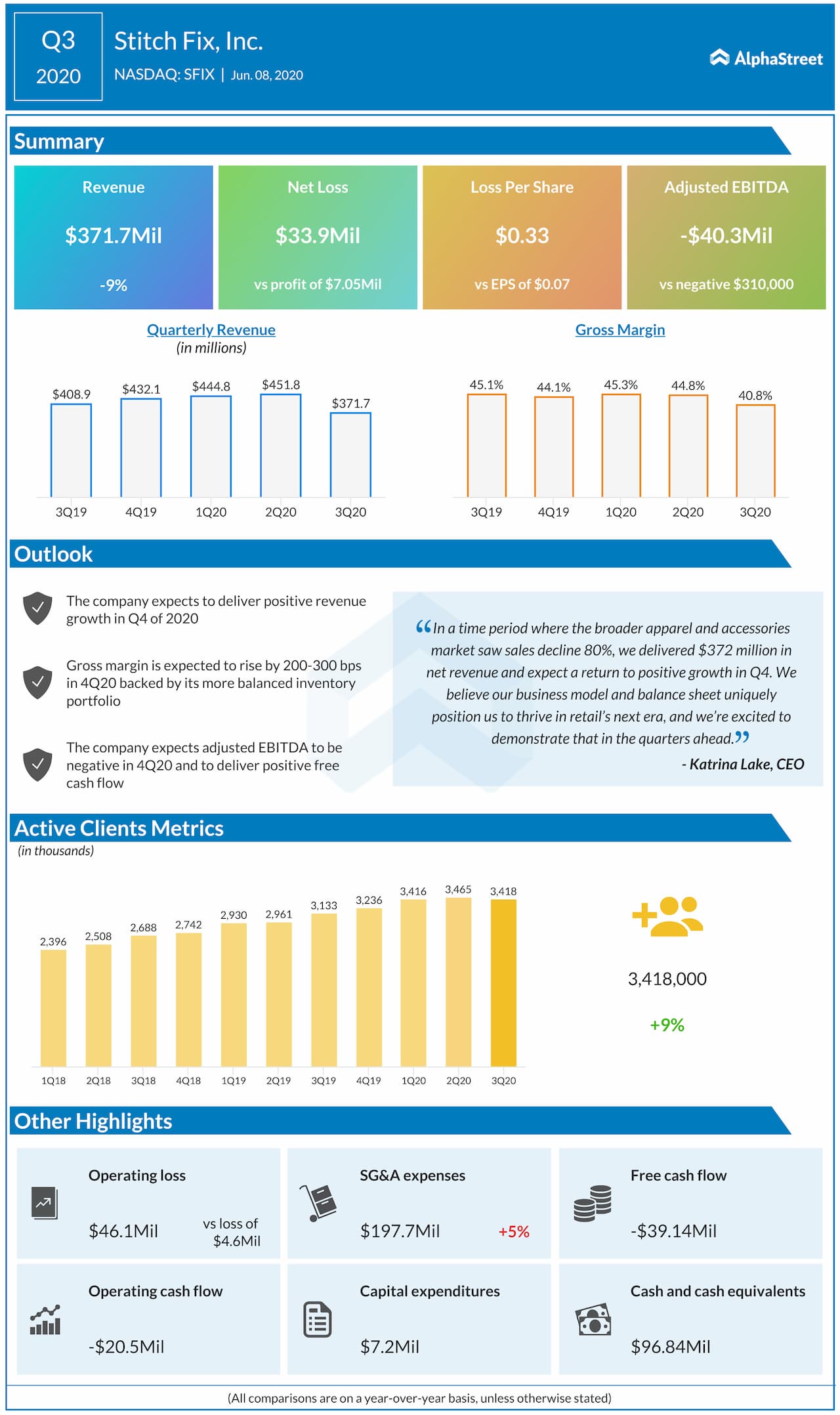

Since late March, the company experienced softness in the client demand due to the temporary shift in consumer mindshare as the COVID-19 crisis escalated. The company exited Q3 at about two-thirds capacity but had an aggressive strategy to ensure it drove continued operational improvements throughout the course of May.

While approaching full capacity, the company is tracking to eliminate its Fix backlog by the end of June, putting it in more of a position to play offense in the coming quarters.