The stock closed the last trading session at $35.89, a price that most investors would find attractive. While the estimates for the just-concluded quarter are mixed, the majority of analysts recommend hold. The 12-month target price is around $40, which represents a 14% upside.

Weak Topline

The softness in the core business, due to faltering volumes, has given rise to skepticism about the stock’s future. It is uncertain whether the ongoing recovery would be sustained until the next earnings release, which is expected by the month-end. The downtrend at the top-line is likely to continue, but eBay’s strong buyer pool leaves room for optimism. Currently, all eyes are on the company’s holiday season sales report, which is due this week.

In the long term, the multi-year plan laid down by the management to enhance operating efficiency should pay off. If realized, the projected margin growth for the next two years would add to shareholder return during that period. Earlier, investor confidence improved in November after the company divested its StubHub ticket business in a $4-billion deal.

Competition

According to experts, the primary challenge facing the company is competition from market leaders like Amazon (AMZN), as more and more retailers switch to the multichannel business model. Another concern is the new sales tax proposed by the government for online traders.

Mixed Q3

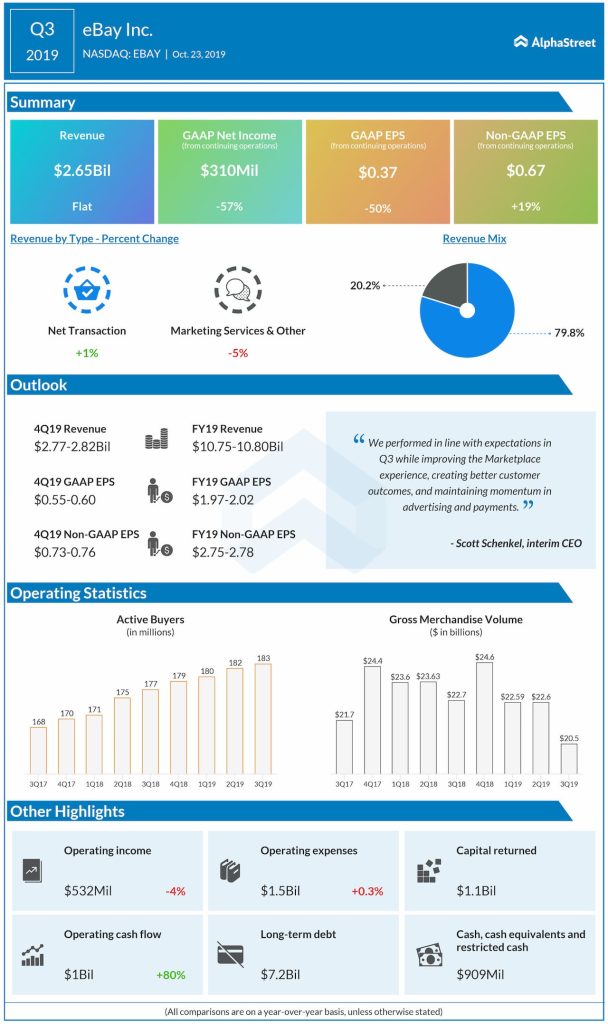

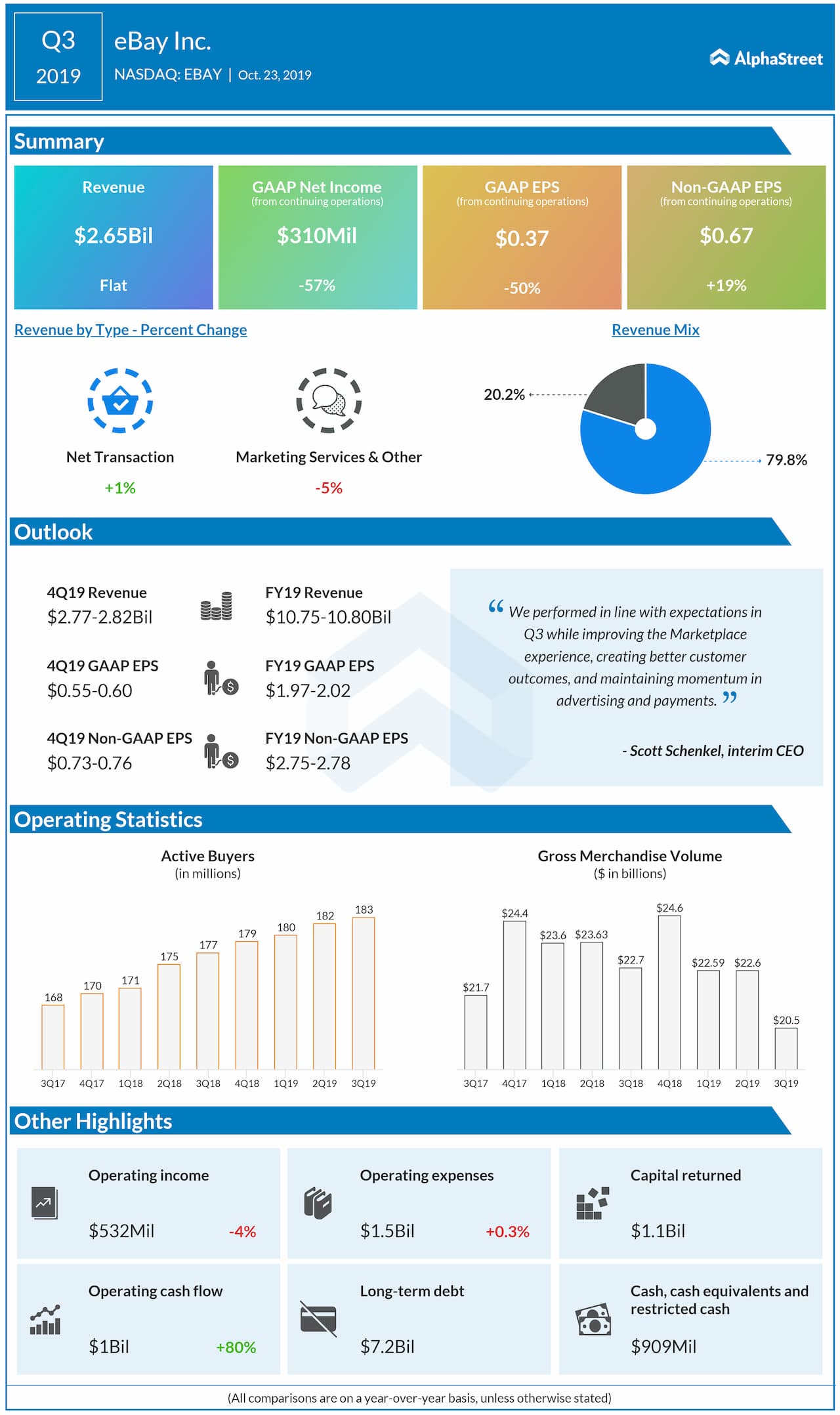

In the third quarter, gross merchandise volume was hurt by weak sales, despite an increase in the number of active buyers. Adjusted earnings increased in double digits to $0.67 per share and topped the Street view while revenues remained unchanged at $2.7 billion, in line with the estimates. Meanwhile, investors were disappointed by the guidance provided by the management, which fell short of expectations.

Also read: eBay gains after $4-Bil deal with Swiss firm

For eBay’s stock, 2019 was a year of high volatility. After a positive start, the shares lost momentum towards the end of the year. They gained about 6% in the past twelve months.