Drugmaker Mylan (NASDAQ: MYL) is all set for a transformation with its planned merger with Upjohn, the generic medicine business of Pfizer (PFE). The transaction, which is expected to close mid-2020, is of great significance for the company at a time when it is facing multiple challenges, including sales slump in North America and pricing issues.

Of late, Mylan has been pinning hope on its biosimilar business, with several candidates at different stages of development and neutropenia drug Fulphila recently securing FDA approval. The company has been gaining market share aided by the positive response to its biosimilar to Roche Holding’s cancer drug Herceptin. Ogivri was rolled out last year after a legal battle.

The Pros

These positive factors, combined with the Pfizer tie-up, should help the company regain strength this year. Incoming chief financial officer Sanjeev Narula, who is expected to assume office at the combined entity later this year, will have several key tasks to perform.

Stock Movement

Mylan’s stock was on the recovery path early this year, after last year’s dismal performance, but it pulled back last month amid the coronavirus-linked selloff. Market watchers predict a strong rebound in the latter part of the year and the majority of them recommend buying the stock.

Currently, the main challenge facing the company is lingering concerns over last year’s lawsuit in which several generic drugmakers including Mylan were charged with price-fixing. The final outcome of the case could play a key role in deciding the company’s future, given the unfavorable market conditions including the falling prices of generic drugs in the US.

Q4 Profit up

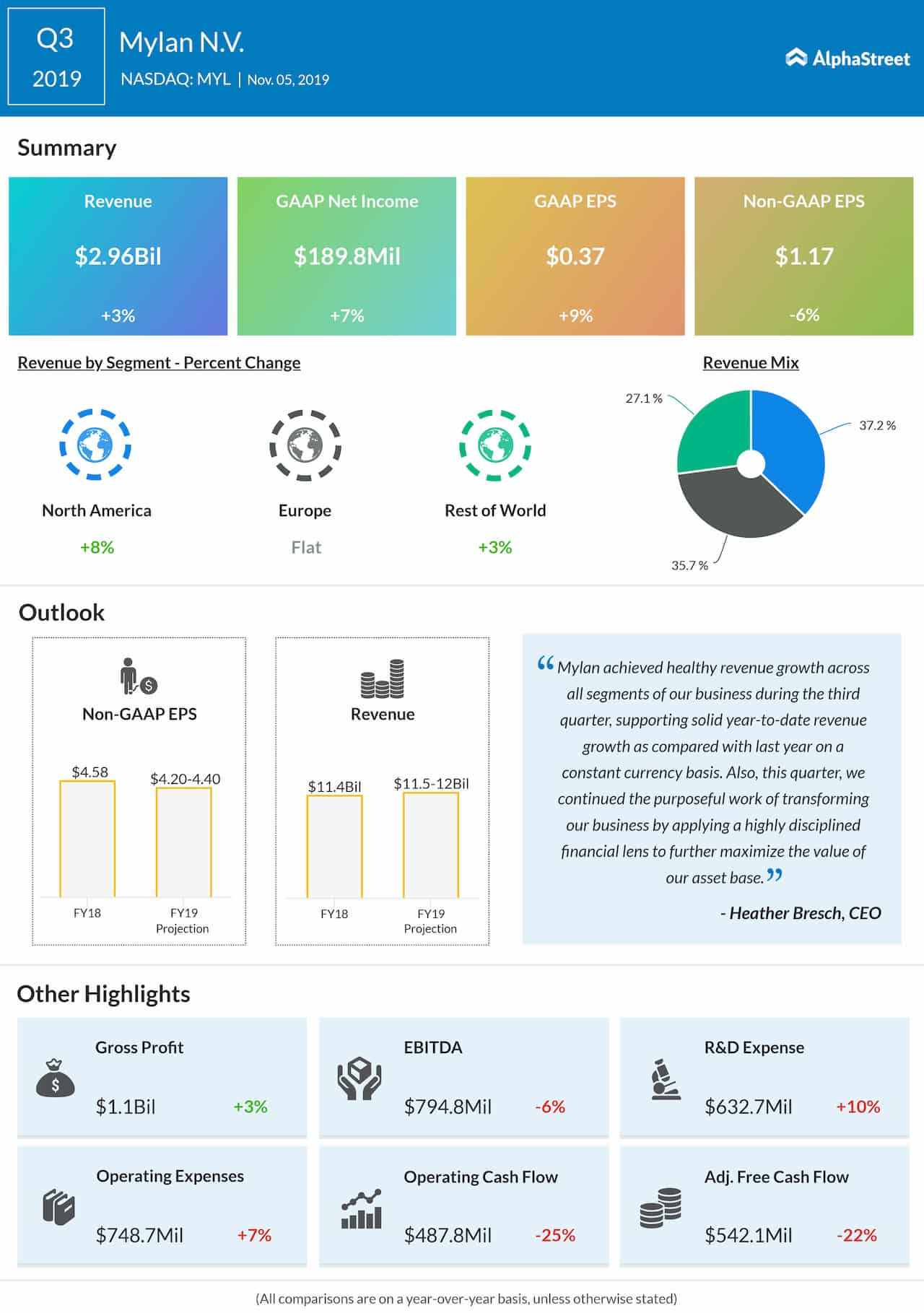

Reflecting the strong demand across key markets, Mylan’s revenues grew 4% to $3.2 billion in the fourth quarter. Consequently, earnings, adjusted for one-off items, moved up 8% to $1.40 per share during the three-month period. While the bottom-line topped the Street view, revenues fell short of expectations.

Mylan’s stock, which has been in a free fall for more than a year, extended the losses in recent weeks as the COPID-19 crisis battered the markets. At $15.04, the shares closed the last trading session down 48% from last year. The stock contracted about 20% this year alone.