Levi Strauss & Co. (NYSE: LEVI) this week temporarily

closed its stores across the US and Canada, in response to the covid-19

outbreak. A year after returning to the public markets, the apparel firm’s stock

is currently trading far below the IPO price, thanks to the recent selloff.

The company in a recent statement said the extent of the coronavirus impact on its operations is “uncertain.” Of late, Levi has been expanding its store network in China, though it sources only a small portion of raw materials from that country. In the present scenario, it is facing near-term challenges such as faltering sales due to muted consumer spending, supply chain disruptions and China-related headwinds.

For the company, which is popular across the world for its namesake denim jeans brand, the last fiscal year was quite successful, marked by decent top-line growth despite challenging market conditions. There was a corresponding uptick in profitability also. If the trend continues, the company should be able to overcome the current issues and hit the recovery path in the latter part of the year.

Mixed Sentiment

Obviously, there is concern among Levi shareholders after having lost most of last year’s gains. The low price, combined with the company’s strong fundamentals and impressive track record of creating shareholder value, can be viewed as a buying opportunity. In general, market watchers are bullish about the future prospects of Levi, which has been assigned strong buy rating.

Digital Prowess

As far as the management’s growth strategy is concerned, a key strength is the encouraging response to its direct-to-customer initiatives. Also, the steady expansion of the e-commerce platform will help the company absorb the epidemic’s impact on physical stores to some extent. Considering the scale of the ongoing market turmoil, every investment has risks associated with it, and Levi is no exception. Moreover, the company’ earnings performance as a listed entity has been better than the industry average, which adds to its value.

Q4 Results

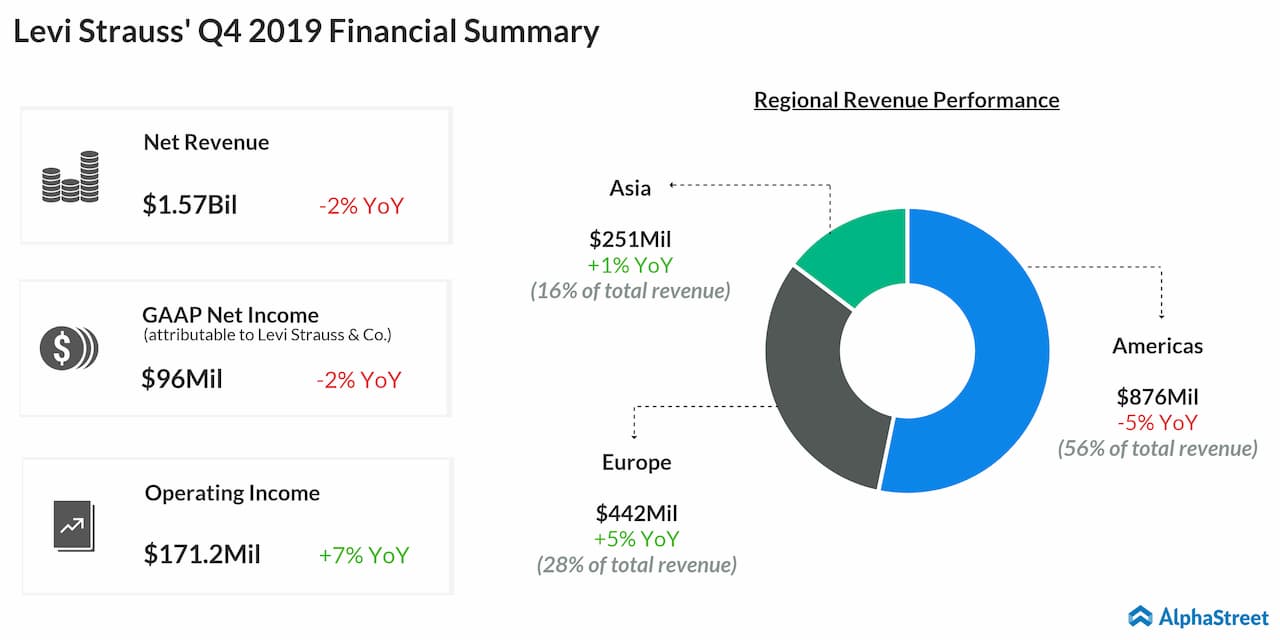

In the fourth quarter, positive performance in Asia and Europe was more than offset by a decline in revenue in the Americas, the region that accounts for more than half of the total revenues. Earnings dropped by four cents to $0.26 per share but exceeded market’s prediction. The top-line dipped 2% year-over-year to $1.57 billion and missed the Street view.

Levi’s shares slipped to an all-time low recently, before paring a part of the loss this week. The stock has lost about 25% since the beginning this year, after making stable gains in the second half of 2019.