Quarterly performance

Trends

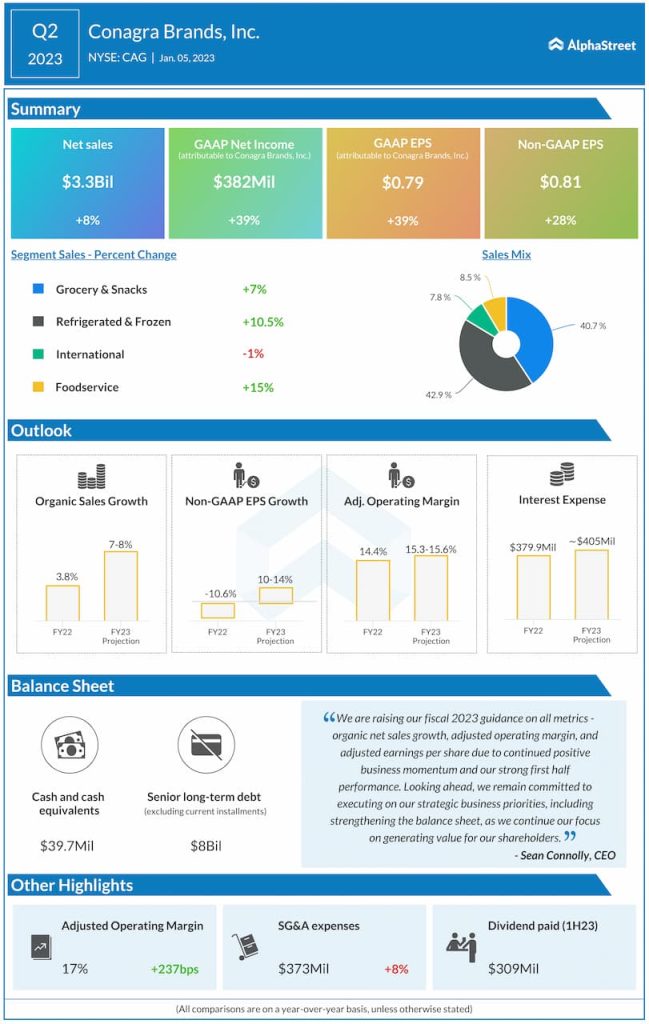

During the second quarter, organic sales increased 8.6%, driven by price increases rolled out by the company to combat inflation. This was partly offset by an 8.4% drop in volume due to the elasticity impact from the pricing actions.

Conagra reported sales increases across all its segments, barring International, which was hurt by FX headwinds. The sales growth was driven by price hikes but the elasticity impact from these hikes led to volume declines across all divisions.

During the second quarter, Conagra’s retail sales grew 10.6% versus the year-ago period. The company gained share in snacking categories like meat snacks and microwave popcorn, as well as in staples categories like canned meat. Sales of microwave popcorn increased 21% versus the prior-year quarter while meat snacks saw sales growth of nearly 15%.

Conagra also gained share in categories like frozen single-serve meals, plant-based protein, and frozen breakfast. In Q2, sales of single-serve meals rose 10.2% versus a year ago while plant-based protein sales increased 5.6%. Sales of breakfast sausage was up nearly 27%.

In Q2, Conagra’s gross profit increased 22% to $922 million, benefiting from organic sales growth and productivity which helped offset cost of goods inflation. Gross margin rose 316 basis points to 27.8%.

Outlook

Based on its business momentum and strong performance in the first half of the fiscal year, Conagra raised its guidance for all its key metrics. For FY2023, the company now expects organic net sales growth of 7-8% versus the previous guidance of 4-5% growth.

Adjusted EPS is expected to be $2.60-2.70, representing year-over-year growth of 10-14%. This compares to the previous expectation of adjusted EPS growth of 1-5%. Adjusted operating margin is now estimated to range between 15.3-15.6% versus the prior outlook of approx. 15%.

Click here to read more on consumer stocks