Sales trends

During the quarter, the food and beverage category recorded low double-digit comp sales growth while comp sales in the essentials category grew in the low single digits. Sales in the discretionary categories remained soft through the quarter. Owned brands outperformed their national brand equivalents as customers looking for value chose affordable options amid rising prices.

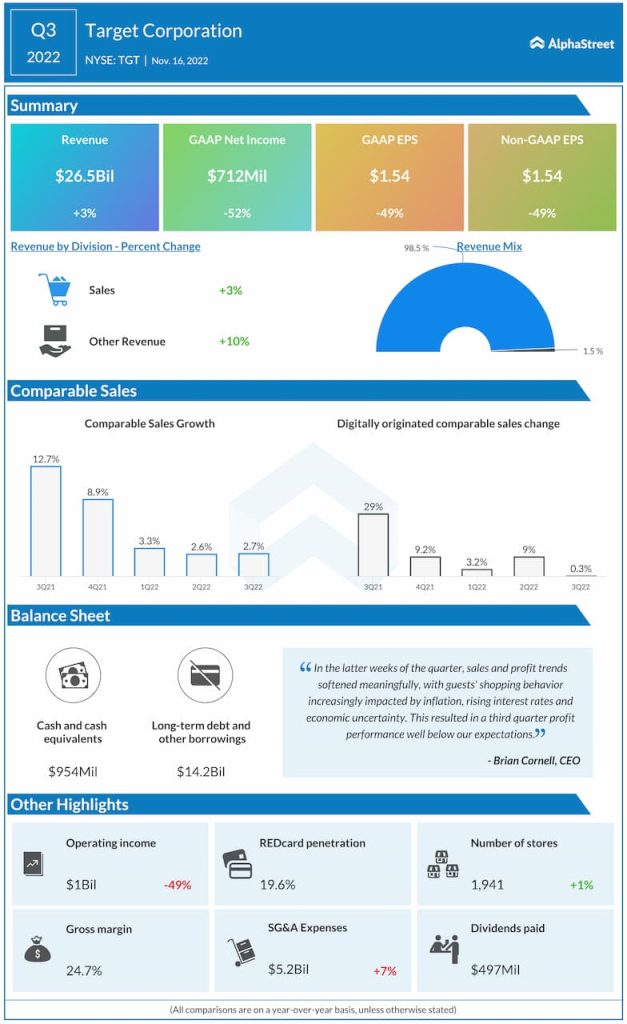

Target’s total revenue increased 3.4% year-over-year to $26.5 billion in the third quarter of 2022. Comparable sales grew 2.7% in Q3. However, this number was up only slightly from the 2.6% reported in Q2 2022 and much lower than the 12.7% reported in Q3 2021. After staying well over 3% through the first two months of the quarter, comps slowed down to just under 1% in October. This slowdown reflects a hesitation on the part of customers to purchase at full price amid inflationary pressures.

Profitability

In Q3 2022, Target delivered adjusted EPS of $1.54, which was down 49% YoY and well below expectations. This was caused mainly by a drop in margins as customers opted to buy more on-sale items than make full-price purchases. Value remains a priority and customers are either choosing smaller pack sizes or owned brands to reduce their spending or they are opting for larger size packs and stocking up on-sale items as they battle inflation.

Target’s margins were also impacted by inventory shrink, which is a problem faced by the entire retail industry. Year-to-date, the company’s gross margin dropped by over $400 million due to shortage and for the full year, it is expected to see an impact of over $600 million.

Another factor that affected gross margin during the quarter was the cost of managing early inventory. However, the company expects these pressures to subside in the near term as it moves through the fourth quarter and into next year.

Outlook

Based on the shopping patterns and sales trends that it has witnessed so far, Target is planning for a wide range of comparable sales outcomes in the fourth quarter that’s centered around a low single digit comp decline. The company anticipates discretionary category comps to be softer than the last two quarters, partly offset by strong growth in the frequency businesses. Target also expects pressure from discounts and inventory shrink during the fourth quarter and hence it is planning a wide range for its operating margin rate centered around 3%.