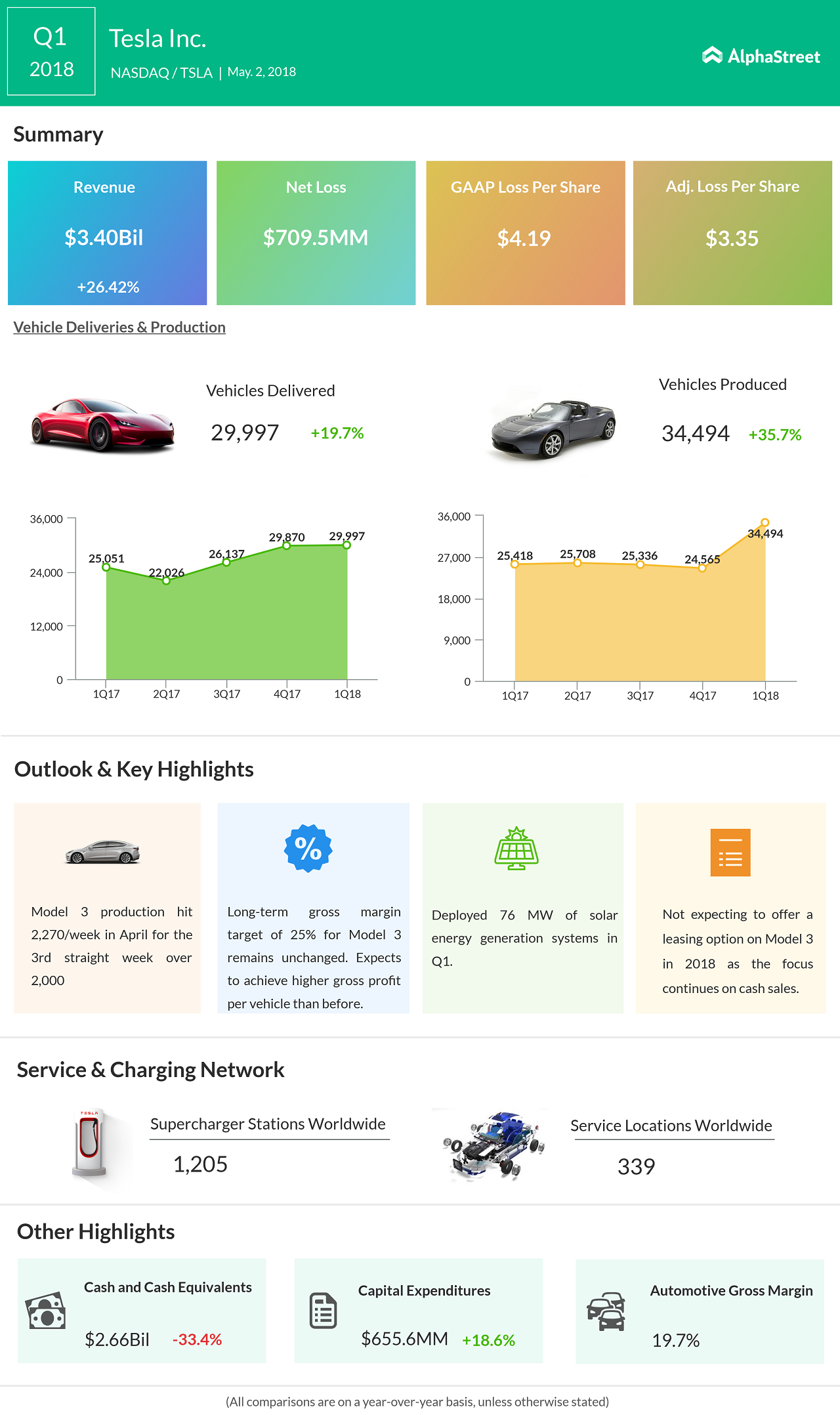

Electric car pioneer Tesla (TSLA) today reported 26% jump in first revenue to $3.4 billion, beating analysts’ estimates. The adjusted net loss for the quarter came in at a better-than-expected $568 million, or $3.35 per share. Analysts had expected quarterly revenue of $3.22 billion and a net loss of $3.58 per share.

On a GAAP basis, the company’s net loss widened to $784.6 million, or $4.19 per share, versus $397.2 million, or $2.04 per share in the prior-year period.

The Elon Musk-headed company reiterated its projection: positive GAAP net income and positive cash flow in the third and fourth quarters of this fiscal year, even as its cash reserves declined 21% to about $2.67 billion.

A worsening cash condition had earlier prompted the Wall Street to predict that the company would need to raise more capital again this year, though Musk had rubbished this on Twitter. The company had $3.4 billion in cash and cash equivalents at the end of fiscal 2017.

Tesla said Model 3 production hit 2,270/week in April. The company had earlier warned that it would miss the weekly production target of 2,500 Model 3s in Q1 and 5,000 Model 3s in Q2. Deliveries were impacted by two production delays during the quarter caused by “problems relating to excessive automation.”

Meanwhile, the company once again maintained its optimism of achieving its weekly production target of 5,000 Model 3s in the coming two months. Tesla also reiterated its long-term gross margin target of 25% for Model 3.

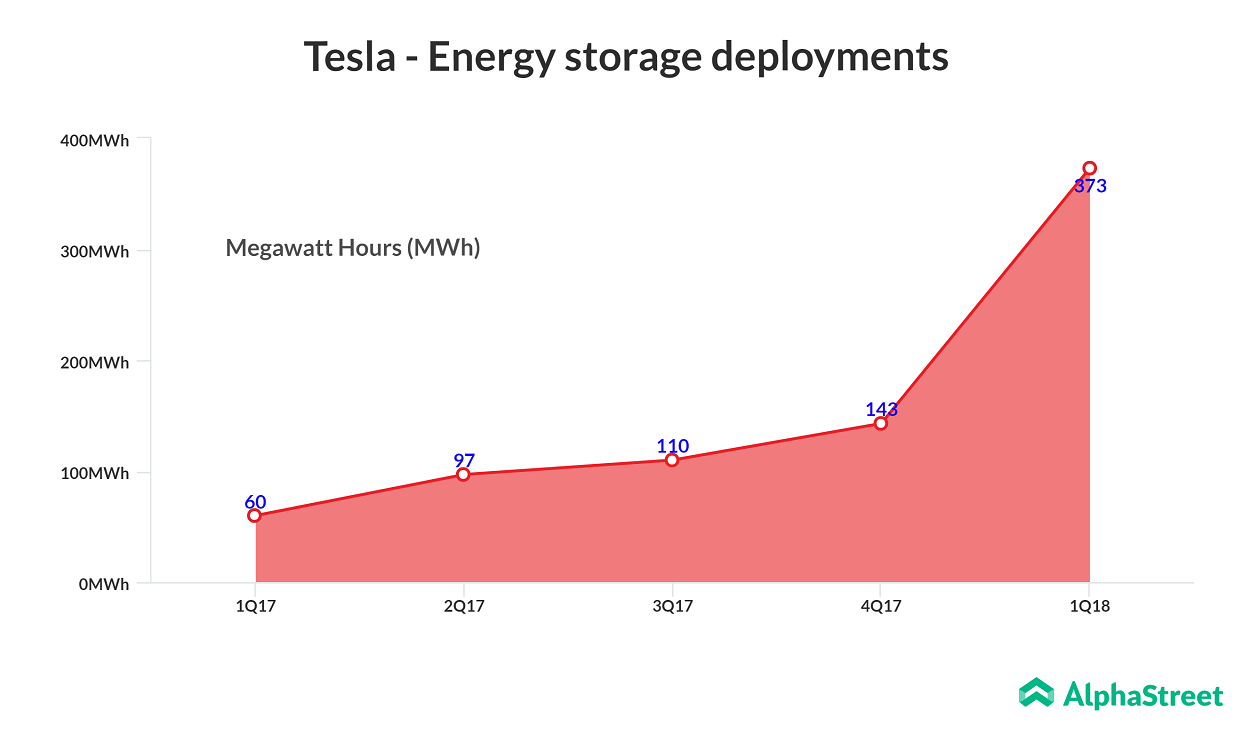

Tesla expects 2018 to be a key period for its energy storage business. The company aims for a three-fold increase in MWh deployed for its energy storage products in 2018.

Yesterday, the Utah-based competitor Nikola Motor filed a $2 billion lawsuit against Tesla, alleging that the company had stolen the patent design of its semi-truck.

Tesla shares rose 0.6% in aftermarket trading following the announcement. The shares are down over 5% in the past 52 weeks and down over 3% year-to-date.