The top line was positively impacted by a strong increase in vehicle deliveries. Revenue growth was offset by higher lease mix, Model 3 becoming a larger part of its mix, introduction of the Standard Range trims of Model 3, and adjustments to vehicle pricing. This resulted in a reduction of the average selling price relative to 2018.

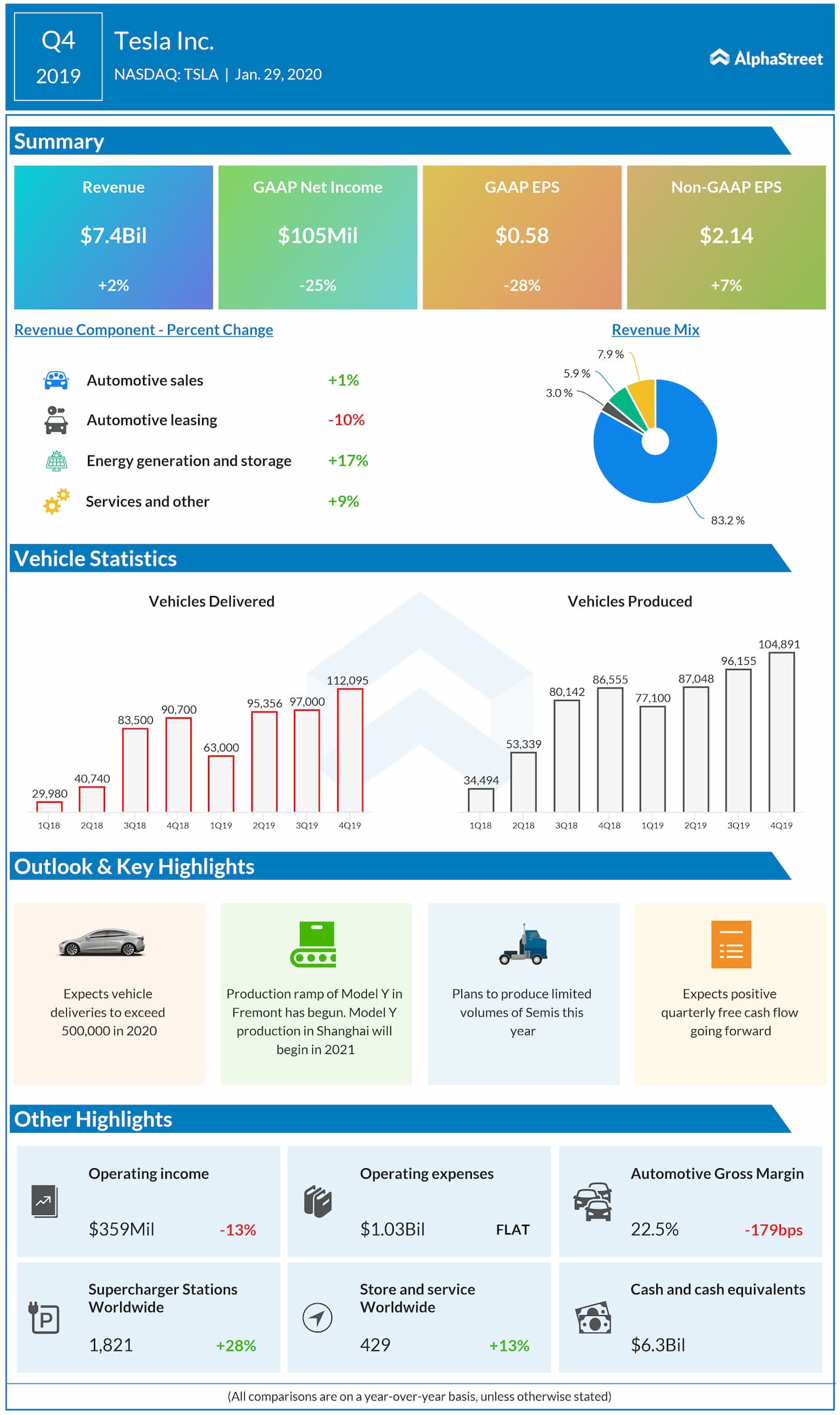

Looking ahead into the full year 2020, the company expects vehicle deliveries to exceed 500,000 units. Due to the ramp of Model 3 in Shanghai and Model Y in Fremont, production will likely outpace deliveries this year. Both solar and storage deployments should grow at least 50% in 2020.

Tesla expects positive quarterly free cash flow going forward with possible temporary exceptions, particularly around the launch and ramp of new products. The company continues to believe its business has grown to the point of being self-funding.

GAAP net income is predicted to be positive going forward as the main focus turned to continuous volume growth, capacity expansion, and cash generation. The production ramp of Model Y in Fremont has begun ahead of schedule. Model 3 production in Shanghai is continuing to ramp while Model Y production in Shanghai will begin in 2021. The company plans to produce limited volumes of Tesla Semi this year.

The company said it is positioned to accelerate its revenue growth further through increasing build rates in Gigafactory Shanghai and its Model Y production line in Fremont. These production increases will allow for higher total vehicle deliveries and associated revenue. The company will start delivering Model Y vehicles by the end of Q1 2020.

For the fourth quarter, Model S/X production dropped by 29% year-over-year to 17,933 vehicles while Model 3 production jumped by 42% to 86,958 vehicles. Model S/X deliveries fell by 29% to 19,475 vehicles while Model 3 deliveries increased by 46% to 92,620 vehicles.

The company deployed lesser solar during the fourth quarter as solar deployed fell by 26% to 54 MW while storage deployed jumped by 136% to 530 MWh. Supercharger stations climbed by 28% to 1,821 and supercharger connectors increased by 34% to 16,104.

Tesla is moving forward with its preparations near Berlin, which has been selected to build vehicles for the European market due to strong manufacturing and engineering presence in Germany. The first deliveries from this factory are expected in 2021.