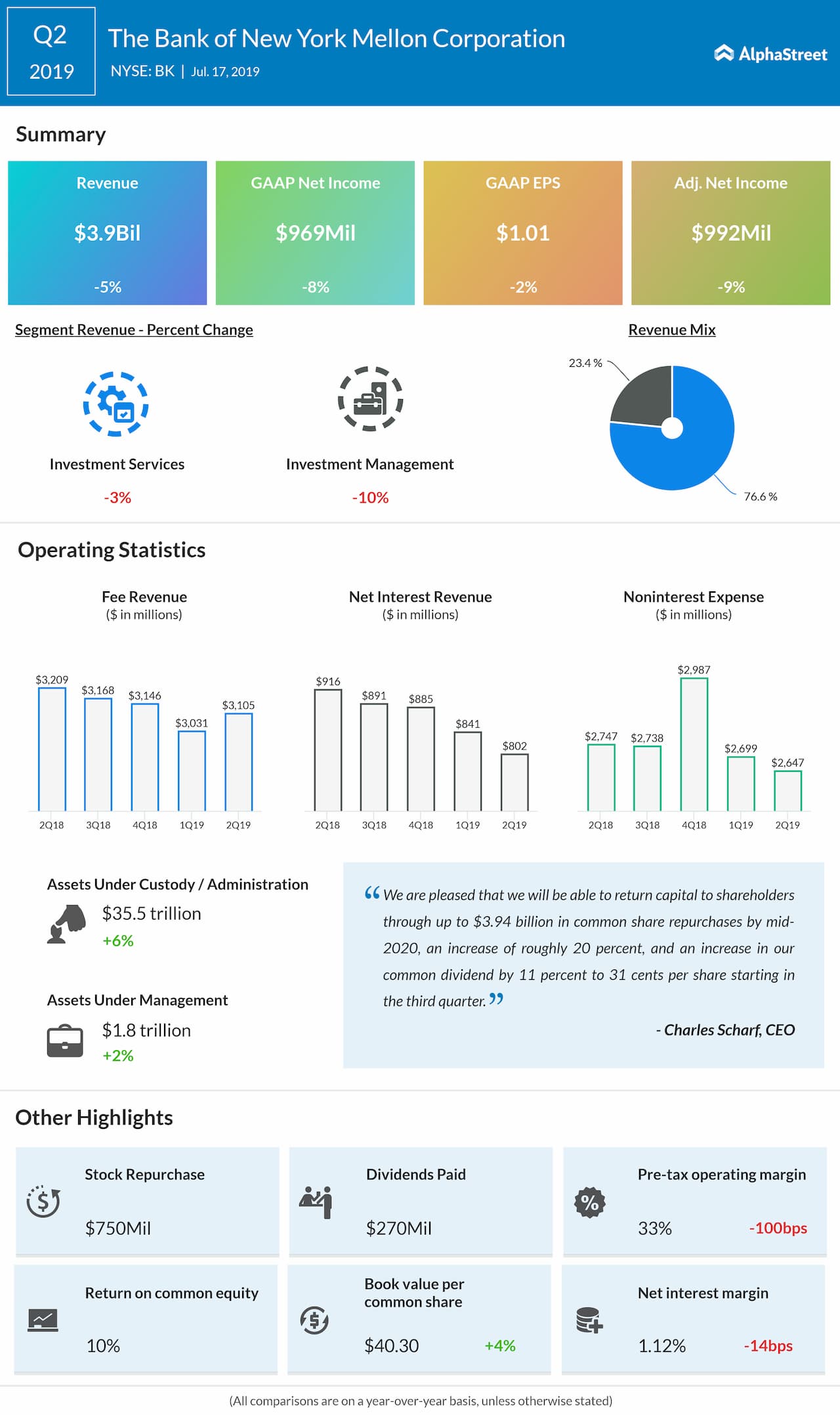

Net income fell 8% year-over-year to $969 million while EPS

dropped 2% to $1.01. Analysts had forecast EPS of $0.95.

Fee revenue decreased 3%, mainly due to cumulative AUM

outflows, negative impacts from a strong US dollar and lower foreign exchange

and securities lending revenue. Net interest revenue declined 12%, hurt by

higher deposit and funding costs and the impact of hedging activities.

In the Investment Services business, total revenues fell 3%.

Within this business, the company saw revenue growth on a year-over-year basis in

most of its divisions except for Asset Servicing and Treasury Services. The

decreases in these two divisions were mainly due to lower net interest revenue.

In the Investment Management business, total revenues

decreased 10%. Within the segment, revenues declined in both the Asset

Management and Wealth Management divisions year-over-year due to various

factors including impacts from divestitures and hedging activities and lower

net interest revenue.

Assets under custody and/or administration (AUC/A) and assets under management (AUM) both saw single-digit increases, helped by higher market values and net new business.

In a separate release, the company declared a quarterly common stock dividend of $0.31 per share, payable on August 9, 2019 to shareholders of record on July 29, 2019.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.