On its quarterly conference call, Nordstrom laid out three growth priorities that it has been focusing on and the progress it has been making on each of them.

Market strategy

Nordstrom’s market strategy focuses on driving growth in important markets by improving customer service and allowing customers to purchase products conveniently through any channel of their choice. During the first quarter, the company rolled out this strategy to 10 new markets, including Atlanta, Houston, Detroit and Minneapolis and it is currently in place in all of its top 20 markets.

Nordstrom continues to expand capabilities such order-pickup and ship-to-store and it saw order pickup more than double in Q1 compared to the same period in 2019. It is also offering personalized styling programs for customers to improve the shopping experience in order to drive sales growth.

Digital growth

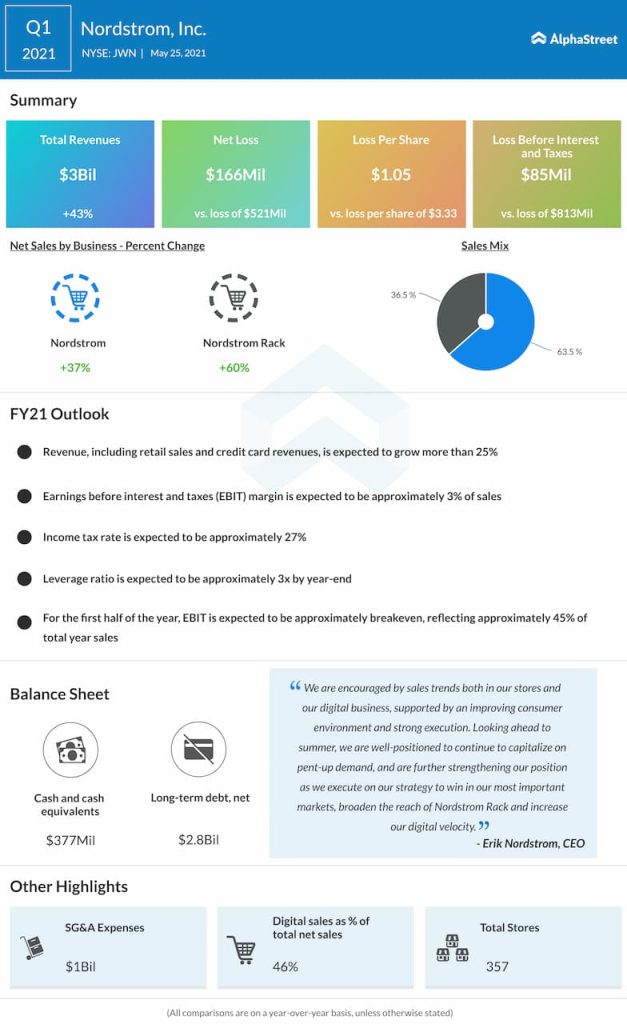

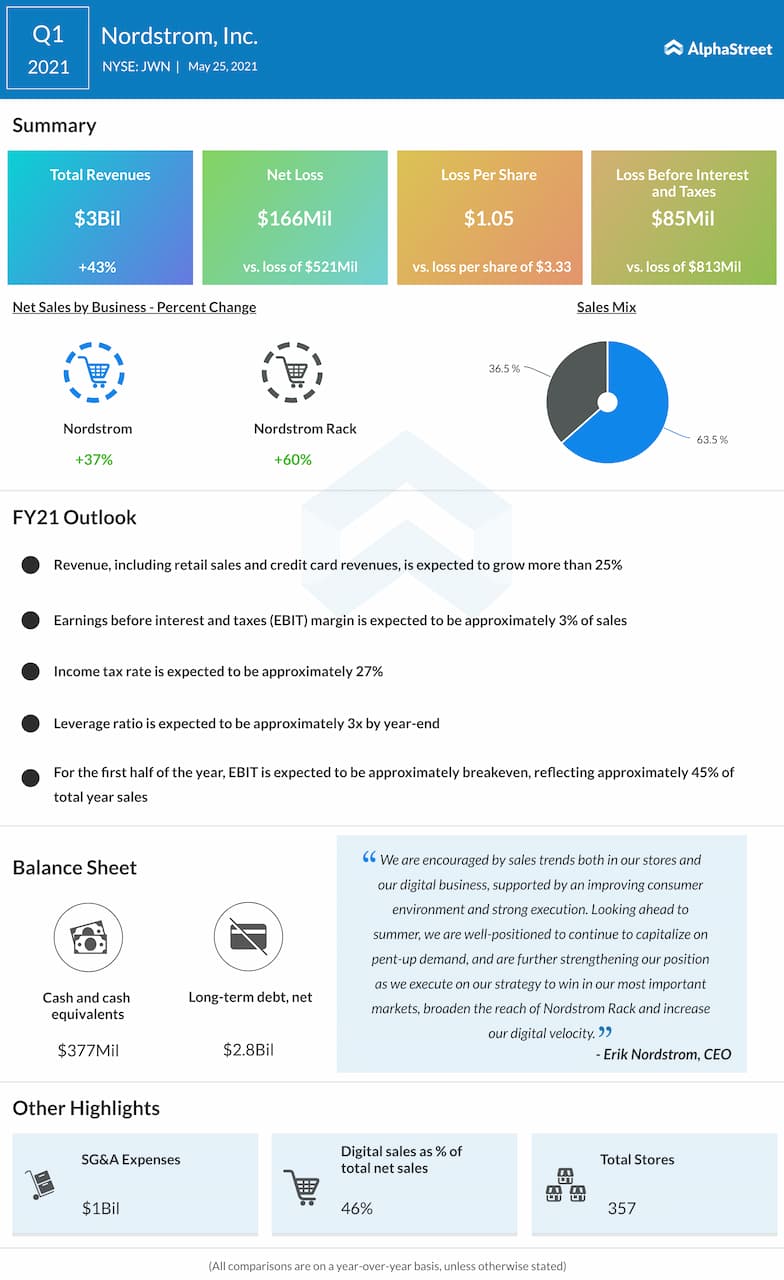

Nordstrom witnessed strong momentum in its digital channels during the first quarter despite a rebound in store traffic and sales. Digital sales rose 23% year-over-year and 28% compared to the first quarter of 2019. The company’s digital penetration currently stands at 46%, reflecting a growth of 15 percentage points over the past two years.

During the quarter, Nordstrom saw downloads of its apps more than double compared to the same quarter in 2019. The majority of the digital traffic and sales in the quarter came from mobile users. Looking ahead to the rest of the year, the company expects digital to comprise around 50% of sales although it expects some fluctuations in its digital channel based on the pace of store recovery.

Nordstrom Rack

The company continues to work on the expansion of Nordstrom Rack. In Q1, the brand’s sales increased 59% YoY but fell 13% compared to the same period in 2019. On a sequential basis, the brand saw sales improve by 10 percentage points.

The company expanded its assortment across both its brands and it saw a pickup in demand helped by the easing of restrictions, rollout of vaccines and stimulus payments. As things begin to normalize, Nordstrom expects pent-up demand to drive momentum in the coming months.

Click here to read the full transcript of Nordstrom’s Q1 2021 earnings conference call