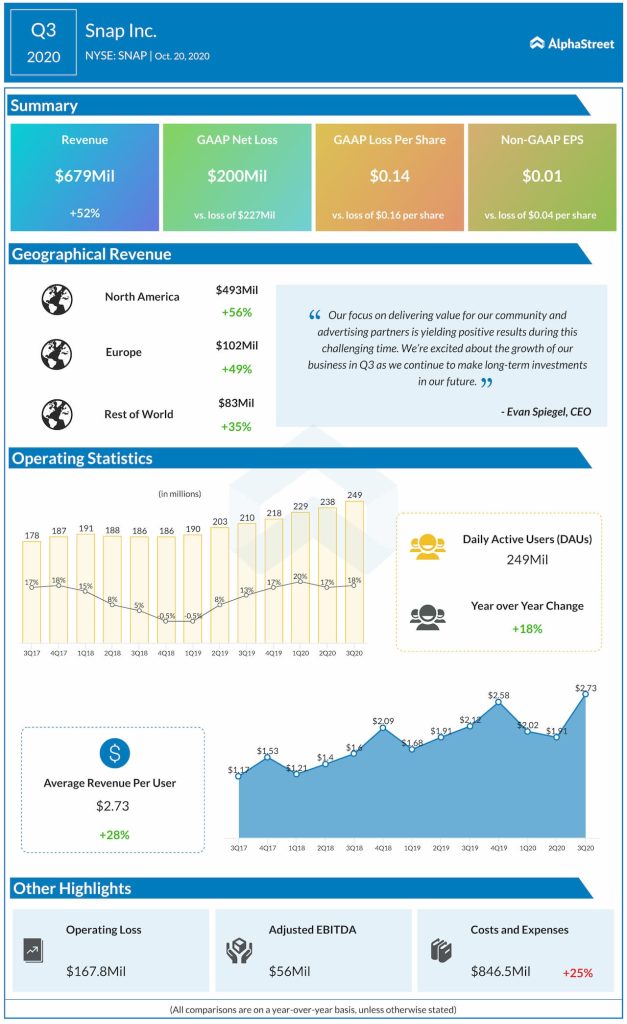

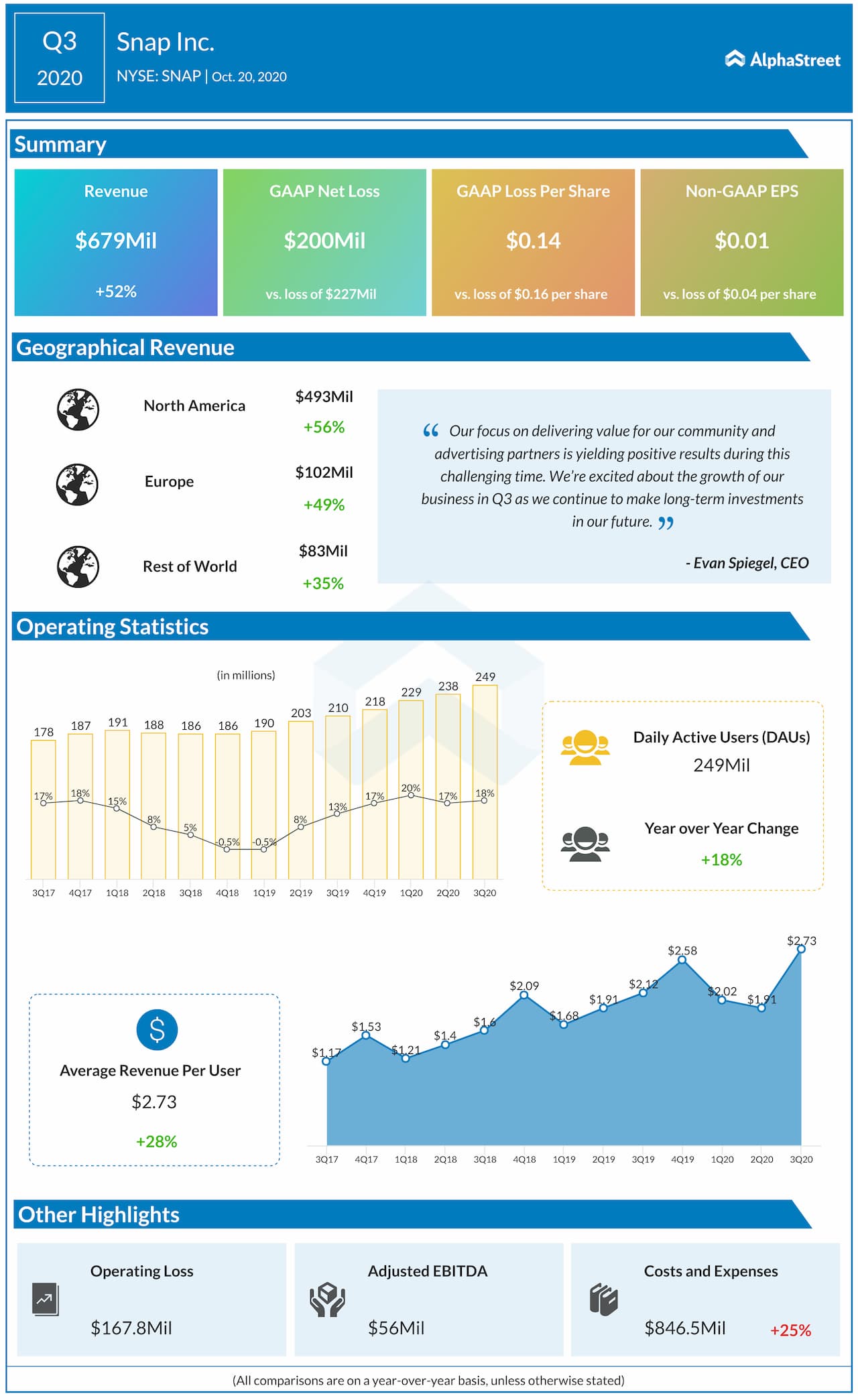

Snap Inc. (NYSE: SNAP) is part of this group. The company reported strong results for the third quarter of 2020 and witnessed strong growth in its user base. The stock has gained over 154% since the beginning of this year and over 91% in the past three months. The company has its focus on three areas that provide meaningful growth opportunities – ecommerce, augmented reality and gaming.

Ecommerce

Ecommerce provides a compelling growth opportunity and Snap is increasing its focus significantly in this space. The company continues to roll out products such as Dynamic Ads, Commercials and Snap Select which help drive returns from advertising and ecommerce.

The Dynamic Ads feature uses the company’s optimization capabilities and product catalogs to drive maximum returns for advertisers by reaching broader audiences through suitable ads. Video advertising is another key area of opportunity thanks to the increase in mobile content consumption. The company is investing in this space through Commercials and Snap Select.

Augmented Reality

Another area of importance is augmented reality. Augmented reality helps improve the customer experience by allowing users to browse catalogs and try on products. Snap is seeing good early adoption from advertisers for this budding opportunity.

The company has partnered with brands like Kohl’s, Levi’s, Clearly and Essie to roll out virtual try-on experiences for their products. Through this feature, eyewear retailer Clearly was able to drive a 7 point lift in brand awareness and 3.3% lift in purchases. The brand also saw a 46% gain in unique page views on its site.

Snap’s investments in Lens Studio are also driving the growth of its augmented reality platform. The company is seeing year-over-year growth in daily Lens views and its efforts in creating new experiences for users is helping drive higher engagement levels. At the end of Q3 2020, over 1.5 million Lenses were created through Lens Studio.

Gaming

Snap is making progress in gaming and along with its developers, it is exploring new genres, monetization models and game types. The company is increasing its investments in this area and rolled out three new games during the third quarter. Revenue generated by developers doubled this quarter versus the year-ago period. The company is also looking at rolling out in-app purchases inside of games, which would provide another revenue stream to gaming companies and partners.

Click here to read the full transcript of Snap Q3 2020 earnings call