Usage

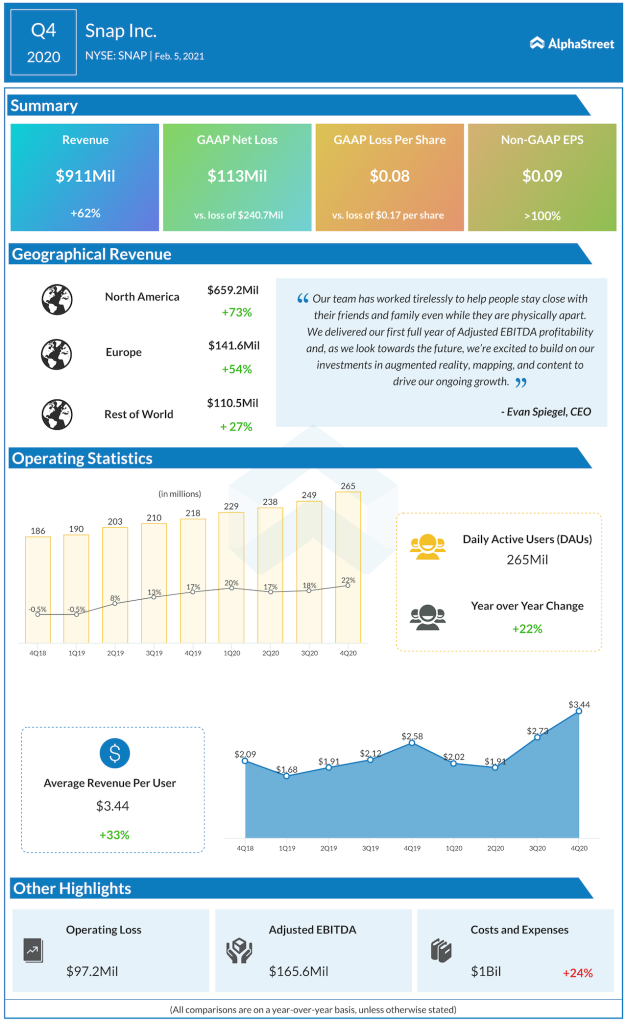

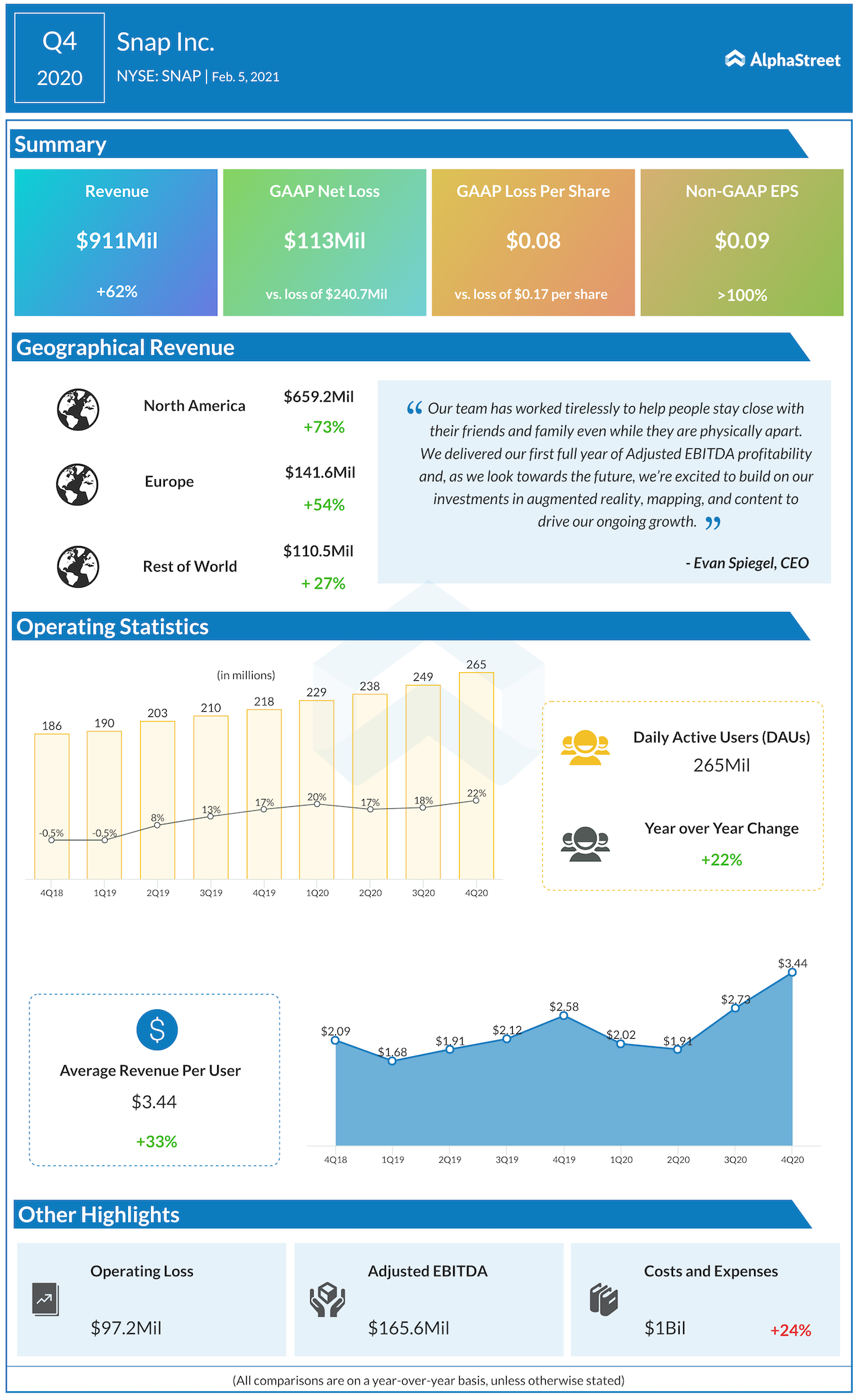

During the fourth quarter, Snap saw its global average daily active users (DAUs) reach 265 million, up 22% from the year-ago period. The company saw increases in DAUs, both on a sequential and year-over-year basis, across all its geographies, with North America growing by 6%, Europe by 10% and Rest of World by 55%. DAUs also increased sequentially and YoY on both iOS and Android platforms.

Snapchat’s user base primarily consists of Gen Z and millennials who are 150% more likely to communicate using pictures than words. This is where Snap’s camera feature comes in handy as it helps drive high frequency engagement. On its quarterly conference call, the company stated that an average of over 5 billion Snaps are created every single day.

The Stories and Shows features have helped drive engagement with the total time spent watching Shows increasing nearly 70% year-over-year during 2020. The company is adding content that appeals to older audiences and has seen a 25% year-over-year increase in viewership among its users aged above 35 years. The Spotlight feature is another popular one, with over 100 million monthly active users in January.

Augmented reality

The COVID-19 pandemic drove an increase in online shopping but this came with limitations in terms of being unable to thoroughly check out products before buying them. Snap is using augmented reality (AR) to help businesses improve the shopping experience for customers in this regard.

Companies in the beauty industry are using Snap’s features to allow customers to virtually try on their products and also to provide makeup tutorials. These features can be extended to help customers try out clothes and visualize products in their home as well presenting further opportunities to drive engagement and revenue growth.

Outlook

Looking ahead into the first quarter of 2021, Snap expects to face some challenges to its business. During the first two weeks of January, the company saw advertising demand stall as advertisers paused their campaigns due to political unrest in the US. This caused Snap to start the quarter slower than previously expected. The company also expects demand to be affected by the upcoming iOS platform policy changes although the longer-term impact remains unknown.

In Q1 2021, Snap expects daily active users to grow approx. 20% year-over-year to 275 million. Revenues are expected to grow 56-60% to approx. $720-740 million.

Click here to read the full transcript of Snap’s Q4 2020 earnings conference call