Shares of Trxade Health Inc (NASDAQ: MEDS) took a beating post the second-quarter results earlier this week as the provider of integrated pharmaceutical and medical services posted lower revenues and wider losses. While the decline in revenues was primarily attributable to a lack of PPE sales, the financials were also impacted by supply chain disruption caused by the pandemic in India and China.

Speaking to AlphaStreet on a post-earnings interview, Trxade Health CEO Suren Ajjarapu said the fall in revenues should not be a concern as sales volumes had increased between the first and second quarters. The impact on revenues was due to the fact that the company charges a lower fee of 1% on branded drugs, compared to 6% on generics passing through the platform. As a majority of generic drugs and APIs are sourced from India and China, where COVID had seen its second surge, this led to a direct impact on the recognized revenues, despite higher volumes, the CEO said.

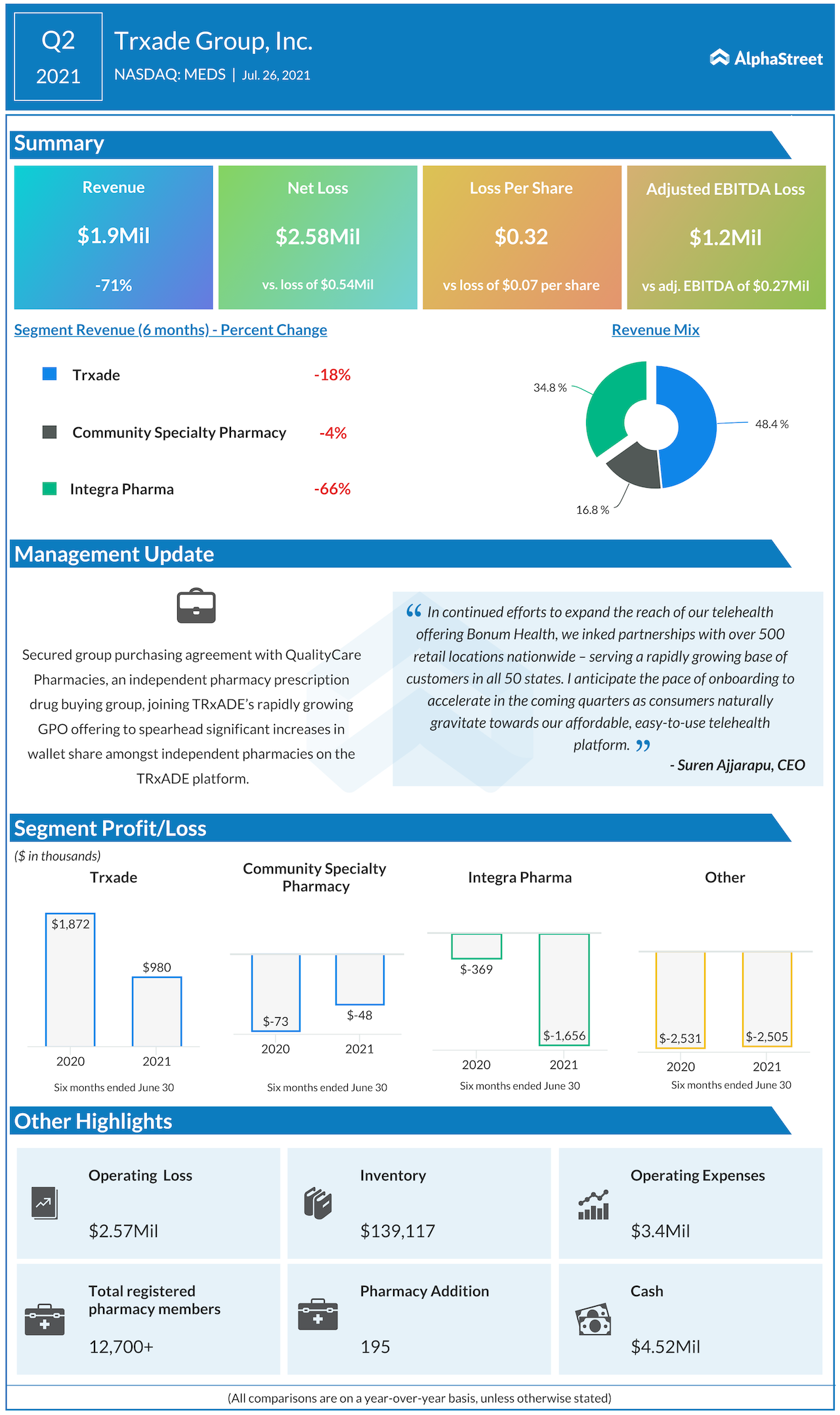

While the bottoming of PPE sales also weighed on the revenues during the quarter, the management expects this to have a positive impact on the overall margins. Being a low-margin product, PPE had been pressing on the margin side over the past year for Trxade. In the recently announced quarter, the company’s gross margin came in at 44.3%, which was significantly higher than the 30.4% it reported during the same period last year. Ajjarapu said the company should continue to see constant margins in this range as Trxade improves platform sales.

Safe-T CEO Shachar Daniel: Pandemic drove demand for secure remote access

Expanding market opportunity

During the second quarter, the Tampa, Florida-based firm continued to add 195 new independent pharmacies to its network, taking the total count to over 12,700. Pointing out that the number of independent pharmacies has increased over the past year, Ajjarapu stated this tends to expand the market opportunity.

Separately, the company is now expanding its reach to urgent care clinics, anesthesiologists, pediatricians, dermatologists, etc, apart from pharmacies. “Our market is slowly evolving into these areas that face similar problems as pharmacies. On a day-to-day basis, they need pharmaceutical products, durable medical equipment, etc. These will be the areas that provide natural expansion beyond our partnership networks,” he said.

The executive added that the company also sees increased demand for telemedicine services following the shelter-at-home period, and is focusing on locking up partnerships on this front to boost its retail presence. Notably, Trxade’s telehealth arm Bonum Health had recently inked numerous partnerships with major retail players including Big Y, Winn-Dixie, and SpartanNash. The firm hopes to add 1,000 to 1,500 more stores between these partnerships to its network.

Vaccination passport business

Meanwhile, Trxade has been facing some political headwinds with its vaccination passport service launched earlier this year named MedCheks. The management is opting for a wait and watch approach to see how the political policies shape up surrounding the use of vaccination passports, before pushing it again in a full-fledged manner.

“The long-term goal of the health passport is to enable patients to carry their health records with them. If I call a Bonum Health doctor and he can access my records, he can give me better medical advice at that point in time. So that’s kind of the end-goal,” Ajjarapu explained.

ALSO READ: Glimpse Group CEO: Big Tech complements our efforts in VR/AR

ADVERTISEMENT

Trxade, which brings together independent pharmacies under one umbrella through its web-based purchasing platform, is present in all 50 states. The company’s stock has traded mostly sideways since the beginning of this year and is currently down about 8%. Analysts covering the stock, on average, expect it to hit $9.50, representing an upside of 91%, over the next 12 months.

_____

For more insights into Trxade Health, read the latest earnings call transcript