Opening up the immense market potential for AR/VR technology to investors, The Glimpse Group (NASDAQ: VRAR) went public last week. The IPO generated an enthusiastic response from investors with the stock price more than doubling on the opening day. It has since cooled off a bit but still trades above the listing price.

The New York-based firm owns a diverse portfolio of nine companies within the virtual & augmented reality space, each focusing on its own niche area. It has filed for 13 patent applications, three of which have been issued till date. Interestingly, the company has wide-ranging partnerships with numerous large technology, consumer, and pharmaceutical brands, as well as universities.

In an interview with AlphaStreet, CEO of The Glimpse Group Lyron Bentovim elaborated on the company’s growth strategy and potential.

AlphaStreet: Your stock opened at $7 and ended the first trading day north of $17. Did you expect this kind of response from the market?

Lyron: To be fair, I did not anticipate to the extent it is. We knew that the IPO was significantly oversubscribed, so there was a lot of interest from investors in our story. We had lots of investor meetings and our story was well received. So I had a feeling we will have a positive entry into the NASDAQ. But the extent that happened the first day surprised me a little bit.

AlphaStreet: Who are your competitors?

Lyron: Given our diversity, each one of our subsidiary units has companies that compete with it. They are usually either early-stage startups or VC-backed firms.

AlphaStreet: Do you see a threat from large technology companies like Apple, Google, and Facebook that have the technology and cash to build great products and market them?

Lyron: They are the best thing that happened to the industry. All these big ones are spending hundreds of millions of dollars developing solutions for the space. They understand this early in the cycle, hardware needs to evolve, both on the enterprise focus as well as on the consumer focus. And their investment is helping all of us build this market. We have never competed with them, and I don’t expect to compete with them anytime soon.

Not only that, if they ever decide that they actually want to do what one of our subsidiaries does, it will be easier for them to buy it, than to go start from scratch and make it as we will already be a few years ahead.

We partner with them. They support us by giving us the hardware that allows us to do what we are doing.

Shapeways CEO: Software platform helps us achieve higher gross margins vs. industry

AlphaStreet: You have mentioned a few popular names such as Snap, Google, Samsung, Whirlpool, and Colgate, as your clients and partners. What kind of partnership do you have with these companies?

Lyron: Each one is different. Some of them are partners on the technology side where we provide certain solutions for them, while others are customers where we help them achieve their goals as they are trying to figure out their strategy in VR and AR. We are partnering with Snap on a lot of their lenses. We help create the AR elements that make their lenses work.

AlphaStreet: Do you have any targets for profitability at this point in time?

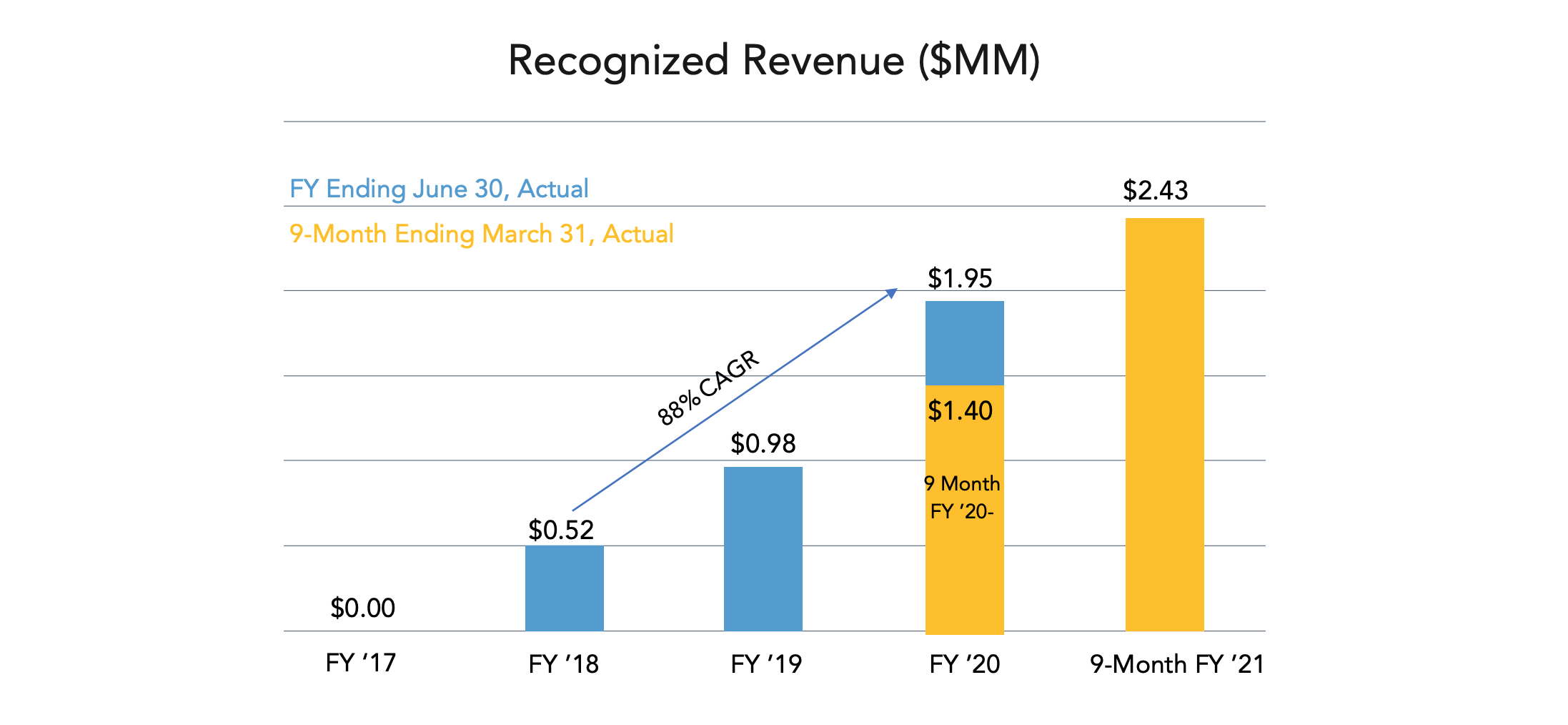

Lyron: Given the early stage of the industry, we are not focused on profitability. Right now we are focusing on revenue growth. But we, as a philosophy, are not a high burning company. So we want to get to the point where we are constantly self-sustaining when we need to make an investment either in R&D or marketing.

Midwest Energy helps coal-fired utilities meet emission norms without cutting output: CEO MacPherson

AlphaStreet: You have exposure to a wide range of industries. Where do you see the scope for maximum growth?

Lyron: I think that changes over time. Marketing and branding is a strong one right now because as budgets evolve, it’s very easy to add an AR element to your campaign or use AR to try and lure customers into your store. Right now, industries like healthcare, real estate, education, etc are slow-moving, but all of those will be very big in VR and AR down the road.

_______