Having started the new fiscal year on a positive note, the management is optimistic about maintaining the momentum for the rest of the year and achieving sustainable profitability. According to Suren, the strategy is to increase the per-wallet share per month — currently, the purchasing power vs. spending on the platform is $250K vs $5K. The company is increasing the breadth of its product offerings and adding new members, like clinics with new product categories, aiming to achieve exponential growth.

The fast-growing Integra Pharma subsidiary — doing business as Trxade Prime — will continue to be a key growth driver going forward. Suren expressed confidence that Trxade Prime’s revenue share would continue to grow, aided by its successful business model.

“Going forward you will be seeing more and more rev share by Trxade Prime whose model is one box, one invoice single catalog, which is easy for the pharmacy to consolidate in payments and receiving shipments vs. multiple suppliers and multiple invoices,” he said.

Earlier this year, the company formed a joint venture partnership with Exchange Health and created SOSRx, LLC for providing drug makers with a single platform to optimize the sale and distribution of products directly to big drug purchasers. On being asked about the initiative, the CEO said that since SOSRx is a startup, its contribution to revenues would not be significant until the end of the year.

TRxADE HEALTH Q1 2022 Earnings Call Transcript

Referring to Trxade’s business expansion plans, Suren said the company might raise additional capital through the line of credit or accounts receivables financing to support operations. In the near term, rising inflation would have a negative impact on shipping costs. “…biggest costs are shipping costs, we see some impact on shipping costs but not major,” he added.

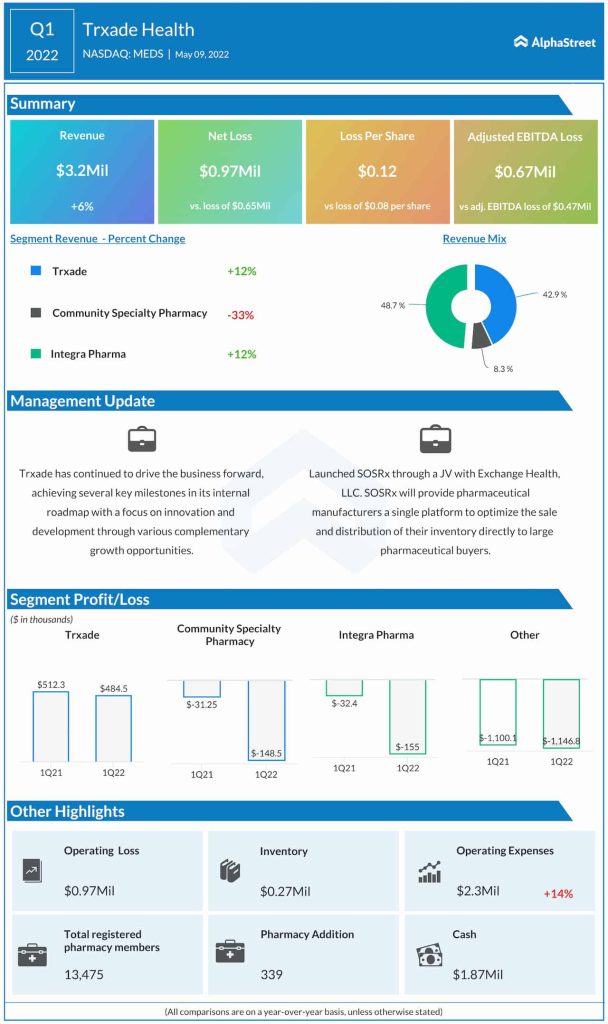

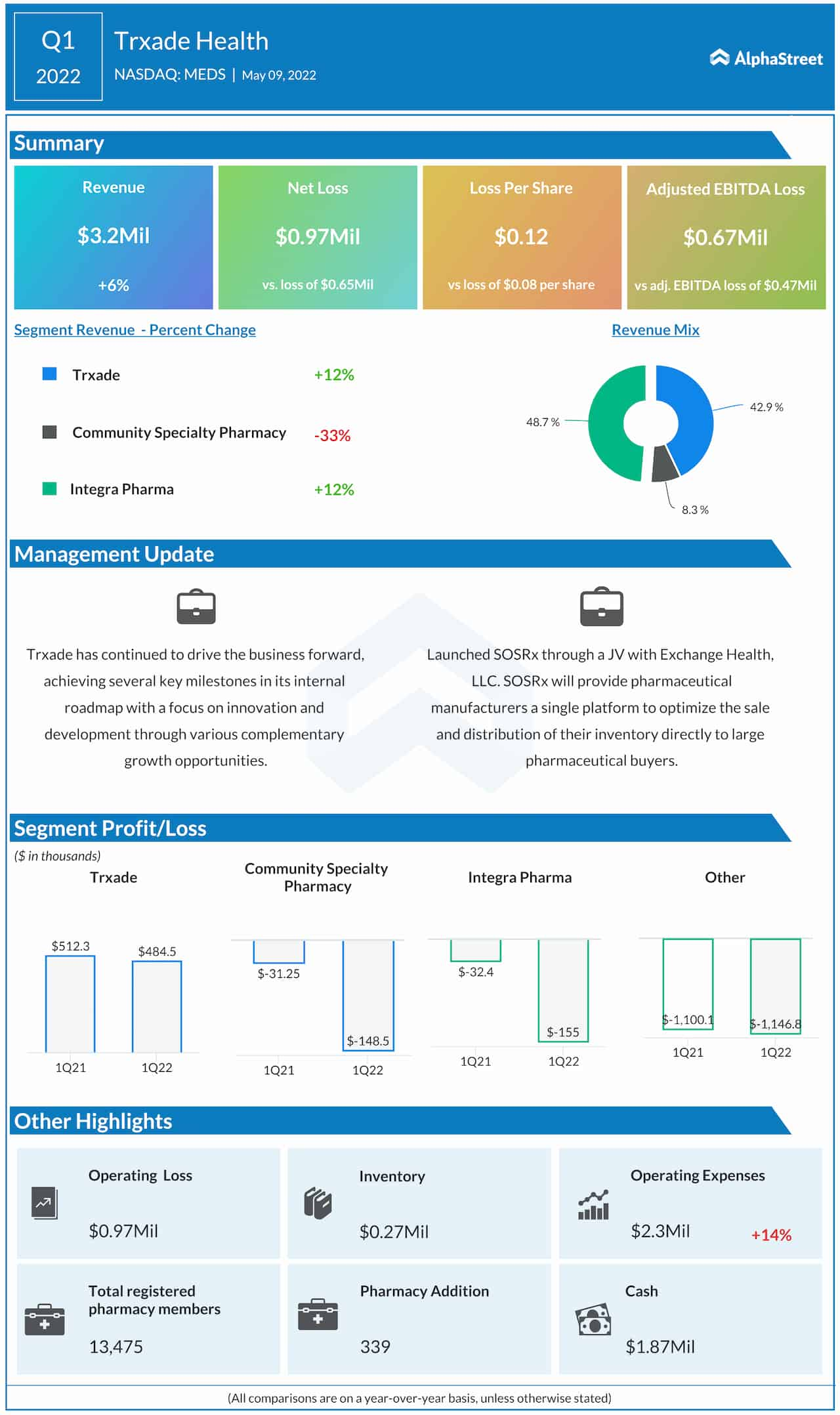

In the first quarter of 2022, Trxade’s revenues increased 6% year-over-year to $3.2 million as double-digit growth in the main operating segments more than offset weakness in the Community Specialty Pharmacy segment. But, net loss widened to $0.12 per share from $0.08 per share last year, reflecting a sharp increase in operating expenses.

The company generates revenue by charging an administrative fee of up to 6% of the buying prices of generic pharmaceutical products and collecting up to1% on brand pharmaceuticals that pass through the platform. It has more than 13,400 registered members on the platform, which includes around 340 new members who were added in the first quarter.

Trxade’s stock experienced weakness in early May following the first-quarter earnings release but regained some momentum as the month progressed. The company has a market capitalization of slightly above $12 million.