Suren attributed the sharp increase in second-quarter revenues mainly to the strong performance of the Integra Pharma subsidiary — doing business as Trxade Prime — and refocusing on the core business. “…our refocus to core business and Trxade Prime, and also we have added new members vs the Q1 2021,” he said.

Of late, Trxade Prime has been growing at a steady pace, thereby increasing its contribution to the top line. Reflecting the uptrend, combined with strong momentum at the core Trxade segment, revenues rose sharply in the most recent quarter.

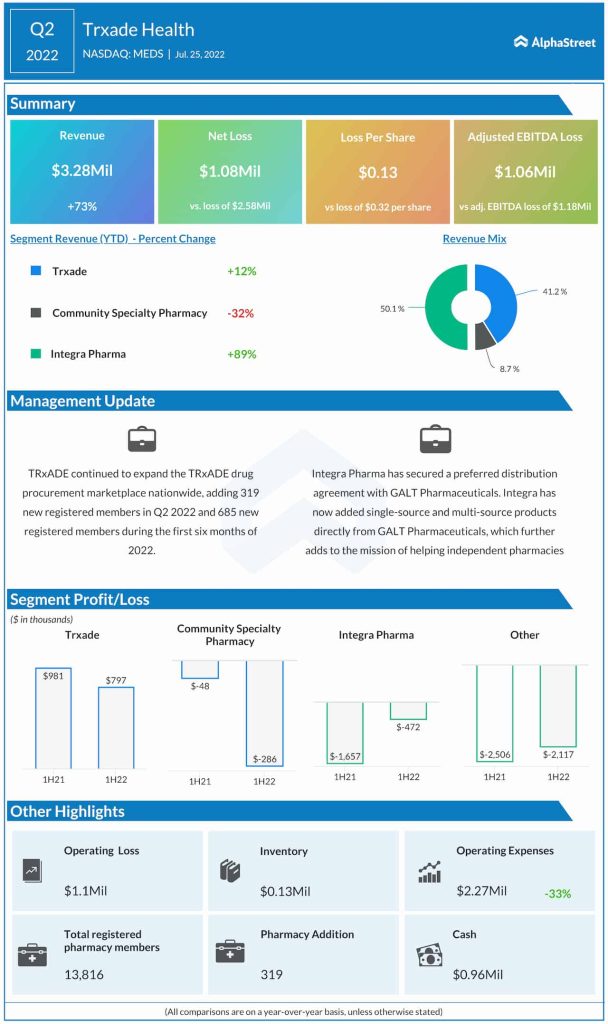

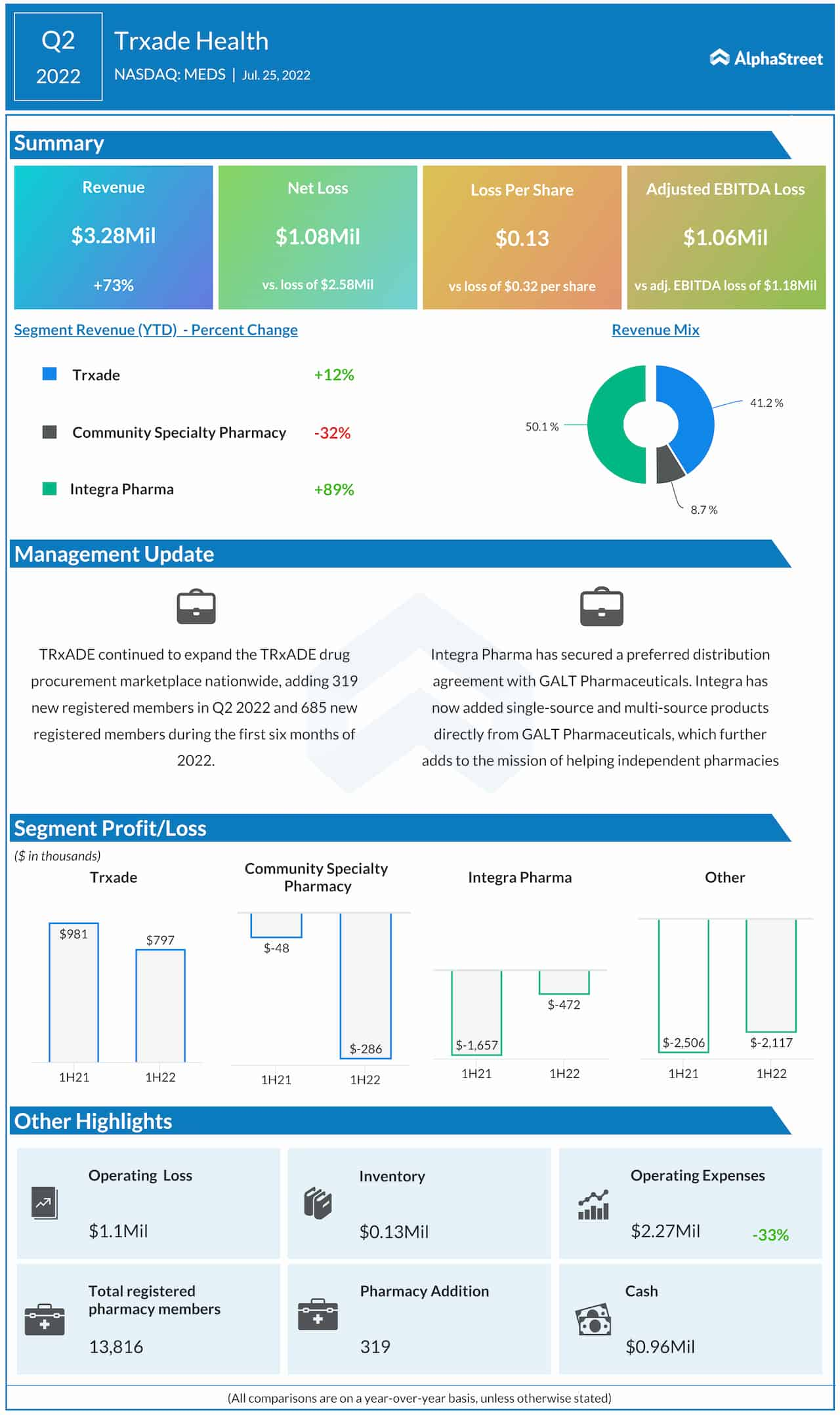

Recently, Trxade Prime inked a distribution partnership with GALT Pharmaceuticals to help independent pharmacies and members access top medication products more efficiently. According to Suren, a clear picture of the partnership’s effect on the business would emerge in the coming quarters. He said, “this is a new partnership, we are understanding the nuance of this, so we will be able to give more color in the coming quarters.”

One of the highlights of the second-quarter report was a 33% fall in operating expenses, thanks to the management’s initiatives to reduce costs that contributed significantly to the bottom-line improvement. The CEO said the company has cut down on some of the staff and is working on less spending on the new technology initiatives.

On being asked about the growth plan, he said the strategy is to be “more focused on the core platform and Trxade Prime and building relationships with POS Systems.” Going forward, the company is likely to continue looking for suitable deals and partnerships — it entered into a joint venture with Exchange Health early this year and formed the pharmaceutical platform SOSRx to provide drugmakers a single platform to optimize the sale and distribution of their inventory.

READ management/analysts’ comments on Trxade’s Q2 2022 results

In the quarter ended June 2022, for which the results were published recently, revenues of the core Trxade business and the Integra Pharma segment grew by 12% and 89% respectively, offsetting a 32% contraction in the Community Specialty Pharmacy division. Total revenues rose 73% annually to $3.28 million. As a result, net loss narrowed sharply to $1.08 million or $0.13 per share from $2.58 million or $0.32 per share in the corresponding period of last year. The company added 319 new registered members during the three-month period.

Trxade generates revenue by charging an administrative fee of up to 6% of the buying prices of generic pharmaceutical products and collecting up to1% on brand pharmaceuticals that pass through the platform. It had 13,816 registered members on the platform at the end of June, which includes 685 new members who were added in the first six months of the year.

In the past three months, shares of the company mostly moved sideways and stayed below $2. The stock traded slightly lower in the early hours of Tuesday’s session.