Spin-off

Currently, speculation is rife about the effects of the split, which is expected to make the otherwise expensive stock accessible to smaller investors. Also, post-split, Tesla’s employees will have more flexibility in managing their equity. While market watchers are divided in their recommendations, the majority of them are bullish on the stock that is estimated to grow in single-digit this year.

Tesla Q2 2022 Earnings Conference Call Transcript

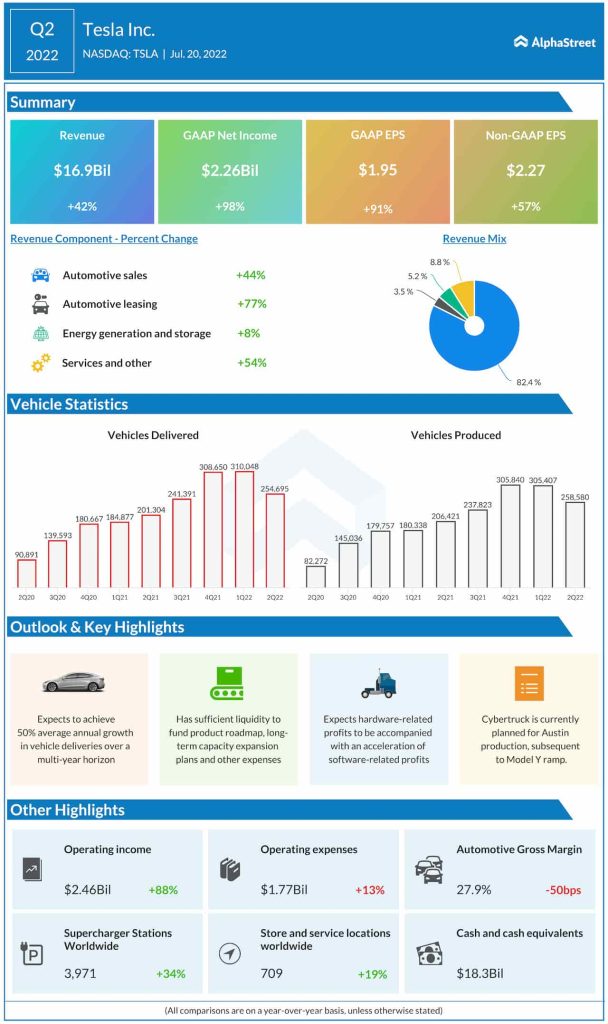

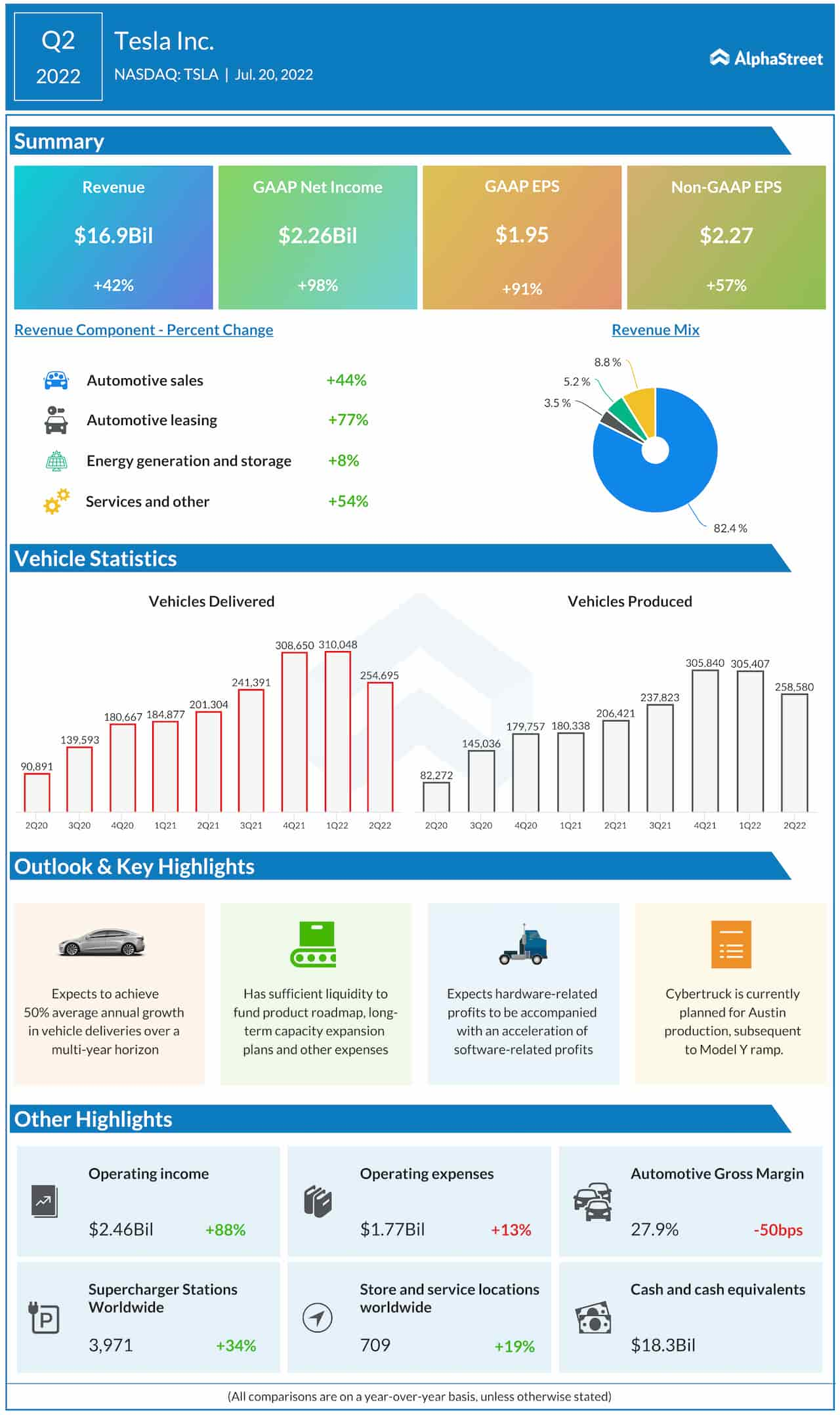

Despite a prolonged plant closure in Shanghai, Tesla’s top line performed well in the most recent quarter, almost matching the previous period. Interestingly, production bounced back strongly and hit a record high in June. That, combined with equally strong production numbers at Fermont, points to a record-breaking second half. TSLA has gained 30% since the beginning of the year but traded below the long-term average in the past few months.

Strong Earnings

Ever since it achieved sustainable profitability a couple of years ago, Tesla maintained solid bottom line numbers that topped expectations in almost every quarter. In the second quarter, adjusted earnings grew a whopping 57% even as revenues jumped to about $17 billion. The company maintained a strong automotive gross margin of 27.9%, which is broadly in line with the prior-year number.

General Motors: A look at the company’s plans for its EV business

The management expects continued growth in vehicle delivery during the remainder of the year. It looks to expand manufacturing capacity to achieve the goal of 50% average annual growth in vehicle deliveries over a ‘multiyear horizon.’

From Tesla’s Q2 2022 earnings conference call:

“The past few years have been quite a few force majeures and it’s been kind of supply chain hell for several years. Credit to our awesome Tesla supply chain team for overcoming entirely difficult challenges and huge thanks to the Tesla Shanghai factory team who sacrificed a lot to get the factory back up and running in June and achieve a record output. So, also making good progress with the production ramp with Berlin. We achieved an important milestone of 1,000 cars a week in June.”

TSLA traded higher on Friday afternoon, extending the post-earnings gains, but stayed well below the record highs of November 2021.