Mixed results

Trends

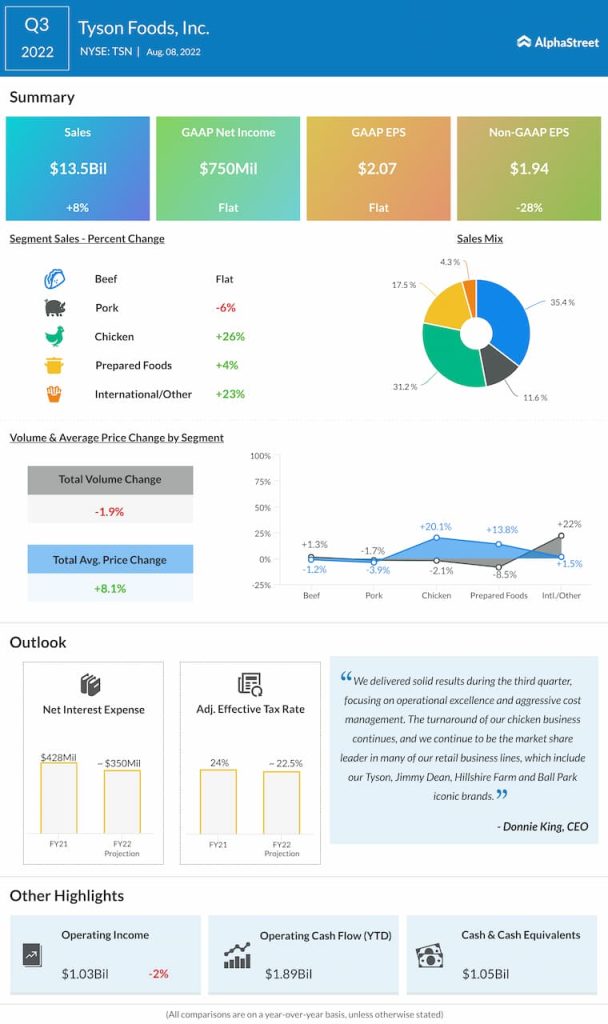

During the third quarter, Tyson saw strength in its retail channel and a recovery in its foodservice channel, which helped drive top line growth. The ecommerce channel also did well with sales growing 15% in Q3 versus the year-ago period. However, volumes were down due to supply constraints and macroeconomic headwinds that impacted consumer demand.

Sales volumes were down in the chicken segment in Q3 due to lower volumes caused by a fire at its Alabama facility last year as well as a reduction in outside meat purchases. In prepared foods, volumes were down due to higher pricing, uneven foodservice recovery, the divestiture of the pet treats business and a challenging supply environment.

Sales volume in the pork segment was down in Q3 due to lower global demand. In the beef segment, sales volume increased, helped by a strong global demand environment but this was partly offset by a challenging labor environment and supply chain constraints.

Tyson incurred higher input costs during the quarterly namely for labor, feed ingredients, live animals and freight costs. The company’s price increases, which partly offset the higher input costs, helped drive sales growth in the quarter.

Outlook

Total sales for FY2022 are expected to be $52-54 billion. Tyson expects adjusted operating margin for its beef segment to range between 11-13% in FY2022. Adjusted operating margin is estimated to range between 3-5% for the pork segment and 5-7% for the chicken segment for the year. In the prepared foods segment, adjusted operating margin is expected to range between 8-10%. The company plans to tackle inflation through price increases for the year.

Click here to access the full transcripts of the latest earnings conference calls