The company sells IoT-enabled home products including refrigerators, washing machines, water purifiers and, water heaters. Two-thirds of the sales take place through its own and third-party online stores including Tmall and JD.com (NASDAQ: JD), while the rest is sold through an extensive chain of offline experience stores.

In an exclusive interview with AlphaStreet, Viomi CFO Shun Jiang talks about the company’s operational success, expansion strategies and the logic behind an early IPO.

On Xiaomi partnership

Perhaps one of the most striking factors about Viomi Technology is its strategic partnership with Xiaomi, which is the second-largest mobile phone vendor in Asia and the fourth-largest in the world, according to GlobalStats.

Apart from being a strategic partner, Xiaomi is Viomi’s key shareholder and sales channel. According to Viomi’s SEC filings, revenues from sales to Xiaomi accounted for 51% of total revenues in 2018. The CFO said Xiaomi is an important pillar for the firm and would continue to grow this relationship.

On operational strength

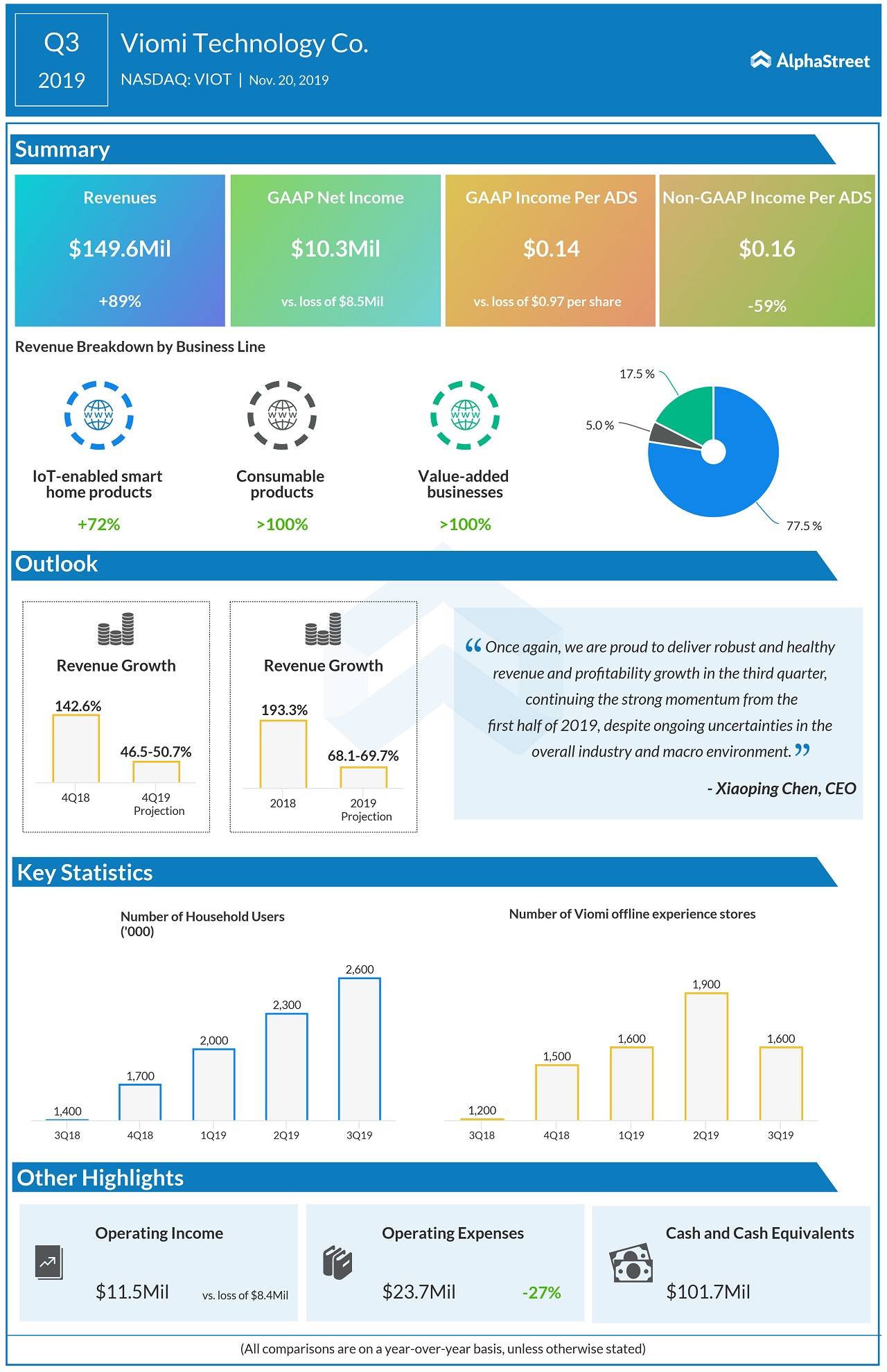

Jiang reasoned that the company has been delivering robust growth, which, unlike some other firms, has not come at the cost of profitability or steady cash flows. Viomi boasts of a strong balance sheet of over RMB 1.2 billion in cash and equivalents.

LISTEN TO: Viomi Technology Q3 2019 earnings conference call

“This is a testament that the business model works, and is a model that is accepted by consumers,” Jiang said.

He added that the idea behind an early public listing, in the US, was part of its strategy to project itself as a technology company that works in the consumer space, and not the other way around.

Regarding pricing pressure on smart water purifiers

Smart water purification system, which accounts for almost 20% of Viomi’s total revenues, saw its sales being dragged by pricing pressure in Q3. Despite registering a modest 1.2% growth in revenues, sales volumes were dented by a decrease in average selling price.

While Jiang cited one of the reasons for the decrease in ASP as competition, he said a bulk of it was due to lower production costs being transferred to the end-consumers. He added that ASP across SKUs is expected to be stable, with an upside potential going forward.

On international expansion plans

Viomi estimates the addressable Chinese home appliances market at around RMB 1 trillion, which leaves plenty of room for domestic growth. Therefore the emphasis on international expansion has been pretty minimal, Jiang said.

READ MORE: Q&A session from Viomi Technology Q3 2019 earnings conference call transcript

However, the Guangzhou, China-based firm hopes to benefit from partner Xiaomi’s presence in certain international markets in Asia and Europe. Separately, Viomi is also identifying some markets in Southeast Asia, where it might partner with any potential local brands to expand presence in the future. The CFO, meanwhile added that international expansion is not a core focus for the time being.

On the impact of economic weakness in China

Pointing out to its strong sales growth this year and optimistic outlook, Jiang said he expects the economic conditions to have minimal impact on the business. “We have been able to tap into a market that is quite differentiated, unlike traditional home appliances, which has been under a degree of pressure,” he asserted.

On newly launched coKiing brand

Explaining the logic

behind the launch, Jiang said they wanted a brand for premium customers, which

is slightly differentiated from its other products that are aimed at

middle-income families. As a first step, the company has launched co-Kiing

branded air-conditioning systems.

While the CFO stated alluded to more launches from this brand next year, he sidestepped from revealing what these products might be.

Get access to timely and accurate

verbatim transcripts that are published within hours of the event.