Revenue and profits

Total revenue per available seat mile (TRASM) was up 25.8% compared to Q4 2019 while passenger revenue per available seat mile (PRASM) was up 24.6%. Although TRASM continued to outpace PRASM in Q4, the company expects this trend to reverse in 2023. During the fourth quarter, PRASM remained strong across all parts of the network. United expects TRASM to remain relatively flat in 2023 compared to 2022. For the first quarter of 2023, TRASM is expected to be up around 25% YoY.

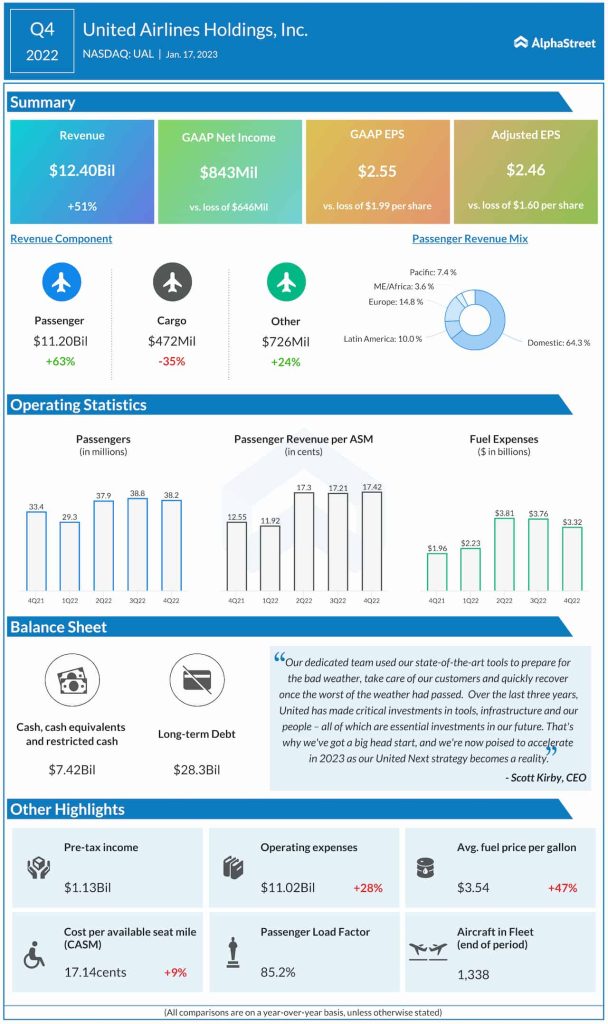

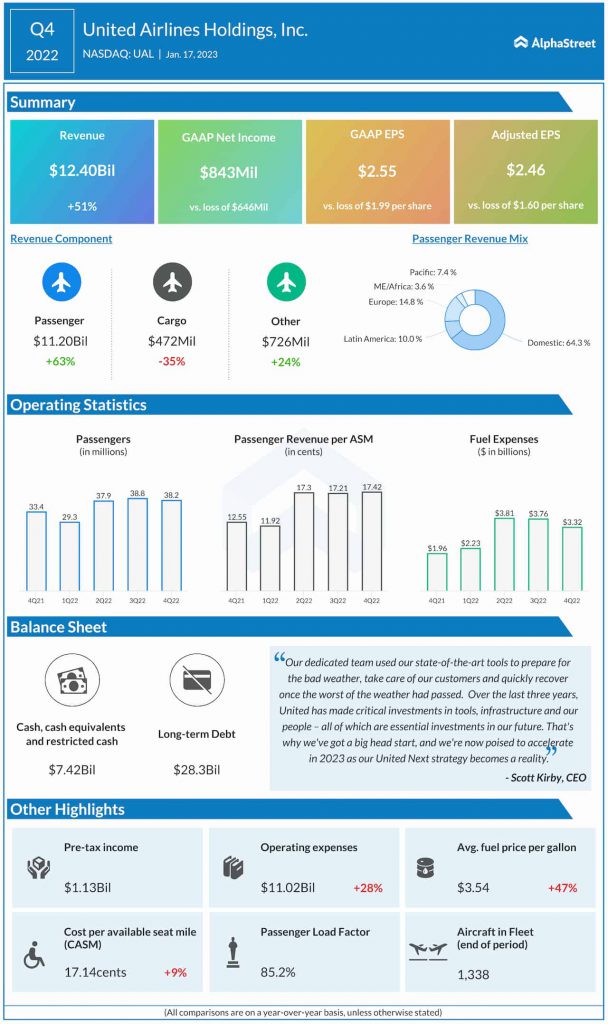

For the fourth quarter of 2022, United delivered adjusted EPS of $2.46. This compares to a loss of $1.60 per share reported in the prior-year period. Adjusted EPS was down nearly 8% from Q4 2019. For the first quarter of 2023, adjusted EPS is expected to be $0.50-1.00. For FY2023, adjusted EPS is estimated to range between $10-12.

Demand and capacity

United is seeing healthy demand. International demand is particularly strong and the company believes there is opportunity to generate significant profits and margins across its global network. In the fourth quarter of 2022, capacity was 9.5% lower than Q4 2019. For the first quarter of 2023, capacity is expected to be up 20% versus the first quarter of 2022. For the full year of 2023, capacity is projected to be up high-teens versus 2022.

Costs

In Q4 2022, cost per available seat mile, excluding fuel (CASM-ex) was down 2% YoY but was up 11.2% from Q4 2019. For the first quarter of 2023, CASM-ex is expected to be down 3-4% versus Q1 2022. For FY2023, CASM-ex is expected to be flat versus 2022.

Click here to read the full transcript of United Airlines’ Q4 2022 earnings conference call