Losing Streak

Why streaming services are set to take over the world

United Airlines’ stock recovered steadily after slipping to a seven-year low early last year but languished well below the pre-COVID levels. The target price set by market watchers shows that the stock has more room to grow – up to 28% in the next twelve months. But investors should move cautiously, considering the challenging operating conditions and deepening pandemic-related uncertainty.

Recovery Hopes

Meanwhile, the COVID vaccination campaign has brightened recovery hopes for aviation firms, and the drive is expected to help the companies during the upcoming travel season. The recent improvement in cash flow – which turned positive in March – should add fuel to United Airlines’ recovery efforts. Encouraged by the improving demand conditions, the company recently launched new services to Iceland, Croatia, and Greece.

We’re more confident than ever in the recovery and in the long-term earnings power of United Airlines. Even with business and long-haul international demand is still off by 80-plus-percent, we can now squarely focus on returning to positive adjusted EBITDA as our next milestone. In fact, we now see a clear path to reaching that milestone even with business and long-haul down as much as 70%. In addition, we expect to return to positive net income once business and long-haul international recover to down 35%.

Scott Kirby, chief executive officer of United Airlines

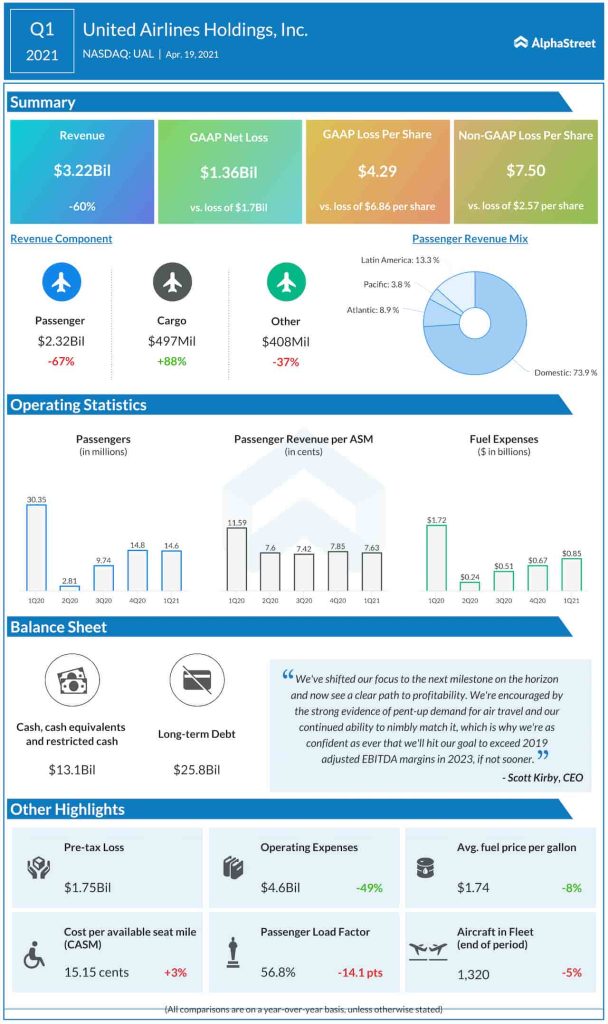

After a challenging year, the company started fiscal 2021 on a dismal note, posting a wider loss for the first quarter when revenues plunged 60% to $3.22 billion. Passenger traffic remained sharply below the pre-pandemic levels, though volumes improved since the early days of the virus outbreak.

Peer Performance

The earnings report published by Delta Air Lines (NYSE: DAL) earlier this month was almost similar to that of United, with net loss widening sharply hurt by a 60% fall in revenues. Worse, Delta’s management expects the top-line to remain weak in the current quarter, and the stock entered a downward spiral after the announcement.

Read management/analysts’ comments on United Airlines’ Q1 report

United Airlines’ stock is trading 15% below the 52-week high price. The stock, which has gained 20% since the beginning of the year, closed the last session lower. Currently, the value is below the long-term average.