Following a rough year in 2020 due to the coronavirus outbreak, Delta Air Lines (NYSE: DAL) might be seeing a glimmer of hope in 2021. A stable pickup in leisure travel managed to provide a cushion against weakness in business and international travel during the first quarter of 2021. Although the situation is far from optimal, this is providing optimism for a recovery in the back half of the year.

Travel trends

On its quarterly conference call, Delta described the first half of Q1 as “very much like an extension of 2020” with slower-than-expected demand. But as vaccinations started being widely distributed and consumer confidence in air travel began to grow, the company witnessed a rise in demand. Delta’s daily net cash sales, defined as tickets purchased less tickets refunded, in March were twice that of the level seen in January and it is continuing to improve.

The company is seeing booking behavior turn more normal as customers make travel plans for the spring and summer. In addition, the CDC has given permission for vaccinated people to travel within the US. All these factors are giving the company optimism with regards to its recovery and the revival of the industry as a whole.

Delta is seeing pent-up demand for leisure travel. Domestic leisure bookings have recovered 85% to 2019 levels while Latin leisure markets have been fully restored. The company will start selling middle seats from May 1. This will raise sellable capacity from 46% of 2019 levels for April to 67% of 2019 levels for June. This increase in capacity and the continued recovery in leisure travel is expected to bring about an improvement of approx. $2 billion in June quarter revenues compared to the March quarter.

Corporate travel has been seeing a slow but steady improvement. In March, volumes were nearly 20% recovered, up from 15% at the end of 2020. The recovery in corporate travel is largely hinged on the vaccine roll-out and easing of restrictions. As this gradually takes place, corporate travel is expected to see improvements through the summer with a more significant pickup coming after Labor Day. Corporate customers are expected to travel more for sales and operational matters but not so much for conferences and meetings.

The weakness in international travel continues with long-haul booking volumes only 15-25% recovered. Delta does not expect to see a meaningful improvement in demand for international travel until later in the year.

Return to profitability?

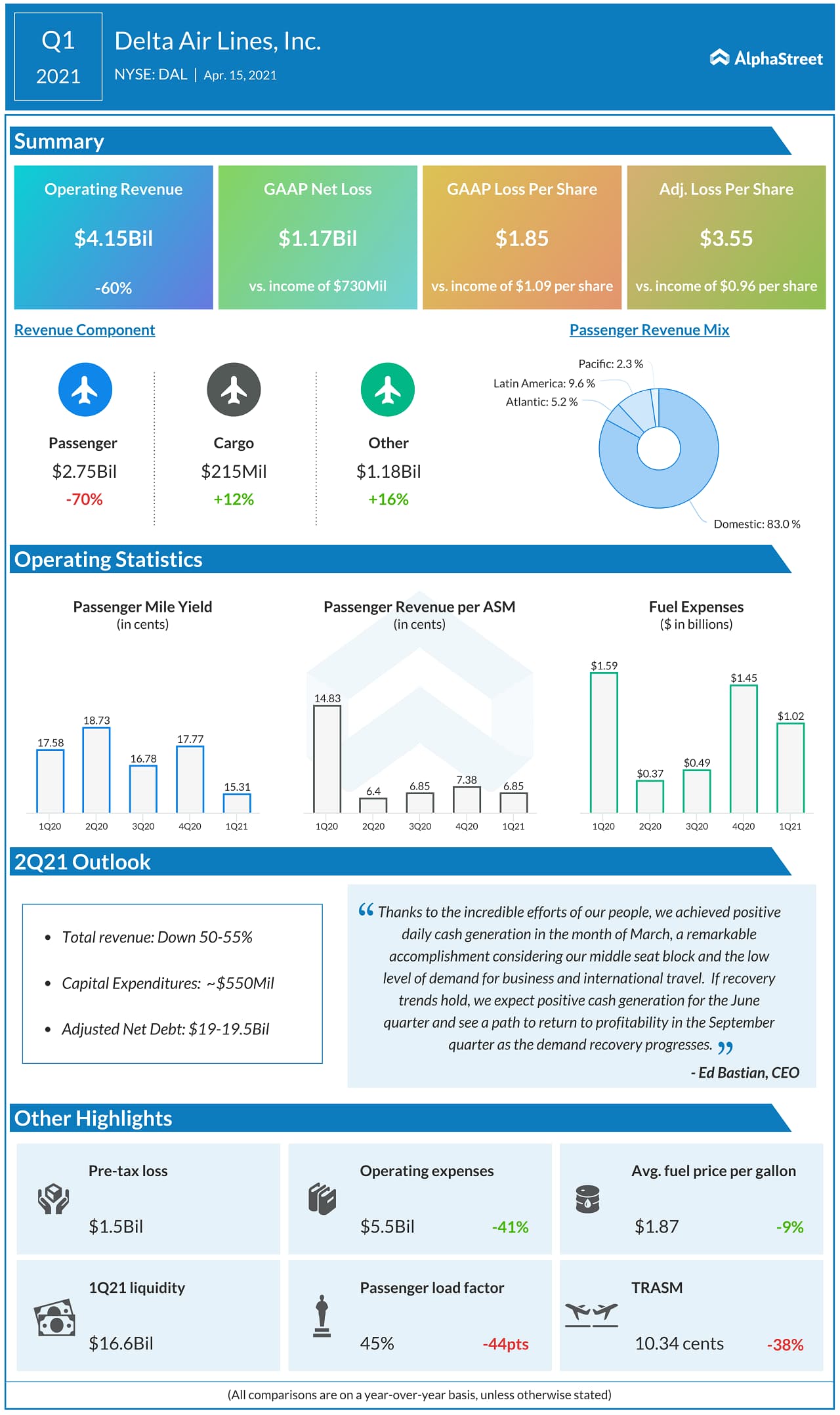

Operating revenue fell 60% year-over-year to $4.1 billion on a reported basis. Adjusted net loss amounted to $2.2 billion, or $3.55 per share. If the current recovery trends continue, Delta believes it can cut its pre-tax losses by more than half in the June quarter to between $1 billion and $1.5 billion and perhaps return to profitability in the September quarter.

One of the notable highlights of the quarter was the positive cash generation of $4 billion in March, which was the first since the start of the COVID-19 pandemic. Daily cash burn for the quarter averaged $11 million.

Outlook

For the second quarter of 2021, Delta expects scheduled capacity to be down around 32% and sellable capacity to be down approx. 40% compared to the same quarter in 2019. Total revenue is expected to decline 50-55% from Q2 2019.

Stock

Delta’s shares have gained over 91% over the past 12 months and over 15% since the beginning of the year.

Click here to read the full transcript of Delta Air Lines Q1 2021 earnings conference call