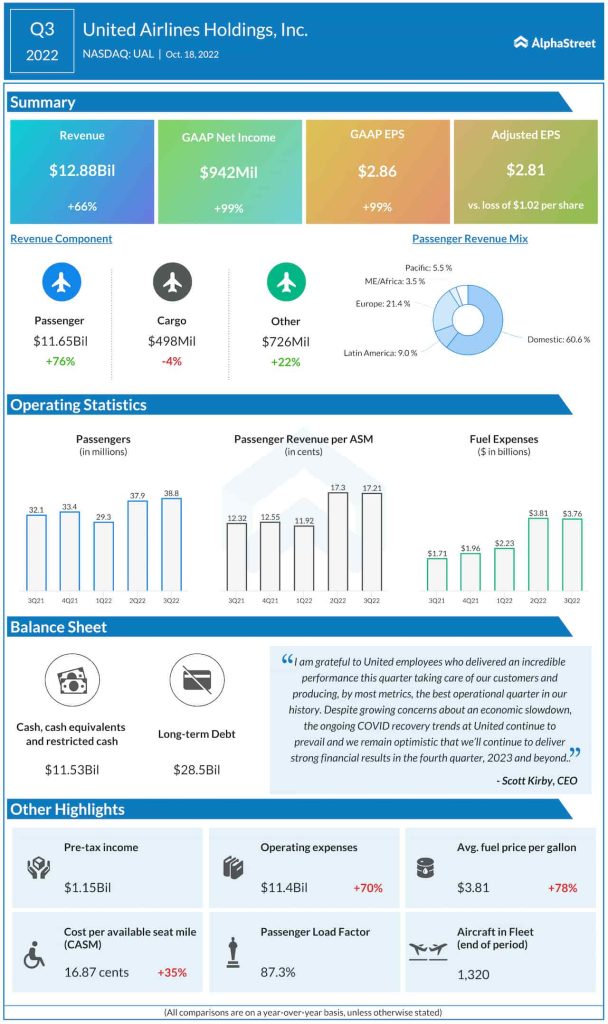

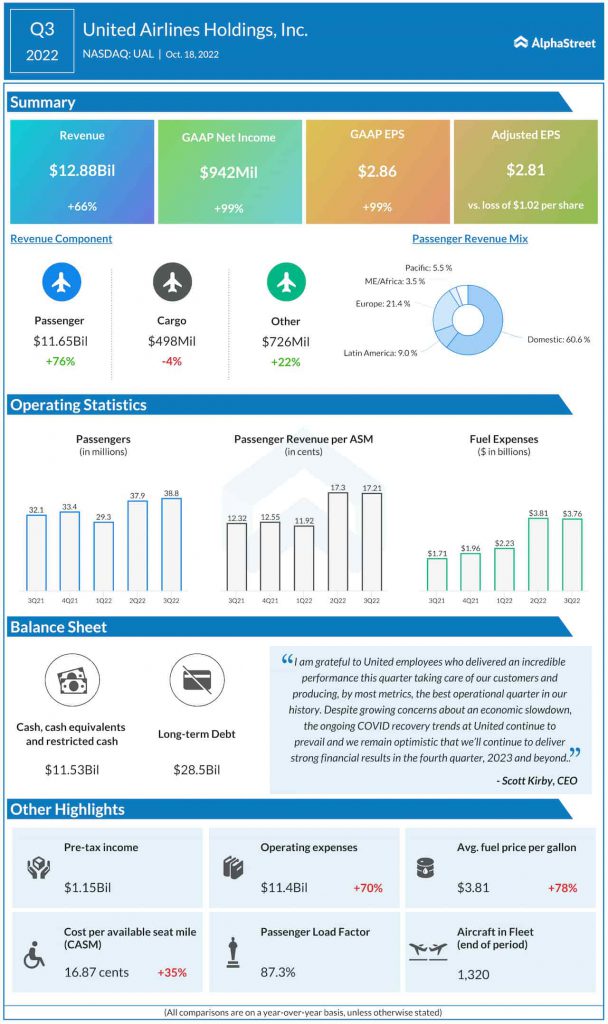

Revenue growth and profitability

Adjusted operating margin of 11.5%, driven by strong revenue and better costs, exceeded the company’s own projections. Total revenue per available seat mile (TRASM) was up 25.5% versus Q3 2019 on about 10% less capacity. Passenger revenue per available seat mile (PRASM) increased 23.3% versus 2019.

Favorable trends

Despite the ongoing geopolitical and macroeconomic headwinds, United sees three favorable trends that will help air travel stay resilient. Firstly, the aviation industry is still recovering from the pandemic and demand for travel remains strong as markets continue to reopen. As people choose to spend on experiences after a rough two years, demand for travel is likely to stay healthy despite fears of a recession.

In Q3, United increased capacity across the Atlantic by 22% compared to 2019 adding 10 new cities. Atlantic PRASM increased 21% versus Q3 2019. The company plans to expand its Atlantic network by nine new routes in 2023. In the Pacific region, capacity was down 59% versus 2019 while PRASM increased 41%. With the reopening of Japan, United will focus on resuming the bulk of its Pacific capacity in the next year.

Secondly, business travel continues to see an uptick even though it may not be fully restored to pre-pandemic levels. As stated on the company’s conference call, the corporate business travel recovery in Q3 was about 80% of the volume of 2019 and stable over the quarter. Also the business traffic for long-haul segments across the Atlantic have recovered at a faster pace than domestic.

In addition, the flexibility provided by the hybrid work model has benefited leisure demand because people can now take trips on any weekend as they have the option to work remotely on those days. This trend helped drive a strong performance for United during September, which is typically an off-peak month. The company believes this trend could help fuel momentum during off-peak periods. Thirdly, external supply challenges will limit industry supply for years to come.

Encouraging outlook

Looking ahead to the fourth quarter of 2022, United expects the revenue environment to remain strong. The company expects its adjusted operating margin in Q4 2022 to be about 10%, exceeding Q4 2019. Adjusted EPS is estimated to range between $2.00-2.25. Capacity is projected to be down 9-10% while cost per available seat mile, excluding fuel, is expected to be up 11-12% versus Q4 2019.

Click here to read the full transcript of United Airlines’ Q3 2022 earnings conference call