Morgan Stanley (MS) — the last major investment bank to report earnings — soundly exceeded market expectations during the first quarter of 2018, primarily driven by an increase in equity trading as well as a lower corporate tax rate, which allowed other major national banks also to report higher profits.

After its rivals, JPMorgan Chase & Co. (JPM) and Goldman Sachs Group Inc. (GS) set the tone for higher profits, expectations for the quarter had been relatively high.

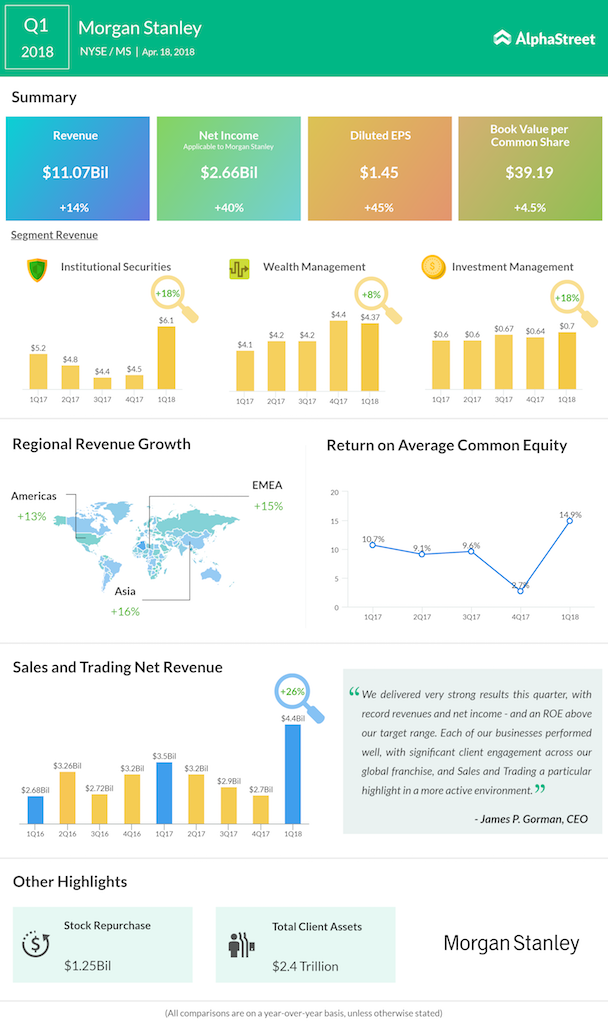

The bank’s quarterly profit during the first quarter surged 38% to $2.67 billion from $1.93 billion a year ago, while EPS jumped 45% to $1.45. Revenue came in at $11.08 billion, an increase of 14%. The bank’s share price rose about 2.5% to $54.44 in pre-market trading.

Morgan Stanley’s sales and trading revenue surged 26% to $4.40 billion due to an increase in the equities trading revenues that rose almost 27% to $2.6 billion. This rise in equities trading was due to strong performance across the bank’s products and regions and higher client activity. Goldman Sachs earlier reported a 31% rise in its total trading revenue.

Morgan Stanley, under its CEO James Gorman, set out new financial targets early this year. The update included a cost-to-revenue ratio of about 73%, ROE of 10-13% and annual pretax profit margins of 26-28% for wealth management. It appears that the bank can easily attain most of these targets, considering the impact of the new tax law.