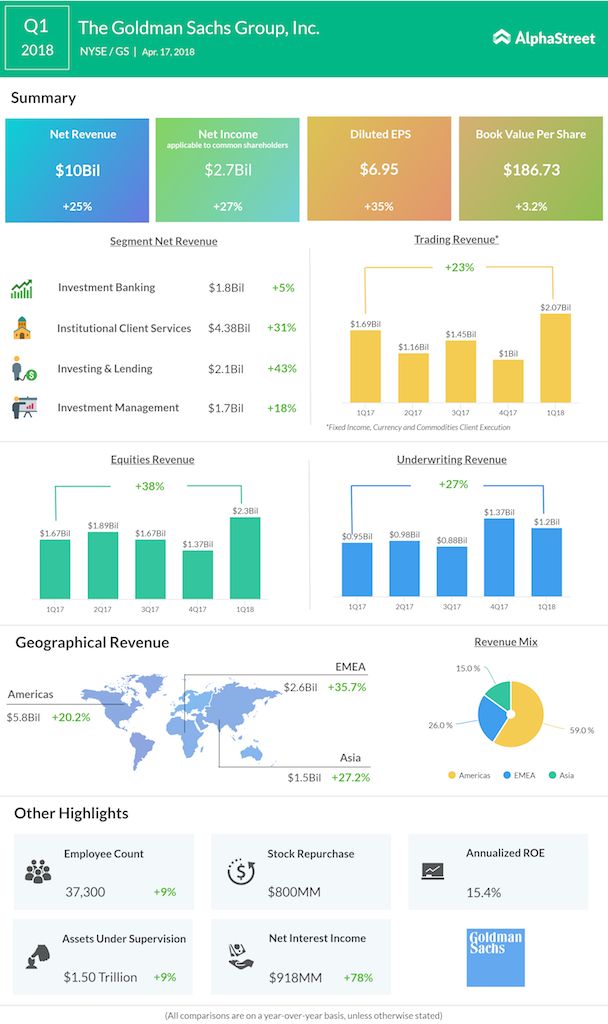

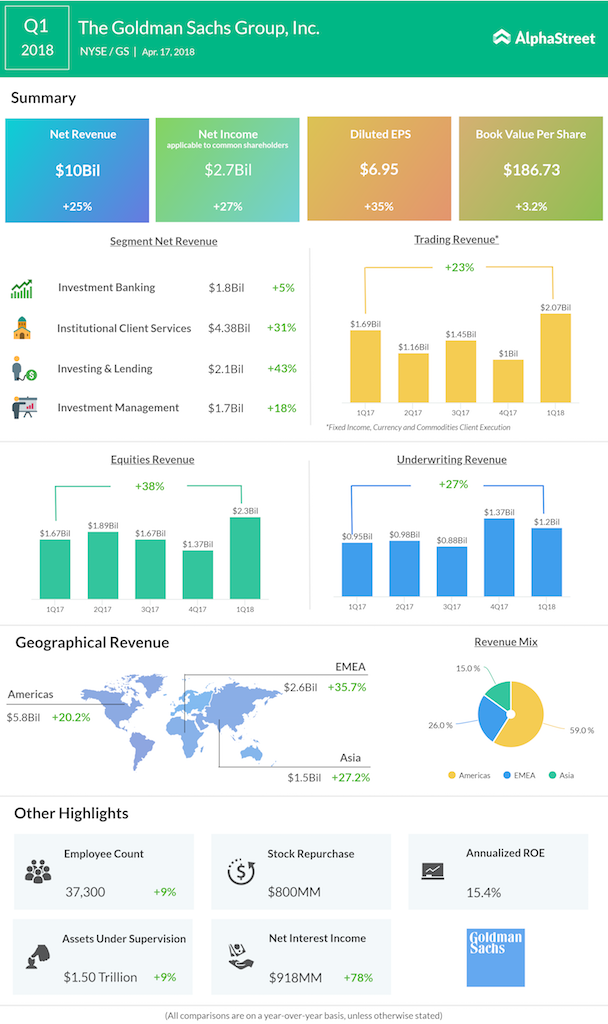

Multinational investment banking titan Goldman Sachs (GS), which has been trying to recover its foothold in its critical trading units for the last couple of years, reported first-quarter revenue and profit topping analyst estimates. Revenue jumped 25% year-over-year to $10.04 billion, its highest in three years, driven by higher net revenues across all the segments.

In line with the bank’s competitors that reported results earlier this week, earnings applicable to common shareholders surged 26.5% to $2.73 billion, while diluted EPS rose almost 35% to $6.95.

The company, meanwhile, increased its dividend to $0.80 per share from $0.75 per common share, up 6.6%.

Goldman’s investing and lending segment, which includes mortgages to illiquid investments in private start-ups , reported a 43% increase in revenue to $2.1 billion. The bank’s fixed income and equities both had their best quarters in three years as Institutional client securities reported a revenue of $4.4 billion.

In the Investment Banking segment, Goldman posted a revenue of $1.8 billion as its debt capital markets business posted its second best quarterly revenue. The results were driven by leveraged finance and asset-backed activity, and higher net revenues in equity underwriting.

The bank seems to have been improving on its initiatives as is evident in the first quarter results. In the previous quarter, Goldman Sachs posted a net loss, due to the new US tax legislation, but topped consensus estimates as is with this quarter.

In the Investment Banking segment, Goldman posted a revenue of $1.8 billion as its debt capital markets business posted its second best quarterly revenue.

M&A continues to be the linchpin for the company as it recently announced the acquisition of Clarity Money, acquiring about a million customers of the app.

The banking giant’s book value per common share increased by 3.2% during the quarter to $186.73, while annualized return on equity of 15.4% was the highest in over five years.

Goldman Sachs stock jumped 1.5% in the pre-market trading following the earnings announcement.