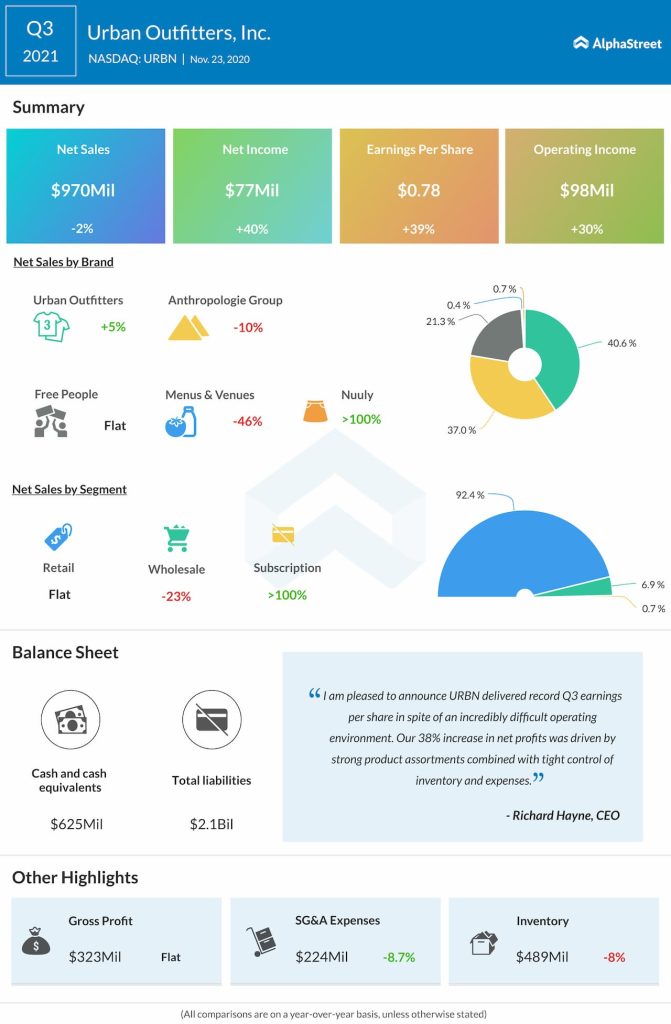

Quarterly numbers

Category trends

Urban saw store traffic decline across all its brands during the quarter due to restrictions in operating hours brought on by the pandemic. Even though traffic slowly picked up sequentially throughout the quarter, toward the end of October, the resurgence of the pandemic caused a slowdown again.

The weakness in stores was more than offset by the strong performance of the digital channel. Digital delivered mid double-digit comp sales during each month of the third quarter with that momentum continuing into the fourth quarter. The number of new digital customers rose by 45% with increases in orders and conversion.

For the Urban Outfitters brand, solid performance in the digital channel drove positive retail comps across all geographies along with strong trends in conversion, average order value and customer growth. The brand’s digital customer base grew 36% year-over-year with particular momentum in North America and Europe. The company rolled out its new website in Mexico and the response has been positive.

Retail stores saw a decline in traffic but this was offset by gains in conversion and average transaction value. The stores helped fulfill online orders meaningfully during the third quarter and also rolled out the curbside pickup option which is expected to benefit the upcoming holiday demand.

In terms of assortment, apparel saw weakness as demand for formal wear remained low but this was more than offset by strong trends in casual wear as people stayed at home. The company also saw strong performance in its home department with continued demand for home products.

The company’s rental business Nuuly has also seen a recovery with active paying subscribers growing 75% since the slowdown in mid-May. Urban believes trends will further pick up as the pandemic subsides.

Outlook

Total retail segment comp sales to date for November are relatively unchanged versus the third-quarter comp level. The last few weeks have seen a softness in store traffic and comps but the increase in digital demand has offset this dip.

The resurgence of the pandemic in places like the UK and the re-imposing of restrictions have brought significant uncertainty into Urban’s holiday season outlook but the company continues to bank on its digital channel.

Total company sales to date in the fourth quarter are pretty much in line with the third quarter. The new restrictions have brought about a slowdown in store performance but the digital channel continues its momentum. Urban expects digital demand to accelerate in the coming weeks.

Click here to read the full transcript of Urban Outfitters’ Q3 2021 earnings conference call