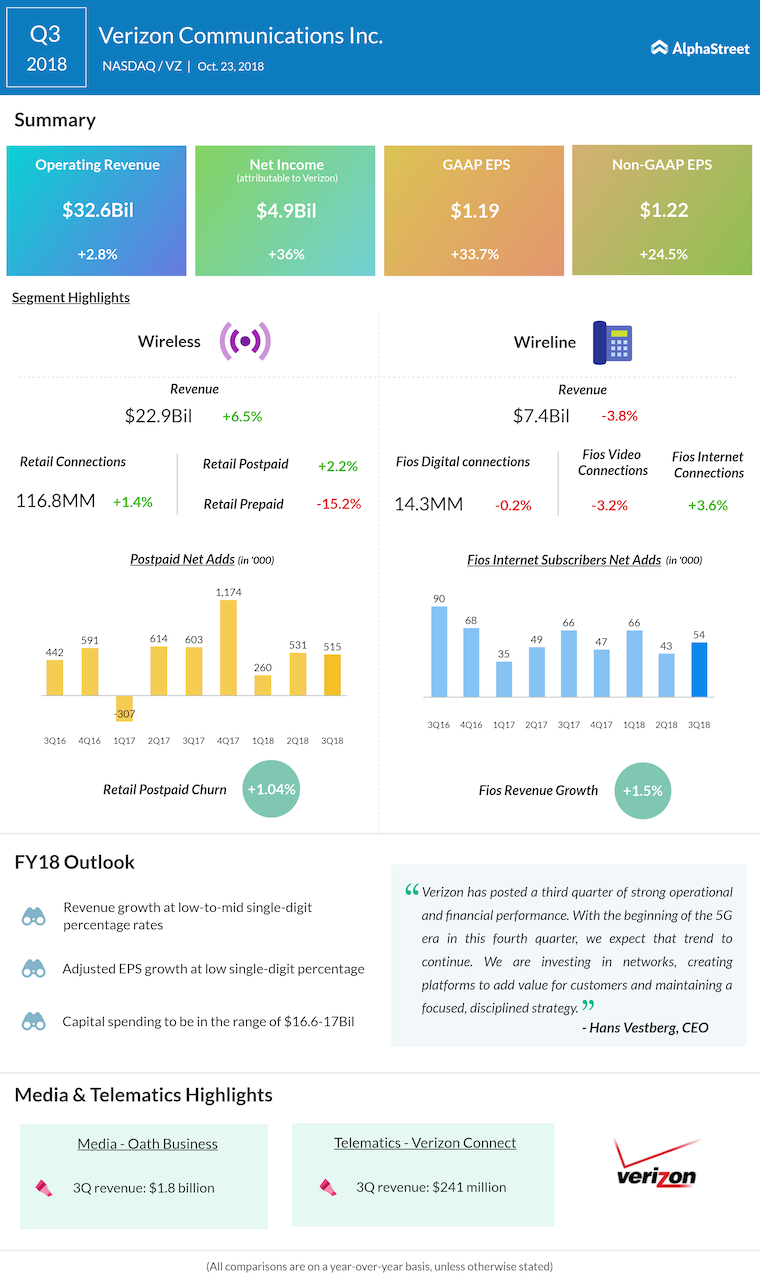

Total operating revenues advanced 2.8% year-over-year to $32.6 billion during the quarter, surpassing expectations. While wireless and wire-line revenues grew 6.5% and 3.7% respectively, the media segment Oath registered a 6.9% decline.

The company registered retail postpaid wireless subscriber additions 515,000 during the quarter and a moderate phone churn of 0.80%, reflecting consistent customer loyalty. The outcome, however, fell short of estimates. Meanwhile, postpaid phone additions – at 295,000 – benefitted from the promotional offers and came in above expectations.

The company registered strong retail postpaid wireless subscriber additions of and a moderate phone churn, reflecting consistent customer loyalty

“Verizon has posted a third quarter of strong operational and financial performance. With the beginning of the 5G era in this fourth quarter, we expect that trend to continue. We are investing in networks, creating platforms to add value for customers and maintaining a focused, disciplined strategy,” said Vestberg.

The management is expected to provide important updates on the 5G service rolled out earlier this month, the first ever 5G network in the world.

Looking ahead, Verizon expects full-year consolidated revenue growth at low-to-mid single-digit percentage rates. Adjusted earnings are seen rising in low single-digit percentage. In the whole of 2018, capital spending is estimated to be between $16.6 billion to $17.0 billion.

The company has been bringing about strategic changes to its core operation in recent years, with additional focus on media, in an effort to stay relevant in the fast-changing telecom sector that witnessed a slew of mergers this year. The wireless segment, which accounts for more than three-fourths of the revenue, continues to lead operations.

Verizon shares closed the last trading session higher and gained sharply in premarket trading Tuesday after the earnings report.