Telecommunications giant Verizon (VZ) reported its second-quarter results Tuesday, the last quarterly results under CEO Lowell McAdam who will be stepping down next month. The company’s shares made strong gains after the better-than-expected results triggered a stock rally.

In the second quarter, adjusted earnings were $1.20 per share, compared to $0.96 per share in the same period last year. Earnings came in above Wall Street expectations. The result included product realignment charges related to discontinuation of the company’s Go90 platform and associated content and acquisition and integration-related charges pertaining to media division Oath, which had a combined impact of $0.20 per share.

Meanwhile, net income attributable to the company, on an unadjusted basis, declined to $4.25 billion from last year’s $4.48 billion. Reported earnings per share dropped to $1.00 from $1.07.

RELATED: Verizon to launch 5G services in LA

Revenue advanced 5.4% annually to $32.2 billion, with strong contributions from the wireless business division, which registered a 15.5% growth. Meanwhile, revenues of the wireline division dropped 3.4%. The top-line surpassed analysts’ expectations.

At 0.75%, retail postpaid phone churn stayed at 0.80% or better for the fifth consecutive quarter, reflecting sustained customer loyalty. Net retail postpaid additions were 531,000.

“Verizon is extremely well-positioned for the future. Our financial and operating results for the first half of 2018 were strong, as evidenced by service revenue, earnings and operating cash flow growth delivered in a highly competitive marketplace,” said CEO Lowell McAdam.

RELATED: Verizon names new CEO

Looking ahead, Verizon expects consolidated revenue to grow in low-to-mid single-digit percentage rates in fiscal 2018, benefitting from strong equipment revenue trends. Adjusted earnings, excluding the impact of tax reform and the revenue recognition standard, are estimated to grow in low single-digit percentage rates.

Earlier, the company had informed that senior executive Hans Vestberg will succeed outgoing CEO McAdam, who will be stepping down on August 1.

RELATED: Verizon Q2 2018 earnings call transcript

AT&T (T), Verizon’s main competitor, is scheduled to release its second-quarter results today after the market closes.

Verizon’s stock, which lost 5% since the beginning of the year, gained nearly 3% in premarket trading Tuesday following the earnings announcement.

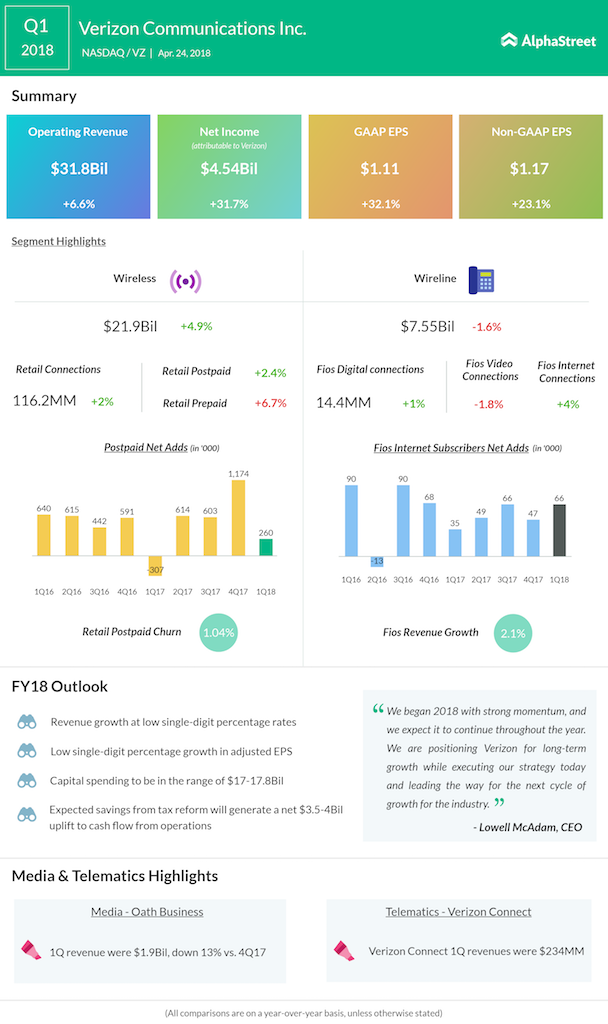

RELATED: Verizon reports strong Q1 results