VIPS shares jumped 10% immediately following the announcement. The stock has gained 16% in the year-to-date period.

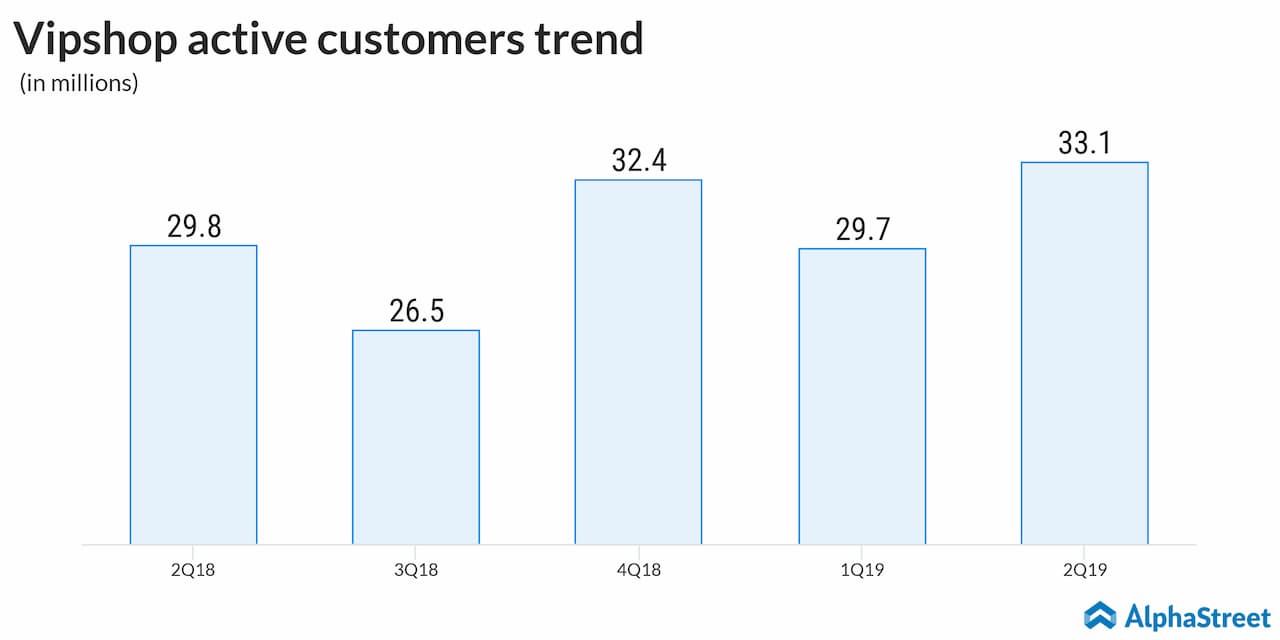

Gross merchandise volume grew by 11% to RMB 35.1 billion in Q2, while the number of active customers increased 11% to 33.1 million. Total orders surged to 147.8 million from 111.3 million in the prior-year period.

READ: Up next in Chinese stock earnings – Qudian

ADVERTISEMENT

CEO CEO Eric Shen said, “Since we refocused on discount apparel and our profitability, we have seen substantial improvement in our financial results and key operating metrics, proving our strategy is very effective.”

Gross margin for the second quarter of 2019 increased to 22.4% from 19.5% in the prior-year period.

For the third quarter of 2019, the company expects its total net revenue to be between RMB 17.8 billion and RMB 18.7 billion, representing a year-over-year growth rate of approximately 0-5%.