Credit card giant Visa Inc. (NYSE: V) this week reported higher earnings and revenues for the first quarter of 2022 as customer spending remained high amid widespread adoption of digital payment services. The numbers also exceeded Wall Street’s projection. But the positive outcome failed to impress the market and the company’s stock experienced weakness soon after the announcement.

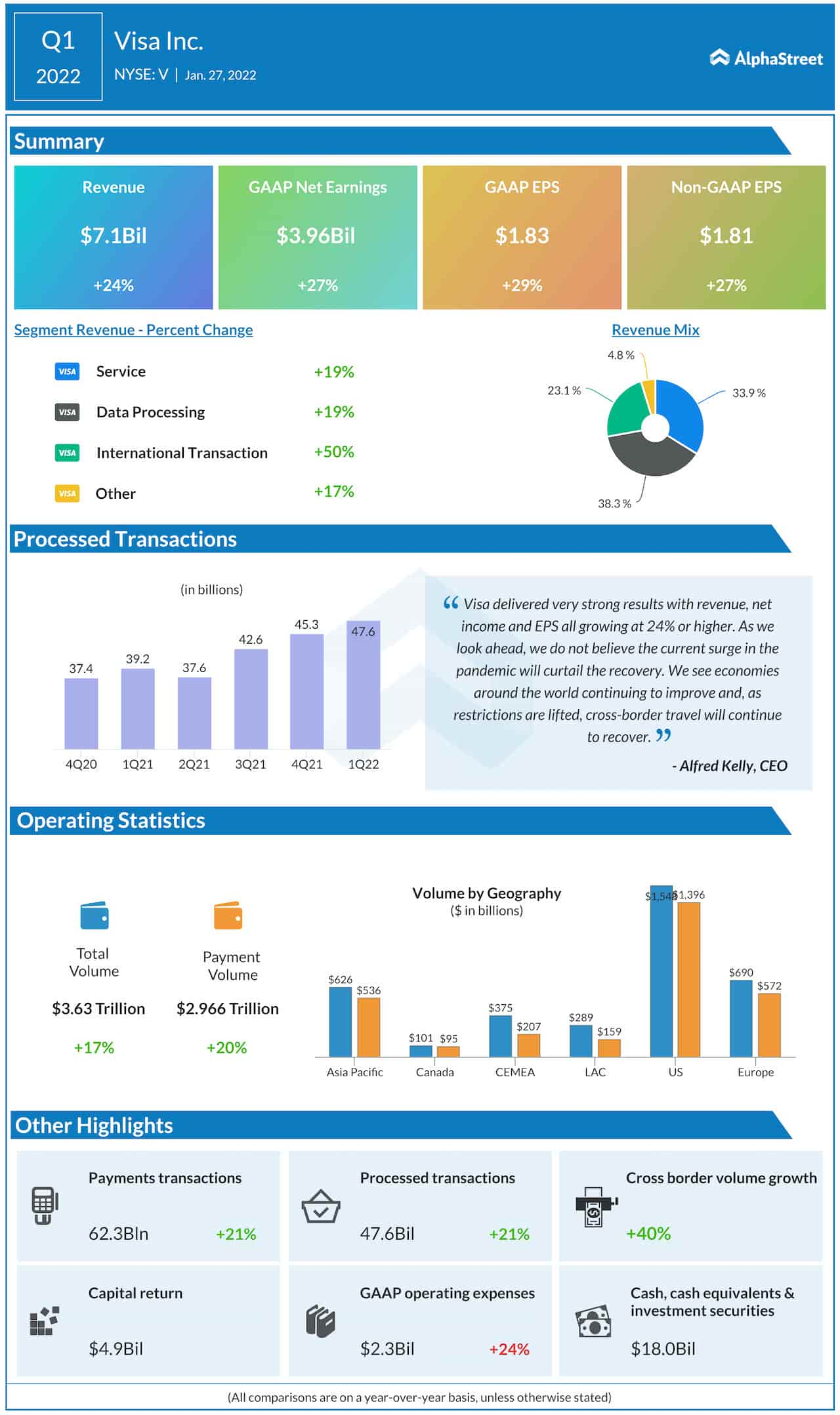

The San Francisco-based payments processing firm said adjusted earnings increased 27% annually to $1.81 per share in the first quarter, which is above the market’s projection. Unadjusted profit rose to $3.96 billion or $1.83 per share.

The impressive earnings performance reflects a 24% growth in net revenues to $7.1 billion. Experts had predicted a slower increase. During the quarter, payments volume, cross-border volume and processed transaction increased at a faster pace. The company returned around $4.9 billion to shareholders in the form of share repurchases and dividends.

Read management/analysts’ comments on Visa’s Q1 2022 earnings

“As we look ahead, we do not believe the current surge in the pandemic will curtail the recovery. We see economies around the world continuing to improve and, as restrictions are lifted, cross-border travel will continue to recover. We remain confident that we are wellpositioned, via our multi-pronged growth strategy, to deliver strong results well into the future,” said Alfred Kelly, chief executive officer of Visa.

The company’s shares recovered from the initial slump and gained on Friday morning. The stock has been experiencing volatility for quite some time, losing about 17% in the past six months alone. Meanwhile, analysts strongly recommend buying the stock.