The ripple effect of international travel recovery is being felt in related industries like tourism and payment service. The business of credit card firm Visa Inc. (NYSE: V), one of the key beneficiaries of the ongoing pandemic unlocking, looks poised to return to the pre-crisis levels this year.

Shareholder Value

The California-based payment service provider is an all-time favorite of investors, thanks to the simple and successful business model that gives it an edge over rivals like MasterCard Inc. (NYSE: MA) and helps create good shareholder value. Despite the virus-related volatility and a pullback early last year, Visa’s stock has constantly maintained an upward momentum.

Read managements/analysts’ comments on quarterly reports

The shares reached a new peak this week and are expected to move higher in the coming months, offering a fresh buying opportunity that is worth considering. Moreover, the price looks reasonable even after the recent rally. In short, Visa is one of those value stocks investors can safely hold for the long term.

Digital Boom

Since the company typically performs in tandem with macroeconomic trends, it can benefit from the ongoing recovery in economic activity. Consumer spending got a fillip from the government’s stimulus program and optimism brought about by the vaccination drive. But the biggest tailwind is the mass shift to digital payment during the pandemic, a trend that is expected to gather steam going forward.

The management has been busy expanding the business to align with the changed market conditions by adding new products to the portfolio and through innovation, given the growing adoption of new facilities like contactless-payment that became popular during the virus crisis. Also, efforts are on to bolster the company’s digital capabilities to better serve its huge global customer base. The vast network and scale of business allow the company to add new clients with minimal cost, which in turn adds to margin growth.

From Visa’s Q2 earnings conference call:

“Consumers, merchants, and governments globally have recognized the value of e-commerce through the pandemic. Governments are upgrading their digital infrastructures, merchants are significantly enhancing their eCommerce capabilities, and more consumers are turning to e-commerce across more categories and also cross-border. We expect these trends will only accelerate. Within our new flows business, Visa Direct has continued to grow at extraordinary rates.”

Staying Alert

But, like every other business, financial service is also undergoing a transformation. It goes without saying that Visa would need to adapt to the emerging trends and keep updating its strategy to stay relevant in the long term. It is scheduled to announce third-quarter results on 27th July after the normal trading hours, amid expectations for a 25% increase in earnings to $1.34 per share, which would be the first positive change in more than a year.

360 DigiTech Q2 2021 Research Summary

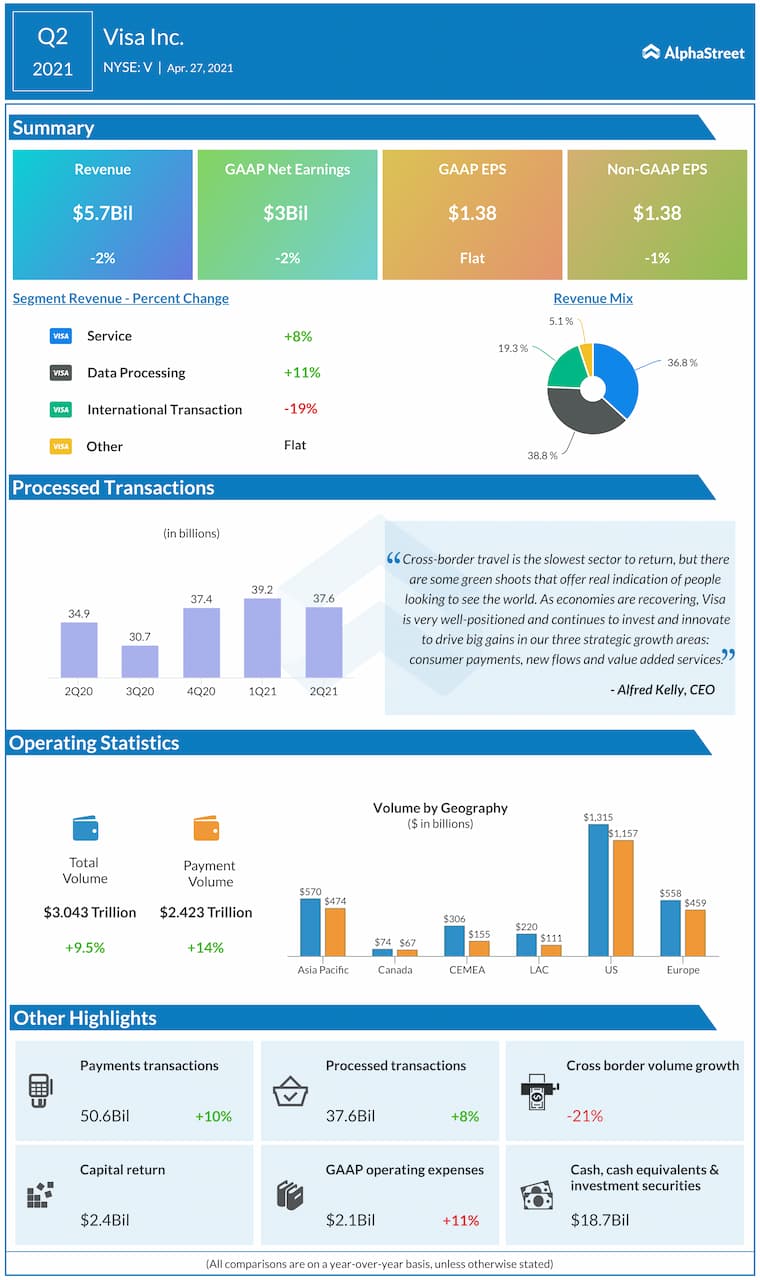

Earnings had declined in all of the trailing four quarters, hurt by the weak demand conditions, but surpassed the consensus forecast each time. A similar trend was visible in the top-line performance. In the most recent quarter, adjusted earnings edged down to $1.38 per share, reflecting a 2% decrease in revenues to $5.7 billion. Positive performance by the core Service and Data Processing segments was more than offset by a double-digit contraction in the International business.

On Wednesday, Visa’s stock traded slightly lower, after closing the previous session at $239.60. It gained about 10% in the past six months and traded well above the 52-week average.