Valuation

Given the company’s successful business model and strong financials, the valuation looks fair, though some prospective buyers would find the stock expensive. It is worth noting that Visa has long been an investors’ favorite, for being one of the safest Wall Street stocks. So, the time is ripe for investors to add the stock to their portfolios. Moreover, the company has raised dividends regularly, a trend that should attract more income investors to it. In short, Visa has what it takes to create solid long-term shareholder value, thanks to its sustainable value proportion and strong fundamentals.

Visa Inc. Q4 2022 Earnings Call Transcript

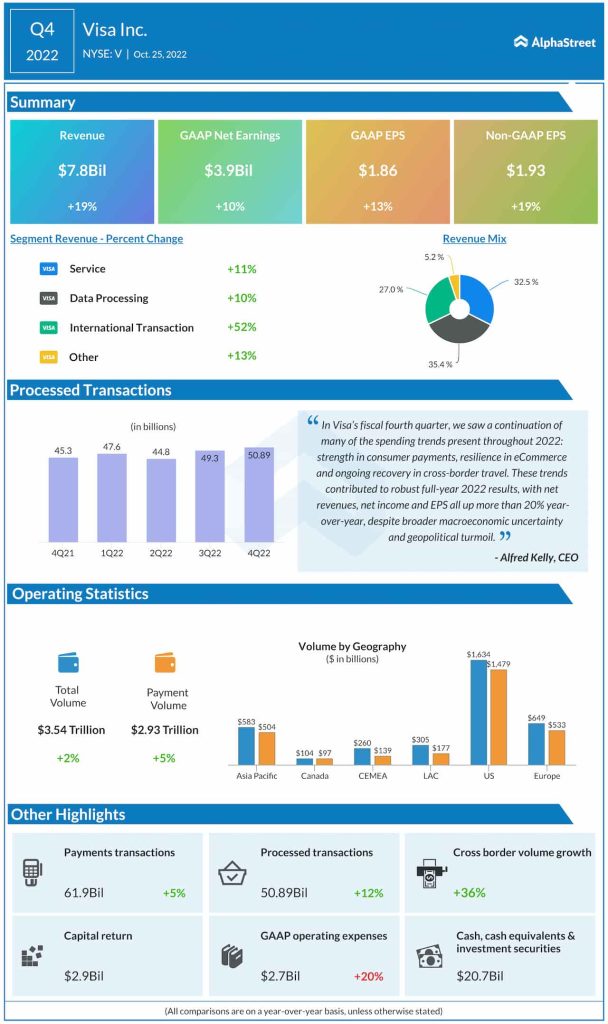

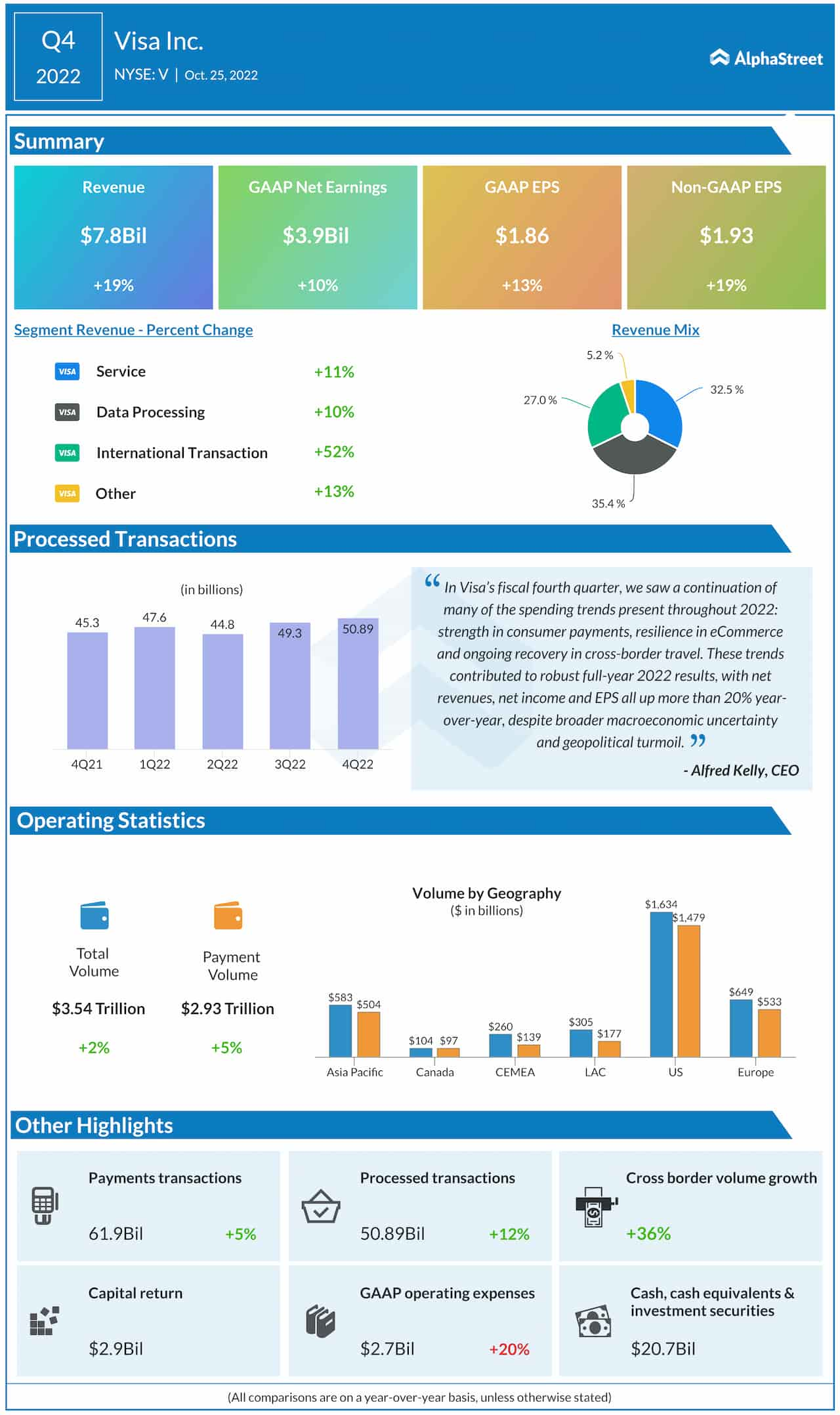

Visa has a good track record of delivering stronger-than-expected quarterly earnings and revenue performance, with the bottom line missing only a couple of times in the past five years. In the final three months of 2022, adjusted earnings grew in double digits to $1.93 per share, on revenues of $7.8 billion. The top line was up 19% year-over-year, reflecting broad-based growth across all business divisions. Cross-border volume, excluding transactions within Europe, increased by 49% during the three-month period.

Cost Management

Considering the inflation pressures and tough macro scenario, the company has initiated steps to effectively manage costs and expenses in line with revenue growth targets, with a focus on prioritizing investment plans. Meanwhile, the acquisitions of Tink and Currencycloud are expected to add to expense growth in the early part of the new fiscal year, which will be partially offset by the discontinuation of Russian operations.

“Should there be a recession or a geopolitical shock that impacts our business, slowing revenue growth below our planning assumptions, we will, of course, adjust our spending plans by reprioritizing investments, scaling back or delaying programs, and pulling back as appropriate in personnel expenses, marketing spends, travel and other controllable categories. In a business like ours, this always requires a careful balance between short- and long-term considerations,” Visa’s CFO Vasant Prabhu told analysts during the earnings call.

MA Earnings: Mastercard Q3 2022 profit, revenue beat estimates

Visa’s stock traded higher in the early hours of Friday after closing the last session higher, aided by the positive sentiment that followed the earnings announcement.