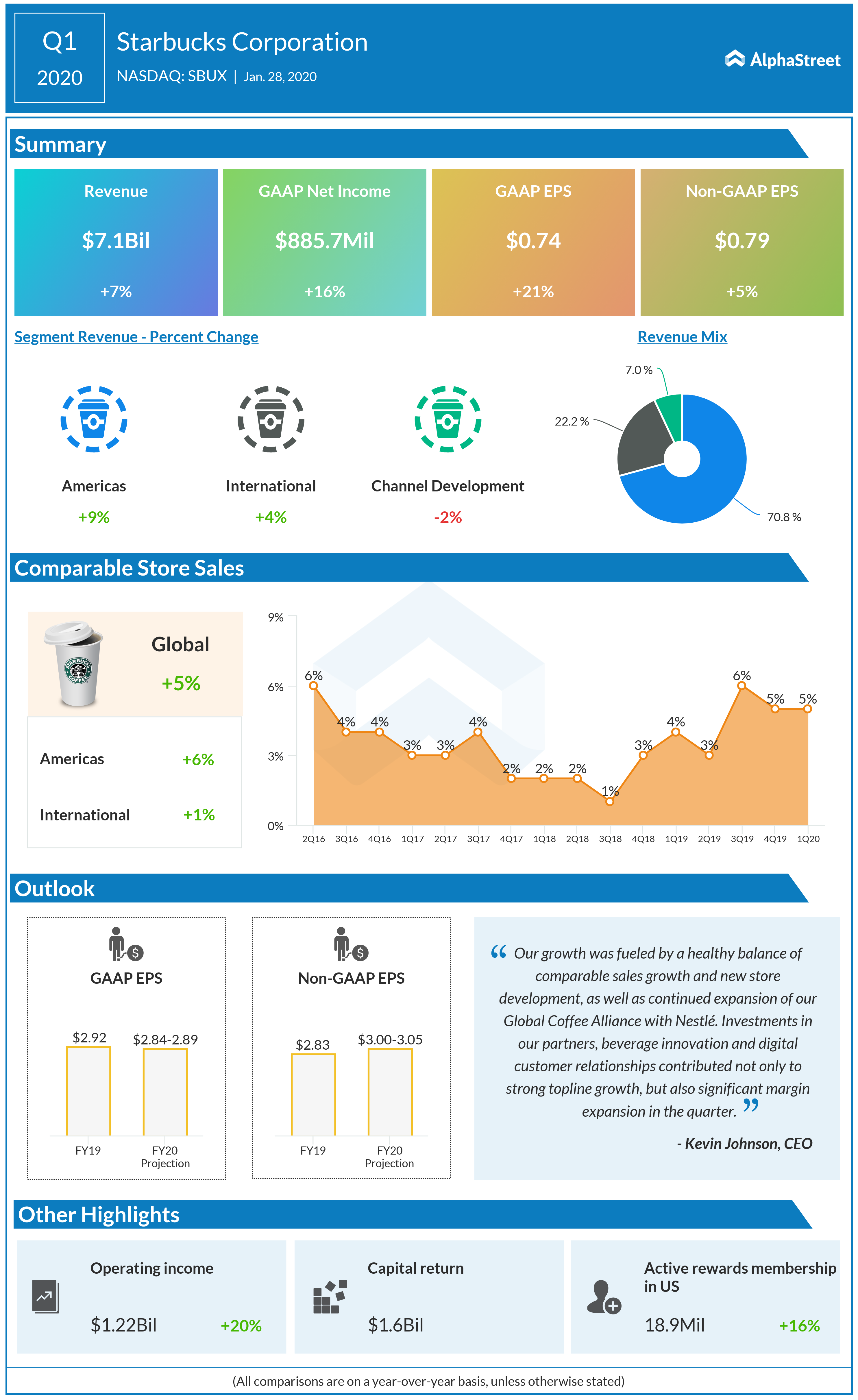

Global comparable-store sales rose 5%, driven by a 3% rise in average ticket and a 2% growth in comparable transactions.

In China

The company said more than half of its Chinese outlets have

been closed following the outbreak of coronavirus. The coffee company expects

this to be temporary and has kept its projections for the full year unchanged.

Starbucks’ global strategy, with a focus on enhancing customer experience through store remodeling and digital innovation, has been producing the desired results, especially in China where it has a delivery partnership with Alibaba (BABA).

READ: We aim to be cash-flow positive by end of FY20: Zedge CFO Jonathan Reich

The company has been recording decent comparable

sales growth in China, a key market in terms of market share, despite intense

competition from local player Luckin

Coffee (LK).

The demand for the company’s pricey specialty drinks, the primary source of margin, has increased in the recent past. The trend is encouraging both in terms of profitability and brand expansion. However, the coffee segments of rivals McDonald’s (MCD) and Dunkin Brands (DNKN) are trying to catching up, which points to the need for Starbucks to keep innovating.

SBUX shares were modestly down during aftermarket hours immediately following the announcement. The stock, which is currently trading below the $100-mark, gained 39% in the past twelve months.