Consumer Purchase Patterns

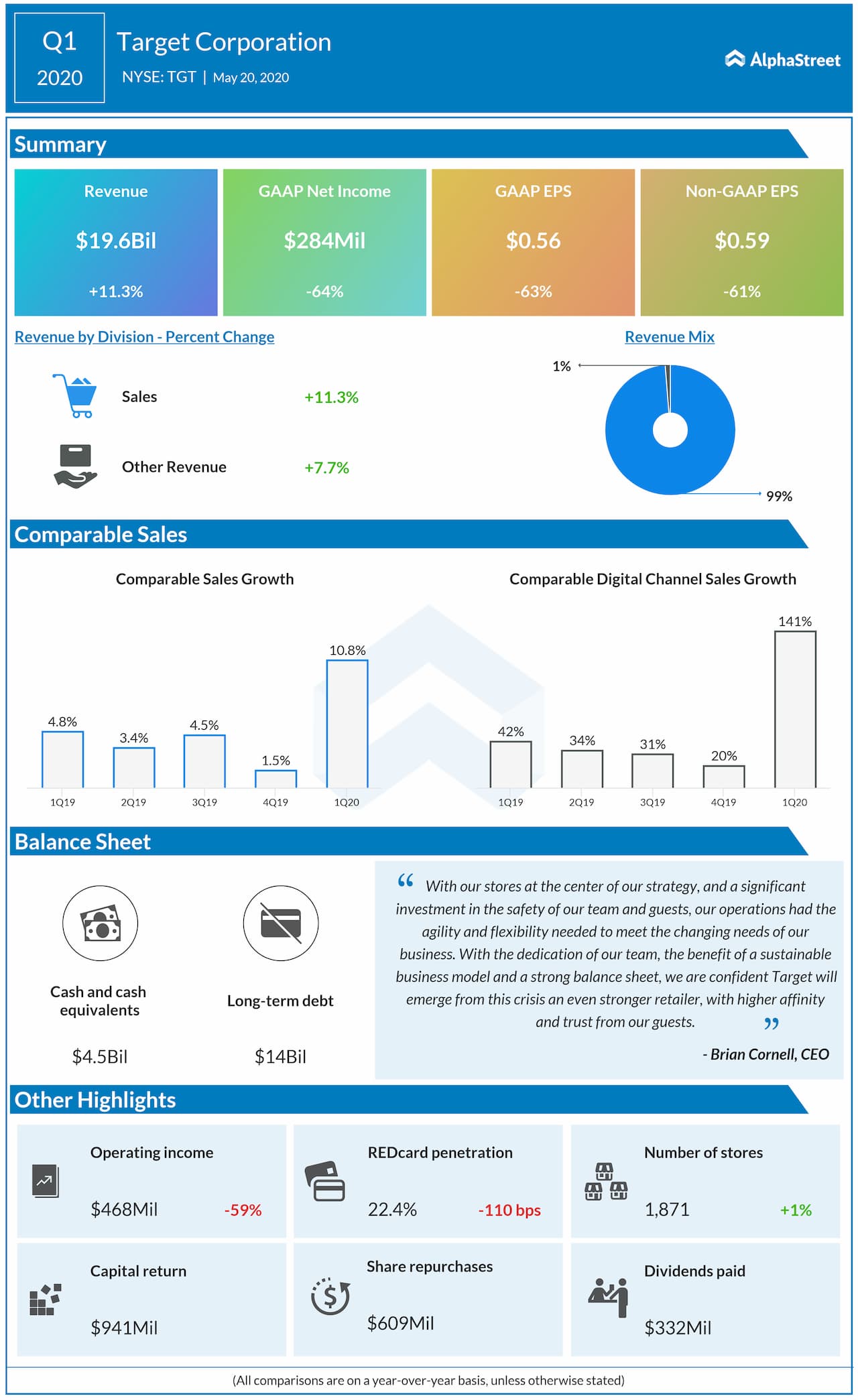

On the other hand, Target saw a surge when only when mid-April checks arrived. The purchase behavior for consumers was similar, they shifted from food, beverage and household essentials (which showed a 20% growth) in March to discretionary items by April. Growth in electronics saw about a 45% increase.

Omnichannel presence

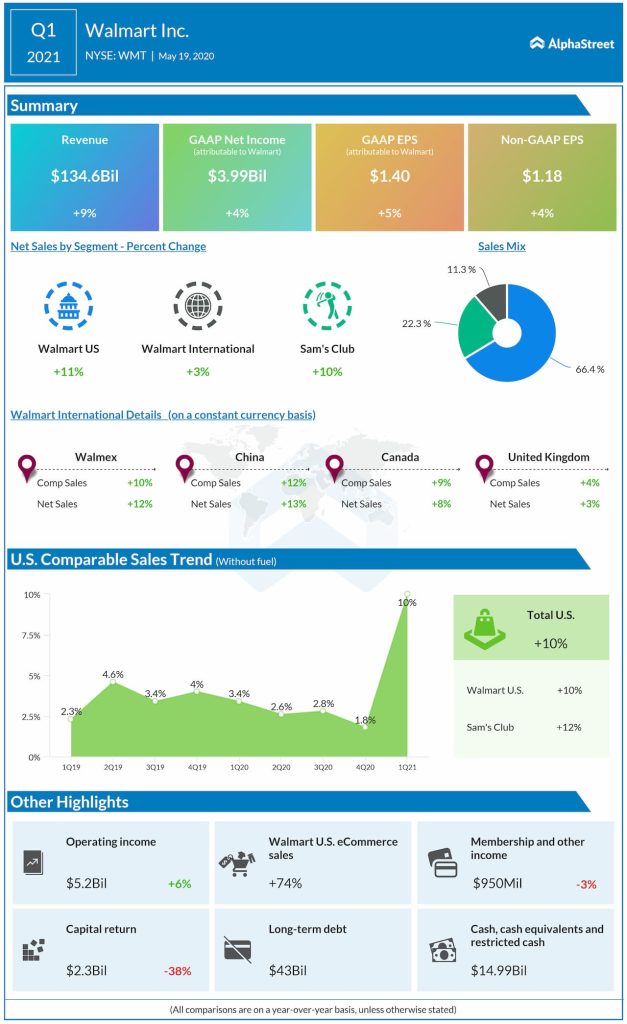

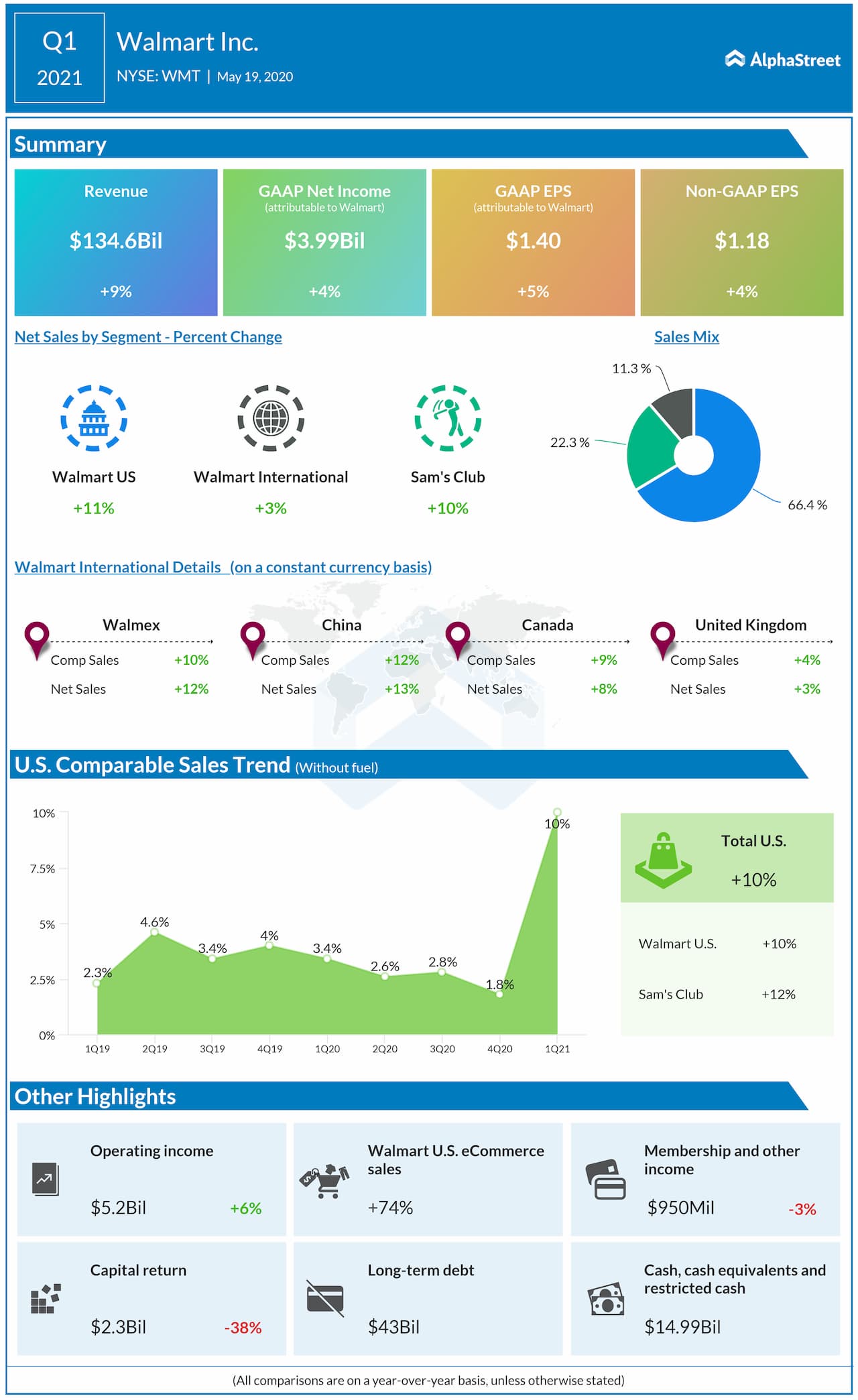

Wal-Mart’s e-commerce business saw a growth of 74% this quarter as customers were stepping out of the house less and decided to drive up to a store to collect an order rather than venture in. While Amazon was lagging at delivery times, Walmart was using its force of 4600 stores and a strong supply chain to deliver promises. Similarly, Target saw a whopping increase of 141% and they used their 1900 stores mostly as fulfillment centers for about 80% of their digitally placed orders.

Digital sales require a costlier supply chain and with a smaller order, the economies of scale just don’t apply. The packaging, shipping, distribution and per employee cost increased. The ‘last mile’ delivery is a big cost driver. So, to compete with the likes of Amazon, these retailers needed to step up their game.

[irp posts=”62564″]

Walmart spent more billions in strengthening its omnichannel presence. Bringing Jet.com under its umbrella probably helped. Jet traffic when it was acquired was 33 million visits, but that number dropped to 1.4 million by December 2019. At the same time, Walmart came up to 469 million for that month. So we all know where all the traffic has diverted to.

Target also recently acquired Deliv, a same-day delivery technology, it assists in sorting and routing of orders.

Where the roads diverged: Operating Margins

This parameter diverges paths between Walmart and Target. Walmart had a higher cost control and ended with a 3.9% margin; last year it ended the quarter with 4% margin. Target had a 2.4% operating margin while it ended last year’s quarter with a 6.5% margin. Target faced pressure from digital fulfillment and supply chain costs as its digital channel accelerated a lot quicker than estimated. John Mulligan, CEO of Target said:

“Our first-quarter digital volumes weren’t anticipated for another three years.”

ADVERTISEMENT

Downward pressure on the margins was also created because of incremental costs from inventory impairment, higher wages, sales of low margin products, and softening of sales of higher-margin products. If Target’s prior trends in apparel and accessories had continued, first-quarter sales in that category would have been more than $800 million higher.

Walmart’s incremental operating costs related to the health crisis were about $900 million in Q1, with about 75% going to associate bonuses and expanded benefits. It’s profit margin although less hurt because of its cost controlling exercise, has taken a toll for the similar reasons – last year’s price investments, crisis-related shifts in sales mix to lower-margin categories and channel mix towards eCommerce, general merchandise markdowns, and temporary closures of Vision Centers and Auto Care Centers.

[irp posts=”62562″]

Walmart has seen a recession-proof growth in the past as well – having been the only chain thriving in the 2009 recession. On the other hand, Target sure has taken a lot of market share of the e-commerce business, but it needs to make itself more sustainable for the future.

__

(Written by Shreya Chandra)