New Model

Taking a cue from the changing digital entertainment landscape, Disney is making major investments in its video streaming service under the leadership of CEO Bob Iger who returned to the company recently after retiring in 2021. More than three years after launching Disney+, the company recently rolled out an ad-supported version with around 100 advertisers to better monetize the platform.

Check this space to read management/analysts’ comments on quarterly reports

The new business model assumes significance against the backdrop of customers shifting to streaming services and spending less on cable subscriptions. At the same time, the streaming space is getting crowded with the entry of new players like Disney and Apple. For the companies, the main challenge is to strike the right balance between quality and pricing as operating costs keep rising and customers become more cost conscious.

“I’ve always believed that the best way to spur great creativity is to make sure that people who are managing the creative processes feel empowered. Therefore, our new structure is aimed at returning greater authority to our creative leaders and making them accountable for how their content performs financially. Our former structure severed that link, and it must be restored. Moving forward, our creative teams will determine what content we’re making, how it is distributed and monetized, and how it gets marketed,” said Bob during his interaction with analysts.

As part of the reorganization, the company will split into three separate entities – Disney Entertainment; Disney Parks, Experiences, and Products; and ESPN. It looks to reduce costs by $5.5 billion through various initiatives including a large-scale workforce reduction.

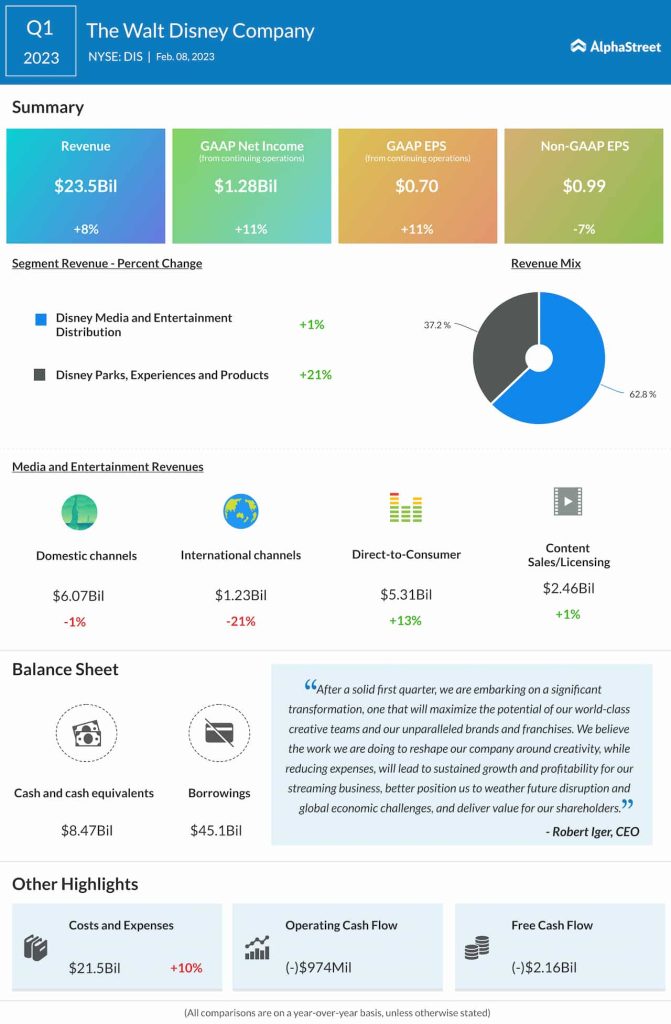

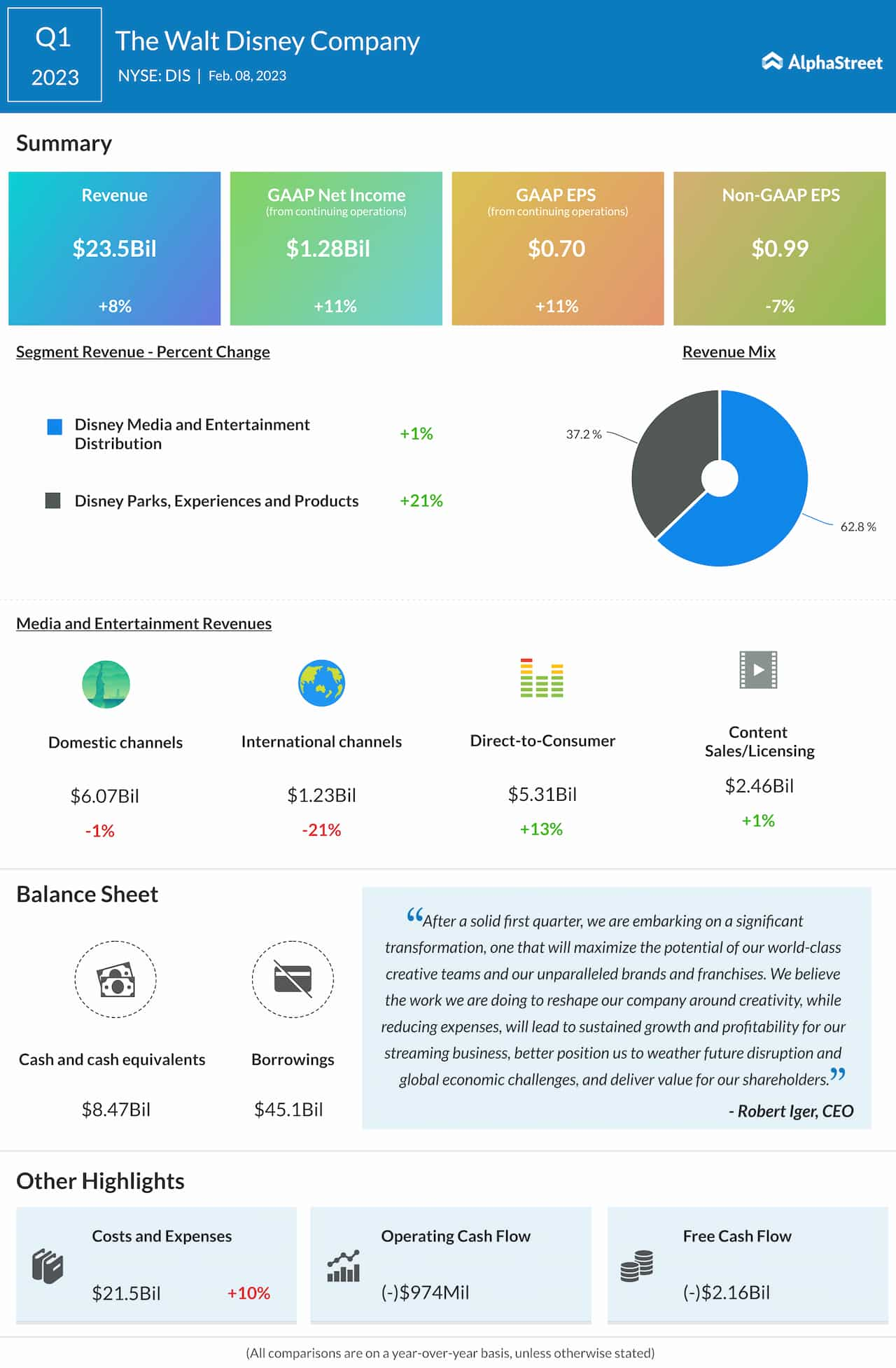

Mixed Q1

Continuing traffic growth at Disney parks, after recovering from the pandemic-induced shutdown, pushed up total revenues by 8% year-over-year to about $24 billion in the December quarter. The core Media and Entertainment division grew modestly, mainly reflecting higher direct-to-customer revenues.

Netflix had a bumpy start but a brighter finish in 2022; what will 2023 bring?

Meanwhile, total subscriptions of Disney+ dropped to 161.8 million, which was smaller than the estimated decline. Though adjusted earnings, which excludes certain one-off items, decreased to $0.99 per share from $1.06 per share last year, the latest number topped expectations. In the previous quarter, both the top line and profit had missed estimates.

After recovering from a multi-year low in the final week of 2022, the value of Disney shares increased and went past the long-term average. The stock traded higher on Thursday, extending the post-earnings uptrend.