For Western Digital Corp. (NASDAQ: WDC), 2019 was a challenging year when its financial performance faltered amid unfavorable market conditions. As it enters the new year, the data storage company is looking for a successor to outgoing CEO Stephen Milligan. After recovering from the lows in the final weeks of last year, the stock made solid gains this week and traded sharply higher on Tuesday.

With the flash memory market showing signs of recovery, the company will now be able to return to the growth path, leveraging its revamped product portfolio. On a day Western Digital unveiled its new high-capacity ultra-portable external hard disk, the company also got a bullish review from Cowen.

Is Stock a Buy?

The brokerage firm upgraded the stock to outperform from market perform and nearly doubled the price target to $88, which represents about 40% upside from the last closing price. The majority of the analysts recommend buy, with a consensus target price of $68.15. Predicting a sooner-than-expected improvement in NAND and DRAM prices and a near-term uptick in flash memory/HDD margins, the analyst also upgraded the rating on chipmaker Micron (MU).

Upbeat Outlook

In general, the current outlook on Western Digital is upbeat. Experts see further growth in the stock’s value, in line with the improving market conditions, primarily on the pricing front. It is an opportunity no investor would want to miss. Though the memory market is cyclical in nature, the latest estimates show that prices would grow in double-digits this year and remain high in the foreseeable future.

Also see: What 2020 has in store for Advanced Micro Devices

Another factor that bodes well for Western Digital is the imminent 5G-smartphone build-up, which is widely expected to spur memory demand. Also, the latter part of the year might witness a tight demand-supply scenario for memory chips, partly owing to the video-game upgrade cycle. However, the company should focus on reducing its high inventory levels, while enjoying the benefits of favorable pricing.

Weak Q1

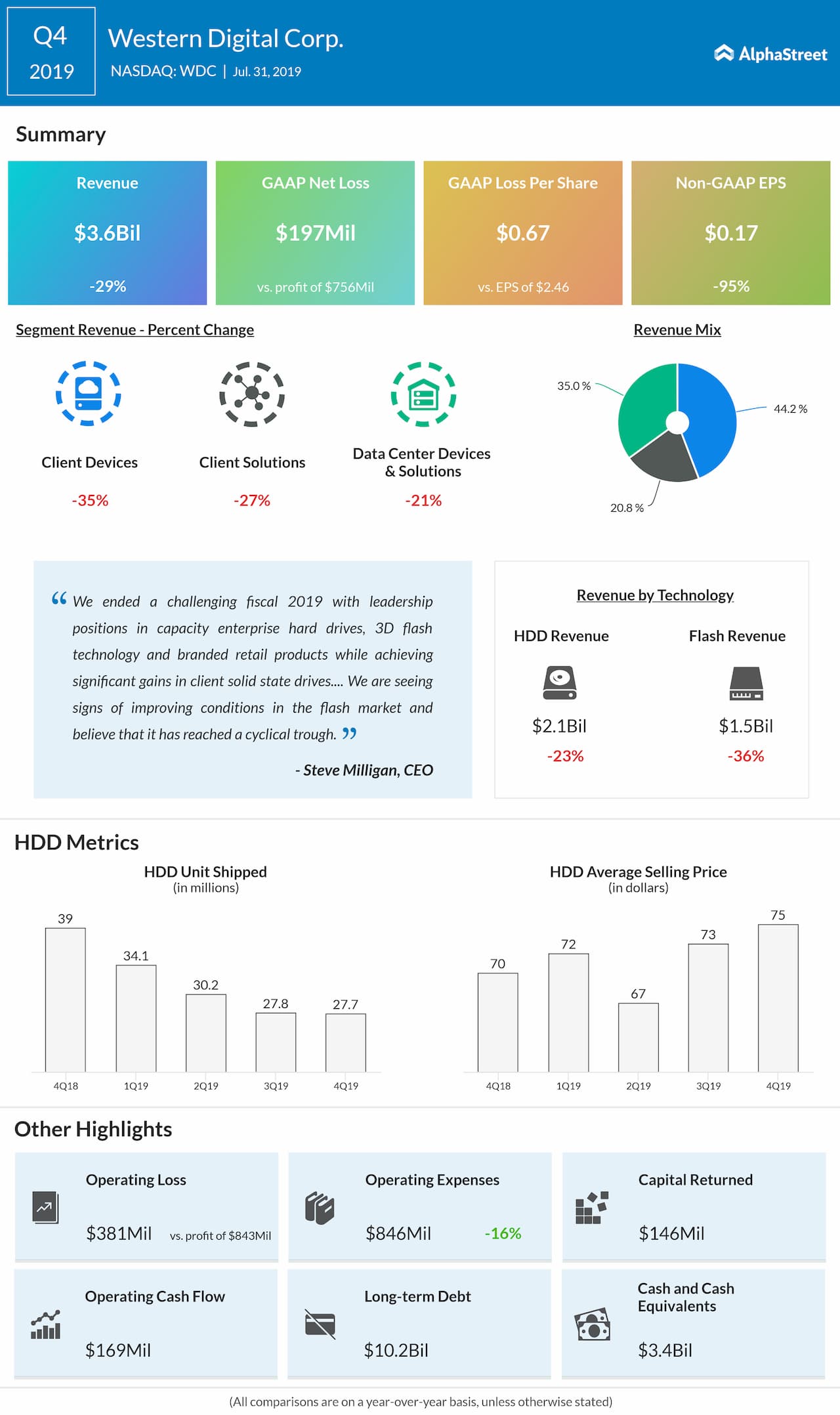

For the first quarter, the San Jose, California-based tech firm reported sharply lower revenues and earnings, reflecting the slowdown in the flash memory market. Earnings also missed the Street view, which prompted the management to guide second-quarter numbers below the consensus estimate.

Western Digital shares gained more than 65% in the past twelve months. The stock traded up 6% during Tuesday’s regular session