Of late, Cloudera, Inc. (NYSE: CLDR) has been focused on offering solutions in the high-growth areas of the cloud computing market, after delivering not-so-impressive performance in recent years. The COVID-driven digital transformation is creating new opportunities for companies in the fast-growing multi-cloud data management and analytics market.

Read management/analysts’ comments on Cloudera’s Q3 earnings

The company’s stock has almost failed to grab the market’s attention since it went public more than three years ago. After a long period of volatility, currently, the stock seems to be on the path to recovery as the company sustains the recent turnaround and remains profitable, aided by the virus-driven demand growth.

Bearish Outlook

The negative sentiment surrounding the stock, which is not considered a safe investment option, can be linked to the uncertainties related to the pandemic. Also, there are concerns that the recent improvement in Cloudera’s financial performance is temporary and some experts attribute the stock’s recovery to the general uptrend in the market.

Realizing the need to innovate, the management is working to tap emerging opportunities in cloud computing such as Big Data and analytics through new offerings like hybrid cloud solution Cloudera Data Platform (CDP) that allows customers to work effectively on both on-premise and public cloud. Contributions from CDP are expected to reflect in revenues by next year and deliver double-digit growth beyond that.

Expressing his bullish views on the Cloudera Data Platform, the company’s CEO Robert Bearden said during the third-quarter conference call, “CDP represents the next generation of data management and advanced analytics as a hybrid multi-cloud platform. As the industry’s first enterprise data cloud driven by the rapid innovation of the open-source community, our enterprise data cloud supports both public and private cloud implementations across the complete data lifecycle in a secure environment. That means CDP can solve real business problems for a wide variety of use cases ranging from data collection to reporting and artificial intelligence.

Innovation

The growth initiatives assume significance considering the fears that Cloudera’s on-premises data warehousing solutions are becoming less relevant in the emerging scenario where the pandemic is driving enterprises to shift their IT infrastructure to cloud platforms. The merger with data software company Hortonworks Data Platform was an important step towards preparing the business for the future, in a market that is witnessing a massive growth in data. The company’s sagging revenues got a big boost after the merger.

Snowflake Inc. Q3 2021 Earnings Call Transcript

More recently, the tech firm acquired streaming data engine Eventador to accelerate its streaming data platform in real-time analytics applications. When it comes to expanding its footprint in the cloud market, the company has an edge over some of its peers due to the multi-cloud and hybrid solutions.

Stays Profitable

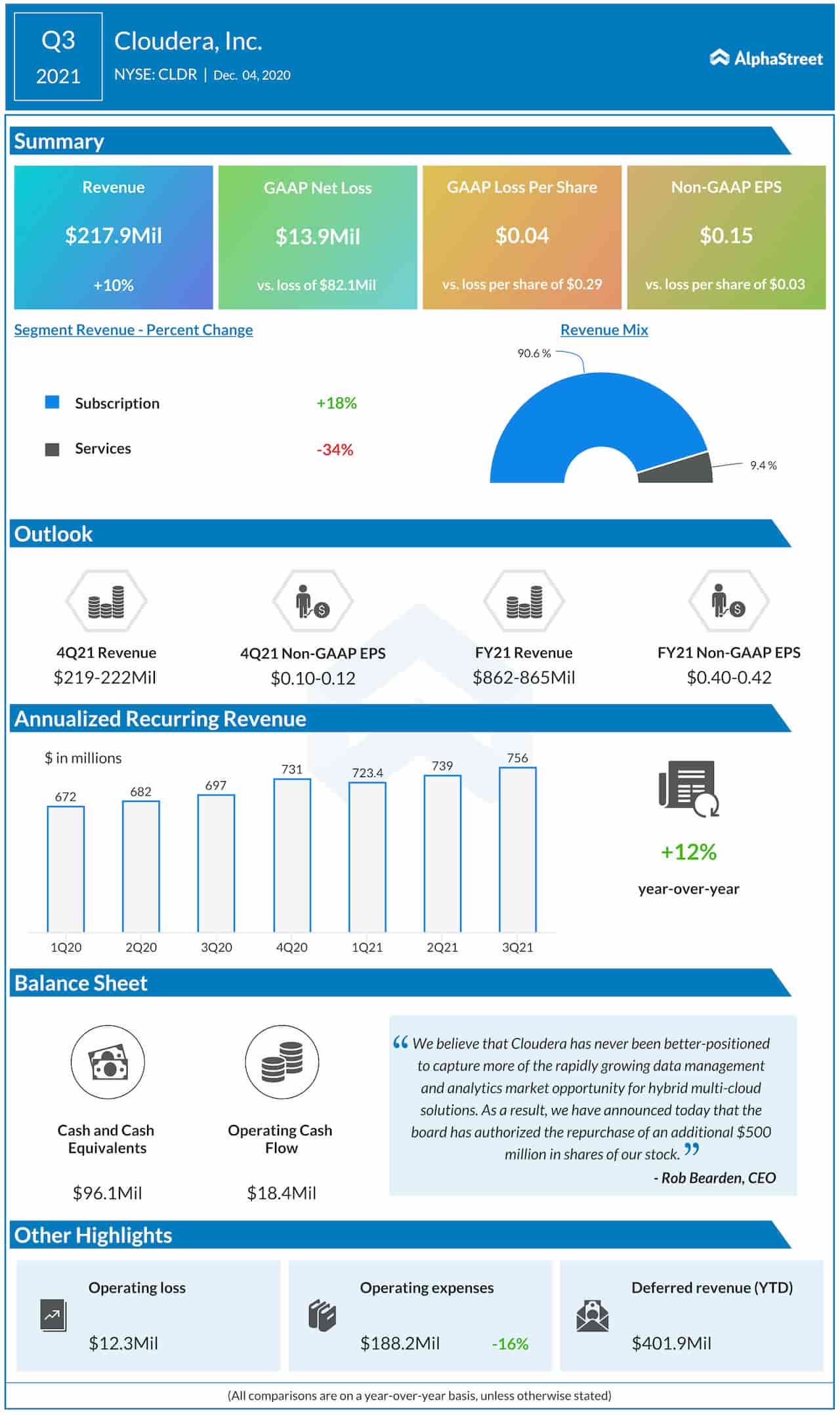

Cloudera swung to a profit of $0.15 per share in the third quarter of 2021 from last year’s $0.03-per share loss. The recovery was driven by a 10% growth in revenues to about $218 million amid strong increase in subscriptions.

The third quarter was marked by record profitability for the company. Greater operating profit is a reflection of a core merger thesis, as well as outstanding execution and sustained revenue growth. In addition, like many other companies, we have seen short-term financial benefits and costs associated with the pandemic. In Q3, our operating margin came in roughly 6 percentage points higher than normalized levels due to lower travel, field marketing, and facilities costs.

James Frankola, chief financial officer of Cloudera

Stock Performance

Extending the gains that followed the earnings release, Cloudera’s shares traded higher during Friday’s regular session but continued to underperform the market. The stock has gained 7% in the past six months.