You can never really tell what goes on inside Elon Musk’s head. I like to think there is an entire amusement park in there or at least just a roller coaster. Musk is in the news every other day, either for some zesty plan or some cranky comment. After that jaw-dropping Tesla (TSLA) conference call earlier this month, Musk got into a tussle with journalists on the credibility of the media. The tweet-fest that followed did not end very well for the maverick CEO.

Musk is a man with a lot of plans, including some very dynamic ones like the hyperloop. All of Musk’s companies involve a lot of very futuristic and bold projects and one would think he would be the most unequivocal champion of artificial intelligence (AI). On the contrary, he is not really ga-ga over it. Musk has warned time and again that A.I. is the biggest danger that humankind has to watch out for, even worse than nukes.

Musk’s views have been disputed and dismissed by quite a few top executives of leading tech companies like Alphabet’s (GOOGL) former executive chairman Eric Schmidt and IBM’s (IBM) Watson and Cloud head David Kenny. Both individuals believe AI will bring significant improvements to healthcare, transportation, cybersecurity and other fields and these benefits will largely outweigh the negatives that people like Musk point to.

Kenny and Schmidt can see where Musk is coming from on his concerns over the astounding potential of the technology and believes there should be proper regulation but still feel the ominous attitude is unnecessary. Musk had supporters including former Microsoft (MSFT) head Bill Gates and late scientist Stephen Hawking who both raised red flags on A.I.

All major tech companies have invested heavily in AI and are ready to grab the gigantic potential this technology holds

Facebook (FB) CEO Mark Zuckerberg, who last year had a slight tiff-of-sorts with Musk over AI, now seems to have found a middle ground with him on the topic. Zuckerberg too said while AI could unlock massive opportunities, there was still a lot of work to be done to tie all the loose ends together and avoid major disasters.

Note that all major tech companies from Google to IBM to Microsoft have invested heavily in AI and are ready to grab the gigantic potential this technology holds. But is there something that the unorthodox Musk sees that is prompting his heavy doubts on the subject? Recall that a while back Musk blamed the excessive automation at his Tesla factory for hindering production.

Musk has also had to deal with a spate of accidents involving the Autopilot feature in his cars. He believes that although the Autopilot needs perfecting, the unfair media coverage is causing unwanted panic. Musk, with his out-of-the-world projects, might have some very fair reasons to sound the warning bells on AI but there is no doubt that the prominence of AI is increasing with each passing day. The increasing investments and acquisitions of AI start-ups by tech giants prove this.

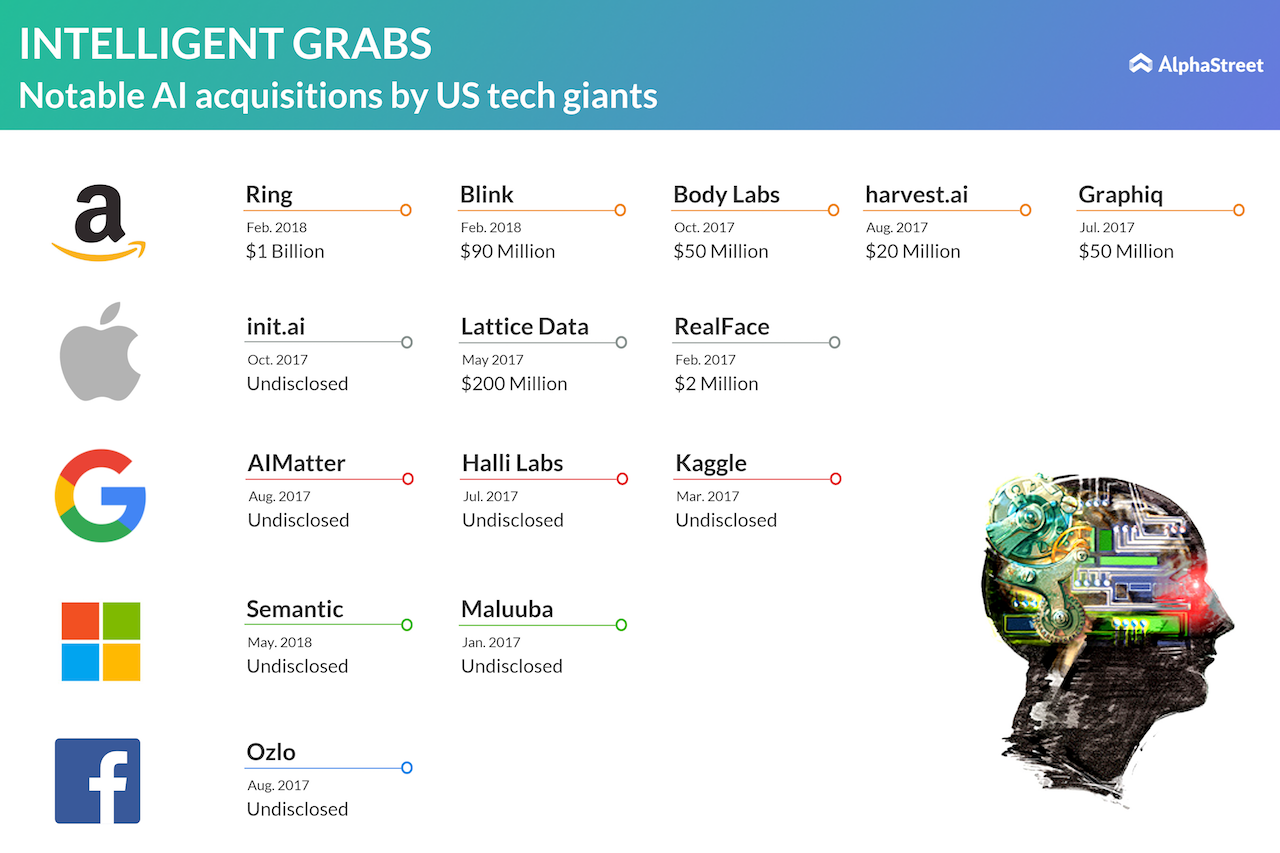

According to CB Insights, around 115 AI start-ups were acquired in 2017. This compares to 80 in 2016 and just 22 in 2013. Tech giants like Google, Amazon, Microsoft and Apple (AAPL) are grabbing up AI firms to boost their capabilities in various areas including digital assistants and smart home devices. Apart from tech companies, several other firms in different industries are investing in AI for various purposes from gaming to cybersecurity.

Musk may be right in his doomsday predictions but the end of humanity at the hands of advanced AI appears to be very far off. At present, however, artificial intelligence is gaining in prominence and can be seen as a valuable investment.