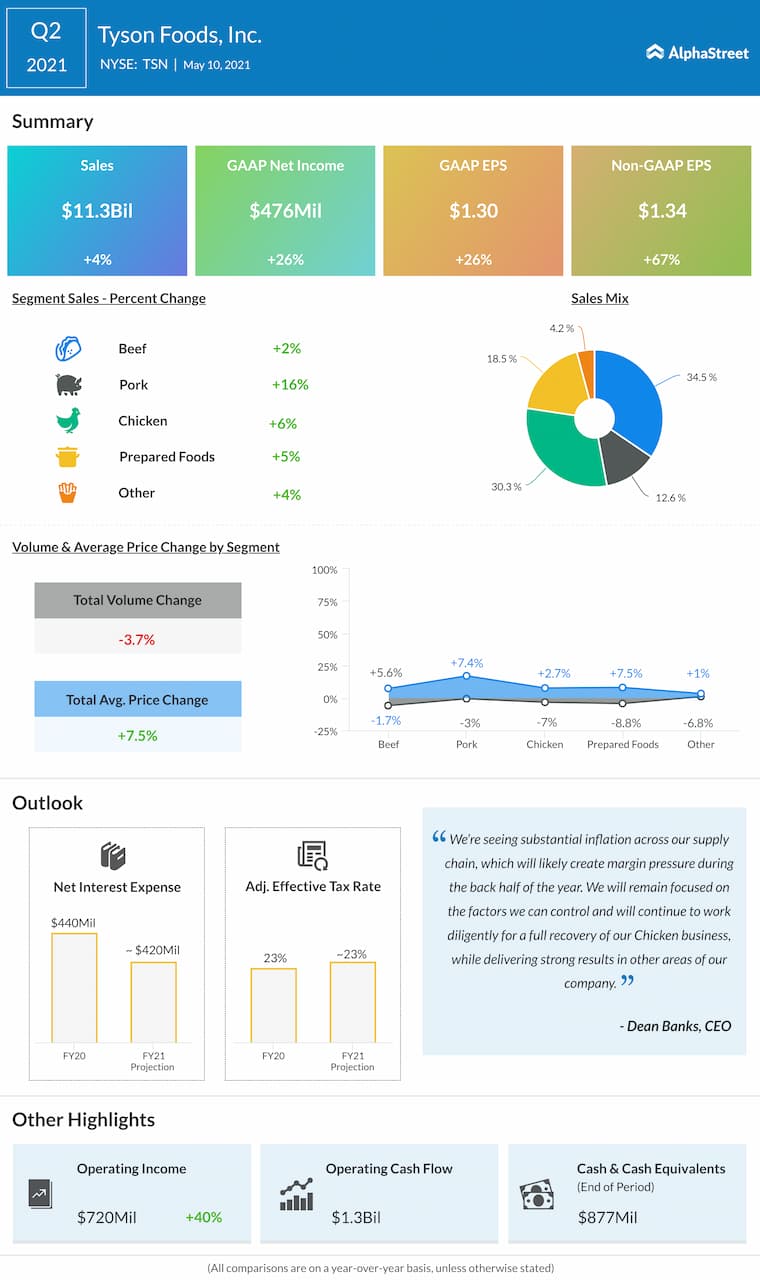

Shares of Tyson Foods Inc. (NYSE: TSN) were in green territory during afternoon hours on Tuesday. The stock has gained 32% over the past 12 months and 23% since the beginning of this year. The company reported its second quarter 2021 earnings results a day ago, surpassing expectations on both the top and bottom lines. Let’s see what lies ahead for the company as the year progresses:

Demand trends

Tyson saw strength in its retail business and an improvement in its foodservice channel during the second quarter. The momentum seen in retail is likely to continue in the near term as consumers continue to stock up on food and beverage and have meals at home. In its earnings presentation, the company mentioned that 50% of consumers continue to eat more meals at home while 60% of consumers enjoy preparing meals at home. 29% of consumers continue to stock up on food and beverage.

The foodservice channel is witnessing a recovery with around 76% of US states at over 75% capacity for in-restaurant dining. The company’s findings show that 72% of customers are somewhat comfortable eating outside at a restaurant while 55% are comfortable eating inside a restaurant.

Tyson indicated in its presentation that the consumption of protein remains strong with 54% of consumers deliberately adding protein to their daily diet. In addition, 20% of consumers are eating animal protein more often than they were a year ago.

Even though consumption of animal protein remains strong, there is a growing demand for alternative protein offerings. To meet the rising demand for plant-based protein options, Tyson rolled out three new products under its Raised & Rooted brand. The company also expanded its alternative protein offerings to the Europe and Asia-Pacific markets.

Although Tyson has warned that inflation is likely to hurt its margins during the latter half of 2021, experts are hopeful that the strong demand for protein might help the company get through this difficulty.

Outlook

For 2021, USDA expects domestic protein production i.e. beef, pork, chicken and turkey to increase less than 1% compared to 2020. Tyson expects worldwide demand for food and protein to continue to increase over time despite some near-term shifts and disruptions.

USDA estimates domestic production will increase nearly 3% for beef and less than 1% for pork in 2021 compared to the previous year. USDA projects a slight dip in chicken production for this year compared to the previous one while Tyson expects feed costs to increase this year. Tyson expects sales to range between $44-46 billion in fiscal year 2021.

Click here to read the full transcript of Tyson Foods Q2 2021 earnings conference call