Last quarter, Aphria said it was on track on achieve an

annual production capacity of 255,000 kilograms when all facilities are

licensed and operational. In November, the company doubled its production

capacity after receiving cultivation license for its Aphria Diamond facility.

The addition of 140,000 kg of production from Aphria Diamond helped the company reach its target of annualized production capacity of 255,000 kg. This is a huge positive.

Also see: Aphria Q1 2020 Earnings Conference Call Transcript

Aphria also started rolling out cannabis vape products which

come with its share of concerns. Vaping is facing several controversies and is

currently under close scrutiny. Updates on this area will be worth watching.

In general, the outlook for cannabis stocks appears to be

bullish for this year on the expectations of strong demand and easing of

regulations.

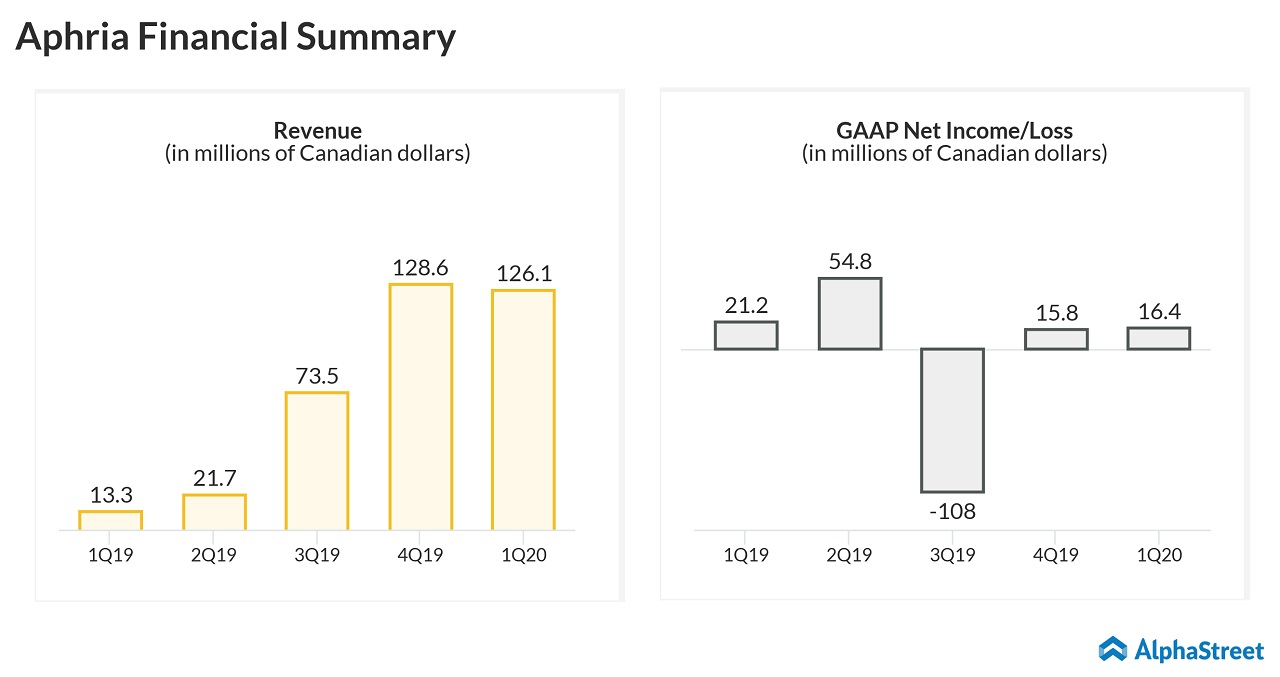

For the full year of 2020, the company has guided for net revenue of approx. $650 million to $700 million and adjusted EBITDA of approx. $88 million to $95 million.

The stock has dropped 27% in the past one year and 5% over the past week. It has a majority rating of Buy and an average price target of $8.61.