Cisco Systems Inc (NASDAQ: CSCO) is preparing to publish April-quarter results next week, after raising its full-year revenue guidance recently. The network gear maker has embarked on a business transformation to adapt to the changing technology landscape and position itself to tap into new opportunities created by the widespread digital shift and cloud adoption.

The Stock

Cisco’s positive financial performance in recent years is yet to reflect on its stock, which is currently staying almost where it was five years ago. The stock’s performance ahead of the earnings release is not very encouraging – this week, it traded at the lowest level since the beginning of the year.

Going forward, the healthy cash flow should enable the company to take initiatives that would increase shareholder returns – the quarterly dividend was raised to $0.39 per share a few months ago, with a yield that is above the S&P 500 average. A key strength of the business is the healthy backlog and rising recurring revenue, thanks to the company’s shift to the network-as-a-service model. The efforts to enhance supply should add to the growth momentum. The fact that enterprise spending on technology remains stable despite the economic slowdown bodes well for Cisco.

Q3 Report Due

Cisco’s third-quarter report is scheduled for release on May 17, after the regular trading hours. Market watchers are bullish on the company’s performance in the early months of the second half, and predict a 12% growth in revenues to $14.39 billion. It is estimated that adjusted earnings rose to $0.97 per share in the April quarter from $0.87 per share last year, continuing the recent uptrend. The projection is broadly in line with the guidance issued by Cisco executives earlier.

From Cisco’s Q2 2023 earnings conference call:

“The modern resilient and secure networks we are building serve as the backbone of our customers’ technology strategy. Cisco is well-positioned to benefit from multiyear investment cycles, with our market-leading hardware, as well as our innovative software and services. Together, these allow our customers to digitize rapidly, secure their environments, and achieve their sustainability goals, all while delivering differentiated experiences.”

Key Numbers

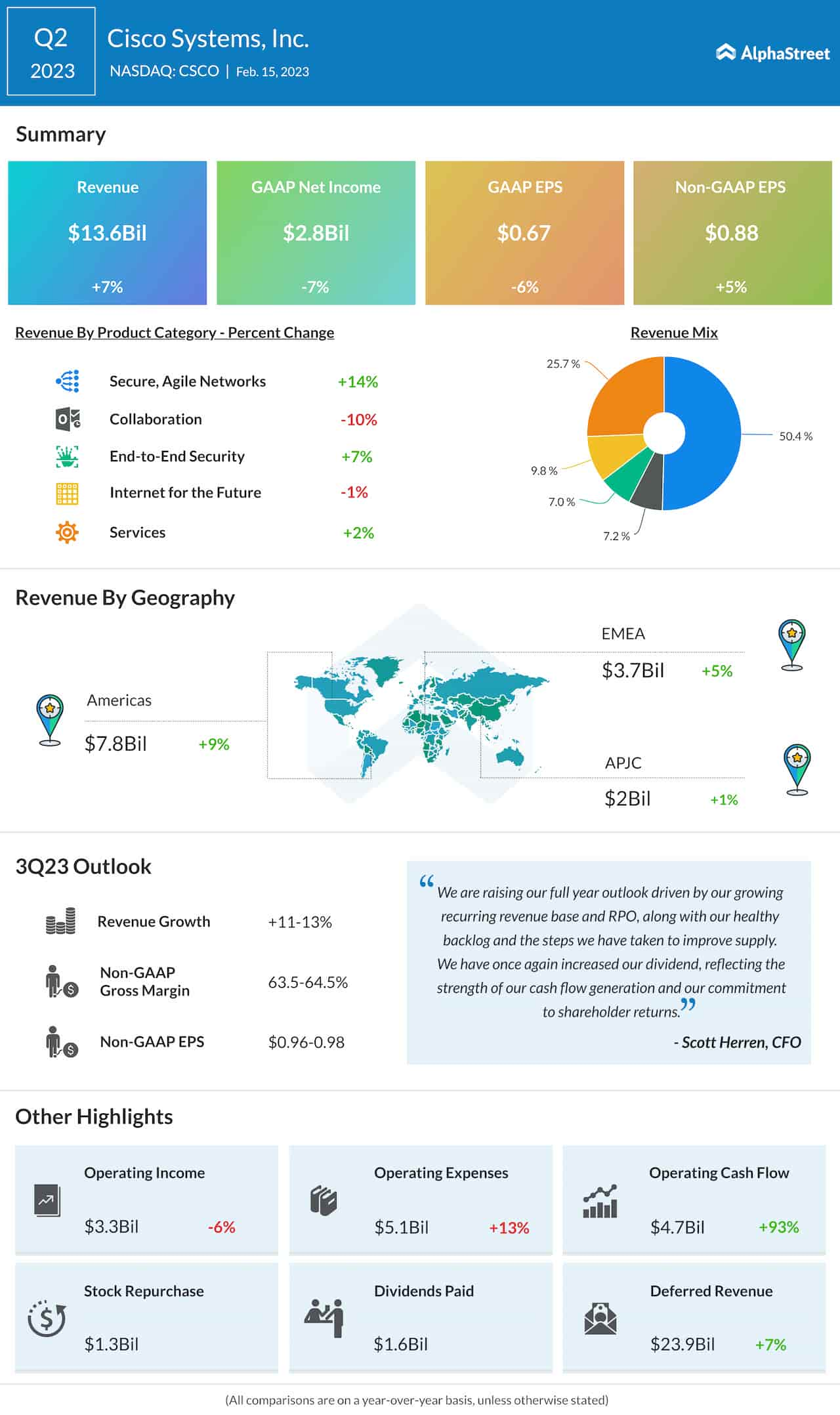

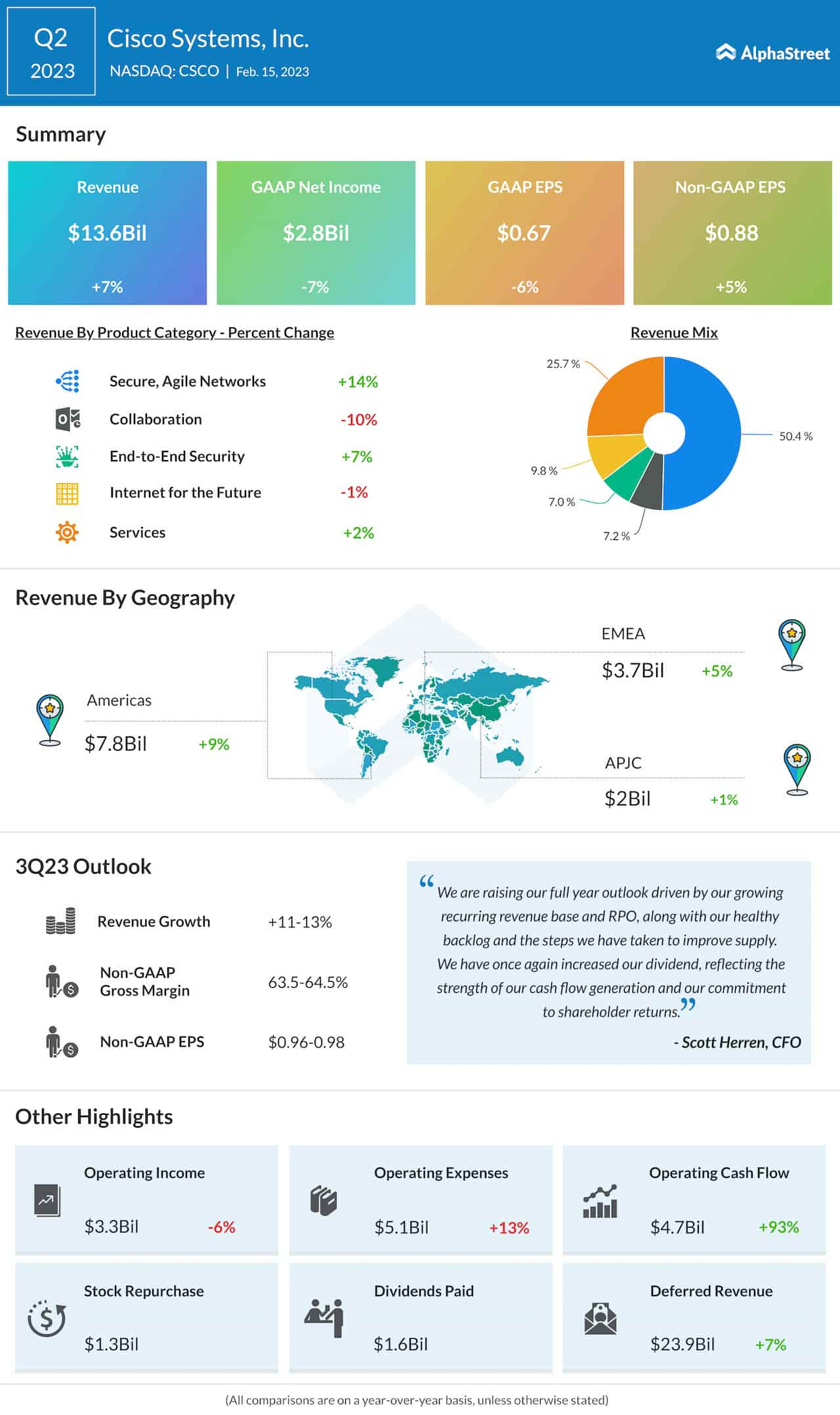

Considering the company’s impressive track record of not missing estimates in any quarter in the past, the bottom line is likely to top expectations this time too. In the second quarter, revenues missed Street View despite rising 7% year-over-year to $13.6 billion, with strong contributions from the core Secure, Agile Networks segment. At $0.88 per share, adjusted profit was up 5% year-over-year during the three-month period.

Shares of Cisco closed the last trading session slightly higher. The stock has lost about 9% in the past 30 days and is currently trading in line with its 52-week average.